This is Capital Signal — timely briefings on what's changing in private markets, wealth structures, and founder behaviour. Playbooks explain the system. Signals track what's shifting.

This Week in 30 Seconds

The IPO market just had its busiest week since 2021. Eight companies raised $100M+ each in New York. Clear Street filed at a potential $11.8 billion valuation. KKR is prepping Wella for a US listing. Syngenta is targeting up to $10 billion in Hong Kong. After two years of hesitation, public markets are pricing real businesses again.

Software stocks just entered a bear market. The iShares Expanded Tech Software ETF is down roughly 25% year-to-date. Jefferies coined it the "SaaSpocalypse." If you hold equity in a SaaS business, the repricing is already affecting your exit math.

UK founders: the tax clock is ticking. Business Asset Disposal Relief rises to 18% on April 6th. Dividend rates climb. VCT relief shrinks. The next eight weeks are structurally different from the eight weeks after.

The IPO Window Is Real. Use It or Understand It.

It's tempting to dismiss IPO headlines as noise. But this week had substance behind it.

Clear Street, a prime brokerage firm founded in 2018, filed for a Nasdaq listing targeting up to $11.8 billion in valuation. They're raising roughly $1.05 billion by offering 23.8 million shares at $40-44 each. BlackRock is anchoring the deal with a $200 million commitment. Clear Street posted net revenue between $1.04 and $1.06 billion in 2025, more than double its $463.6 million the year before. Not a pre-revenue story. Not a valuation based on vibes.

The same week, Eikon Therapeutics raised $381.2 million on Nasdaq, pricing at the high end of its range with J.P. Morgan and Morgan Stanley underwriting. A biotech IPO pricing well tells you something about investor appetite beyond the usual tech suspects.

And it's not just US listings. Syngenta is planning a Hong Kong IPO that could raise $5-10 billion, a massive industrial listing aimed at reducing its net debt by $24.8 billion. Hong Kong recorded roughly $37.2 billion in IPO proceeds in 2025, reclaiming a leading global fundraising position. In India, 21 startups have already filed DRHPs, and another 24 are in preparation. The exit map is wider than the Nasdaq and the LSE.

Then there's the PE exit machine warming up. KKR is preparing Wella Company for a US IPO that could value the beauty business at meaningfully more than the $4.3 billion they originally paid. Bank of America and Goldman Sachs are working on the deal. This is what the PE exit cycle looks like when it actually starts moving: sponsor-backed companies hitting public markets because the window exists and pricing supports it.

According to Renaissance Capital, this was the busiest week for sizable US offerings since 2021. That's not a trend piece. That's a data point.

What's interesting is the mix. Fintech, biotech, beauty, agriculture. This isn't a single-sector mania. Public markets are signalling appetite for profitable, category-leading businesses across industries. For founders weighing exit timing, the question isn't whether the window is open. It's whether your business is the kind of business for which the window is open.

The SaaSpocalypse Is a Pricing Event, Not an Extinction Event

While IPOs are heating up, a parallel repricing is ripping through the software industry.

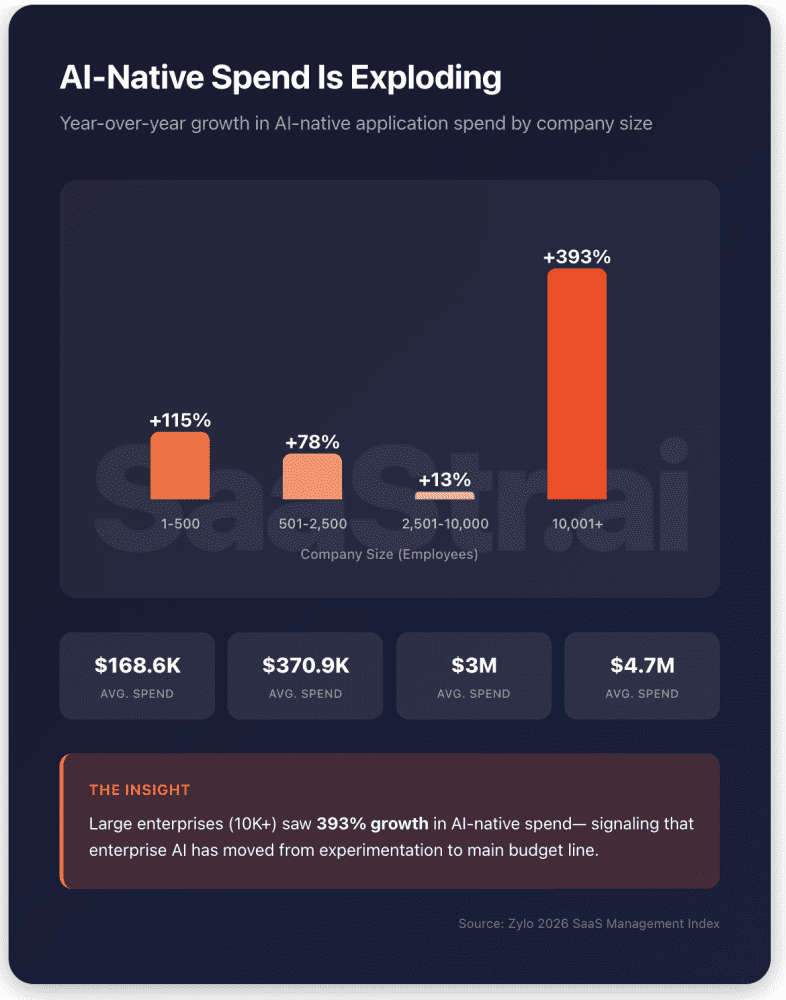

Jeffrey Favuzza at Jefferies called it the "SaaSpocalypse", and the numbers back the drama. The software ETF (IGV) dropped roughly 25% year-to-date. ServiceNow fell 11% despite beating earnings for the ninth consecutive quarter. Microsoft shed $360 billion in market cap in a single day. The selloff wiped out $300 billion across the sector in days.

The trigger was partly earnings disappointments, partly Palantir's CEO declaring that AI could make many SaaS companies irrelevant, and partly the release of new AI tools that demonstrated what automated workflows could actually replace.

BofA's analysts pointed out a paradox: the market is simultaneously pricing in both AI capex collapsing and AI being so good it destroys SaaS. Both can't be true at the same time. But markets don't wait for logical coherence before repricing risk.

Jason Lemkin at SaaStr offered useful framing: this isn't AI killing SaaS overnight. It's the market finally pricing in growth deceleration that started in 2021. The deeper threat is subtler. AI reduces headcount, which reduces seats, which reduces per-user revenue. If ten AI agents do the work of a hundred sales reps, you don't need a hundred Salesforce licences anymore. That's not a technology replacement story. It's an economics story.

For founders holding SaaS equity, exit multiples are compressing, and acquirers are recalibrating. If you were planning a sale in 2026-2027, your comp set just shifted.

This doesn't mean SaaS is dead. Mission-critical enterprise software, the kind that runs payroll, manages compliance, and processes transactions, isn't going anywhere. But the mid-tier, best-of-breed tools that thrived on seat-based expansion? The market is asking hard questions about their terminal value. Model accordingly.

UK Tax Changes: Eight Weeks to Plan

For UK-based founders, April 6th isn't just a new tax year. It's a structural shift in exit economics.

Business Asset Disposal Relief (formerly Entrepreneurs' Relief) rises from 14% to 18% CGT. That's the third increase in twelve months. It was 10% before April 2025. The lifetime limit stays at £1 million, but the maximum tax saving has collapsed from roughly £100,000 to around £60,000 per person. For a founder selling a business worth several million, the relief is increasingly marginal.

Dividend tax rates climb, too. Basic rate moves from 8.75% to 10.75%. Higher rate from 33.75% to 35.75%. Combined with frozen income tax and National Insurance thresholds through 2031, the effective tax burden keeps rising even if the headline rates look modest.

VCT income tax relief drops from 30% to 20%. EIS relief remains, but with tighter qualifying conditions. Carried interest moves toward an income tax framework at an effective 34% rate. AIM shares lose their 100% IHT relief, dropping to 50%.

The anti-forestalling rules are worth noting: contracts entered into between October 30, 2024 and April 5, 2026, are specifically targeted. If you signed heads of terms in that window, thinking you'd locked in the old rate, check the details carefully with your advisors.

None of this makes selling impossible. But it makes timing a genuine variable in deal economics. A completion date in March vs May could represent a meaningful difference in post-tax proceeds on a multimillion-pound exit.

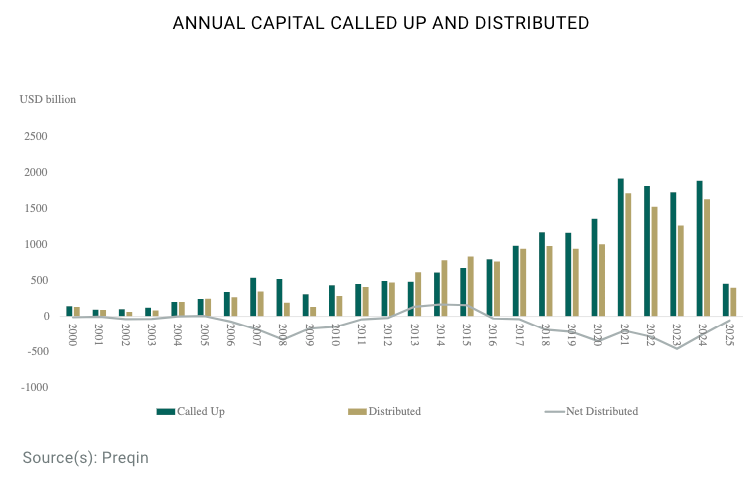

Secondaries: The Stress Test Nobody Wants to Talk About

Every 2026 private markets outlook is saying the same thing: secondaries are mainstream, volumes are surging, and the market has arrived. Fair enough. The numbers support it. Secondary transaction volume hit $162 billion in 2024, up 45% year-on-year, and surged to $103 billion in just the first half of 2025, another 51% increase. GP-led continuation vehicles now represent roughly 20% of distributions, up from a 6% average between 2016-2020. LP portfolios are priced at around 90% of NAV.

BlackRock's 2026 outlook frames secondaries and private credit as the primary liquidity channels going forward. Wealth investors are increasingly accessing these through evergreen structures: ELTIFs, LTAFs, and semi-liquid vehicles. Goldman Sachs estimates that semi-liquid fund NAV reached $426 billion in Q3 2025, growing at a 40% compound rate since 2021.

But here's what keeps getting buried in the optimism. MSCI and UBP both flag that these semi-liquid structures haven't been stress-tested in a coordinated downturn. The liquidity looks good on paper. Limited quarterly redemption windows, withdrawal gates, GP-issued marks that are subjective and opaque. When everyone wants out at the same time, the mechanics of "semi-liquid" get tested in ways the marketing materials don't cover.

This matters practically if you hold private equity stakes, either as an LP or through rolled equity from an exit. The secondary market can provide liquidity without requiring a full sale. But pricing, timing, and cap table provisions all need to line up. If your fund documents or shareholder agreements don't contemplate secondary transfers, have that conversation now. Not when you need the exit.

Capital Founders OS is an educational platform for founders with $5M–$100M in assets. We focus on frameworks for thinking about wealth—so you can make better decisions.

If it's your first time here, don't forget to Subscribe.