When it comes to investing your own money, you might be overwhelmed by the variety of "financial advice" you can get these days.

Some say you only need to invest in index funds and the S&P500, pay as low fees as possible, get your 7% average yearly return, and become a millionaire in 20+ years. (I wish it were that easy!)

Others promote stock picking, crypto, investing in start-ups, or pre-IPO deals, where you can 10X your money in just a few years, if not months (good luck with that!).

There are also lots of opinions in between.

Over the years of working in investment management, I have realised one thing.

Even those who accumulate substantial assets (like $50m+) from their business don't always fully understand how to think about their investments and can lose a lot of money due to bad decisions and wrong calls (usually due to egos).

As Dr. Julie Gurner puts it 👇

There are 3 skills involved in Generational Wealth:

— Dr. Julie Gurner (@drgurner) March 15, 2025

1. Making money

2. Growing it

3. Keeping it

Most people will not be great at all of them.

Don't be stubborn.

Hire financial experts to help you thrive. https://t.co/UmqEY4X5Zm

So, in this article, I will explain how we should think about investing our money if we want to retire comfortably or build generational wealth.

It's not about what you should be doing but how you should be thinking. It is about mental frameworks and systems—not what hot stock or meme coin to buy next.

While it all sounds simple and (most likely) familiar, you will be surprised how many people don't follow these simple rules.

So, let's start with the basics.

Why do we invest?

Take a moment to think about it and answer this question honestly. You can also write it down.

Before I continue, let me share a practical life example I often use.

As a former pro boxer, I can tell you that staying fit requires only two basic things in 90% of cases.

💪 Exercise. You don't need a fancy gym or equipment. You can do core exercises with body weight, cardio, and stretching. If you have a park nearby, that would be great. If not, you can do it at home.

🥦 Food. Again, you don't need a fancy diet. Just watch what you eat and how much. Go for quality, not quantity.

That's it. And, of course, you need discipline to do it consistently.

But in reality, many of us try different training routines and only jump to the next one in a few months' time. We want the gym with the latest equipment, spend hours on research, and look out for high-tech running shoes. Or jump from one diet to another. The list goes on.

There is nothing wrong with it. It's just that it's not what we need but what we want. As long as you understand the difference, you should be fine.

The Ultimate Goal of Investing

It's very simple.

Accumulate enough assets so that the return (income or cash flow) from these assets can cover our cost of living and lifestyle after we stop actively working (i.e., retirement). Ideally, the principal amount invested should also increase in value, but definitely not decrease, as it will impact the quality of our lives.

That is the fundamental goal. It's like Maslow's hierarchy of needs—at its core, it caters to Psychological needs for survival (like food and shelter) and Safety (like health, employment, property, etc.).

We all have our own "Magic Number," which means how much money we need to stop worrying about it. For some, an annual income of £100,000 is more than enough, while others may feel poor with £1,000,000.

But the principle is the same. Once you achieve this goal, you can move to the next one. But you need to complete this level in the Game of Life first.

Setting Up Your Personal Finance OS for Success

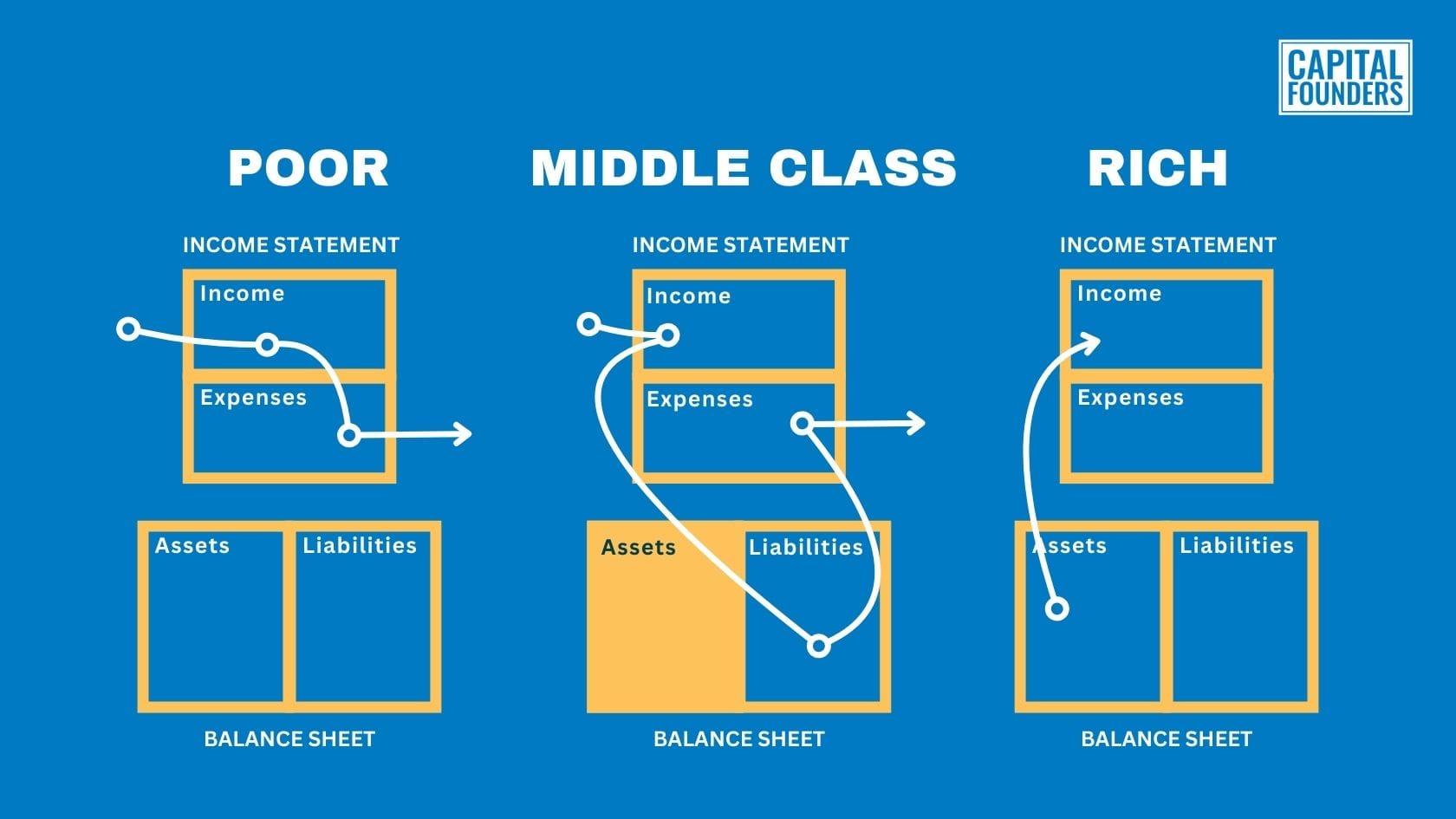

Let's consider a simple personal finance framework to understand how to reach your Magic Number. Essentially, you have:

- Assets (what you own)

- Liabilities (what you owe)

- Income (money flowing in)

- Expenses (money flowing out)

So when it comes to your money…

🚩 Goal #1 – Generate enough income to cover your living expenses (including mortgage, credit cards, etc.) and use the surplus to acquire assets.

🎯 Goal #2 – Build enough assets so that the income they produce can cover your living expenses (and any contingencies) while your asset base remains stable or continues growing.

It is as simple as that. But, of course, it's easier said than done.

How quickly you can achieve Goal #1 is up to you. You need to focus on generating more income—get a higher salary or increase profitability (and dividends) if you run your business. The larger your surplus, the quicker you can invest and grow your asset base.

Remember: business can be either a source of cash flow or (one day) a valuable asset you can sell.

To achieve Goal #2 (and without taking on excessive risk), it will help to work with a qualified financial adviser. Financial advisers provide a service called financial planning. They’ll help you create a plan based on your current situation, income, age, risk profile, etc. A good adviser also helps optimize your investments for tax efficiency.

Many people make the mistake of looking for shortcuts and quick wins when they start investing. This is how we are wired. We get excited by stock charts and news flow and get carried away while losing track of our primary goal.

We want to find the following hot stock or crypto to go to the moon. And while sometimes you can get lucky, it is very difficult (or I would say impossible) to maintain it in the long run.

To become good at investing (like anything else in our lives), you need to try to learn the game. Mistakes are inevitable.

It's like in sports: You can expect to go to the gym for a few months and become a professional boxer. You really need to have dedication and willpower and put in a lot of sweat and blood.

If that is what you really want, then go for it.

But if you want to become fit, focus on a simple routine and do it consistently. You will be amazed at the results you will get in 12 months.

So, the moral of the story is as follows:

Time is money. You need to spend it where your return on invested time is greater.

Start working with a financial adviser as soon as possible. They will help you to create your financial plan and formulate an optimal strategy to achieve it. Once set up, you can run it on autopilot and forget about it (at least for some time).

Focus on generating more income and use it to acquire assets. Leverage what you currently have (be it a job or your own business).

Once you hit your Magic Number or are on track to achieving it and have more time - you can move to the next level and learn the investment game if you want to.

It's fun, and you will enjoy it, but you must cover your basics first.

You must get fit and learn the technique before stepping into the ring.