This is Capital Signal—timely briefings on what's changing in private markets, wealth structures, and founder behaviour. Playbooks explain the system. Signals track what's shifting.

This Week in 30 Seconds

The IPO window is no longer theoretical. Clear Street filed with 160% revenue growth. Liftoff Mobile is targeting a $5.2 billion Nasdaq debut. Blackstone says it's preparing one of the largest IPO pipelines in its history.

That's the good news. The complication: when mega-GPs move at scale, they crowd the calendar for everyone else. Underwriters chase bigger fees. Investors spread thin across competing offerings. Windows that looked open start feeling narrow.

The message for founders planning exits: have a backup route.

1. Blackstone's Pipeline — And Why It Matters to You

Jon Gray, Blackstone's president, said this week the firm is preparing one of the largest IPO pipelines in its history, concentrated in the US corporate space.

Medline's December IPO raised $7.2 billion and trades 40% above its offering price. That performance gives Blackstone confidence to accelerate. But it also sets a benchmark that smaller issuers will be measured against.

Renaissance Capital's Matt Kennedy put it directly: this is "the largest backlog of pre-IPO startups in at least two decades."

Backlog sounds promising. Congestion is the reality. Here's why it matters practically:

Underwriter attention shifts. Banks make more money on larger deals. When Blackstone brings multiple billion-dollar offerings, the same coverage teams that might have prioritised your $200M raise are now allocated elsewhere. You're not competing for capital alone—you're competing for mindshare.

Investor bandwidth fragments. Institutional buyers have allocation limits. A pension fund considering three Blackstone-backed IPOs in the same quarter has less capacity for an unfamiliar name. Demand that looked solid in a quiet market gets diluted in a crowded one.

Timing windows compress. Miss the optimal pricing window because a larger deal jumped ahead? The next opening might be months away—or dependent on market conditions you can't control.

None of this means abandon IPO plans. It means start readiness work now, not when sentiment peaks. And maintain a secondary or M&A fallback—not as Plan B, but as parallel optionality.

2. Concrete Filings: The Window Is Real

Two IPO filings this week prove the window isn't just commentary.

Clear Street filed for Nasdaq with numbers that matter: $783.7 million revenue for the first nine months of 2025, up 160% year-over-year. Net income hit $157.2 million versus $20.7 million in the same period last year. The company has raised $1.48 billion to date and could target a valuation between $10-12 billion. Goldman Sachs is leading.

Liftoff Mobile, backed by Blackstone and General Atlantic, filed for up to $5.17 billion valuation, raising roughly $762 million. Core advertising revenue grew 40% in the nine months ending September. Profitable, growing, sponsor-backed.

The signal: infrastructure businesses and profitable growth companies are leading the IPO recovery. The common thread is real revenue, not narrative. Metrics that don't compare favourably to these filings will get noticed—and priced accordingly.

3. Mega-Deals Are Absorbing the Oxygen

Two stories this week illustrate how capital concentrates at the top.

SpaceX is in discussions to merge with xAI—and possibly Tesla—ahead of an IPO that could raise $50 billion. That would be the largest public offering in history. SpaceX was valued at roughly $800 billion in late 2025; xAI at $230 billion after its Series E. A combined entity could target $1.5 trillion.

Meanwhile, Amazon is in talks to invest as much as $50 billion in OpenAI as part of a $100 billion round at an $830 billion valuation. SoftBank is discussing another $30 billion. OpenAI is preparing for a Q4 2026 IPO.

The founder-relevant point isn't the deal mechanics. It's what happens to everyone else's exit when this much capital and attention flows to a handful of companies.

The trickle-down assumption—that mega-rounds lift all boats—hasn't held in recent years. Capital is concentrating, not distributing. Late-stage founders and venture LPs holding positions outside these gravitational centres should factor that into exit timeline expectations. The rising tide may not reach your dock.

4. Private Credit Liquidity Is Being Manufactured

Private credit liquidity is increasingly engineered, not earned.

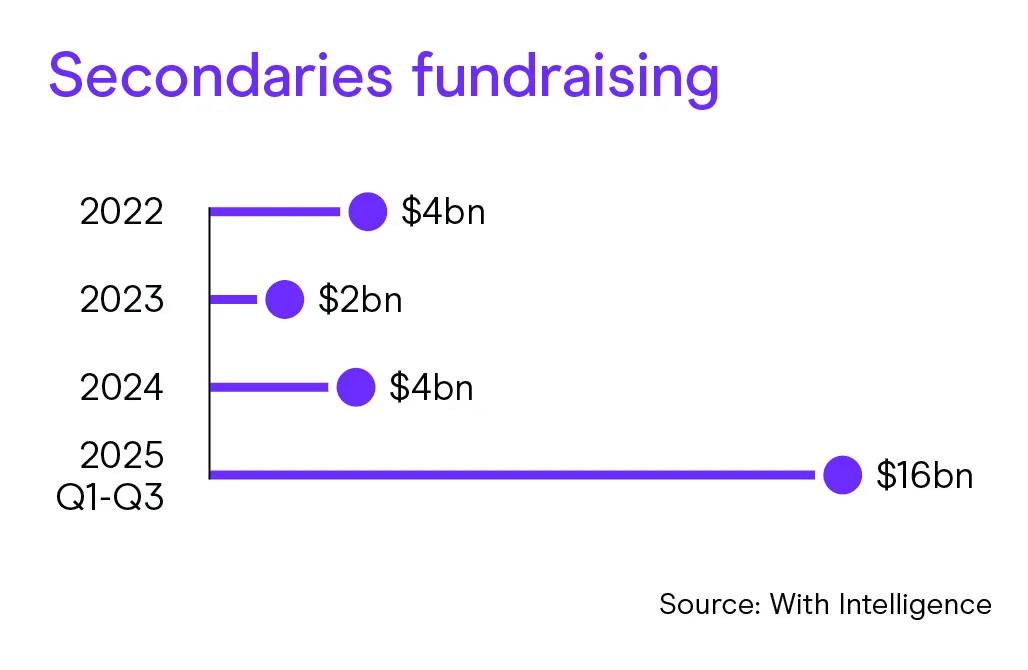

Continuation vehicles—where managers transfer loans into new funds they control—hit $7 billion in 2025, the first year GP-led volume overtook LP-led deals in credit secondaries. The FT reported this week that the trend is accelerating as managers face slow exits and portfolio pressure.

This is financial engineering, not exits. When managers move loans to vehicles they control, they're smoothing yield and managing optics. That's not inherently bad—but it changes what "liquidity" means in private credit allocations.

The due diligence question: how is continuation pricing set, and who approves it? The yield on your statement may not reflect the underlying liquidity reality. Separate income planning from liquidity planning. They're not the same thing anymore.

5. UK Founders: Two Deadlines in 65 Days

BADR

HMRC clarified this week that Business Asset Disposal Relief disposals are taxed based on completion date, not signing date, unless specific "excluded contract" conditions apply. The rate rises from 14% to 18% on April 6, 2026.

On the full £1 million lifetime allowance, that's £40,000. Already in exit discussions with a realistic completion path before April 6? Worth pushing. Six months away? Don't rush a transaction for the tax savings—execution risk isn't worth it.

Dividend Tax

Dividend tax rates increase by 2 percentage points from April 2026: basic rate rises from 8.75% to 10.75%, higher rate from 33.75% to 35.75%.

A shareholder receiving £50,000 in dividends annually faces roughly £1,000 more in tax. Owner-managed companies using dividends as primary extraction should re-run salary/dividends/pension models before April, not after.

Final Thoughts

Exit markets are functional. They're also crowded. Maintain parallel optionality—secondary and M&A routes alongside IPO plans—and start readiness work before the calendar fills up.

Capital Founders OS is an educational platform for founders with $5M–$100M in assets. We focus on frameworks for thinking about wealth—so you can make better decisions.

If it's your first time here, don't forget to Subscribe.