For most people, buying a home is a milestone. For capital founders, it's just the beginning.

Real estate has always played a starring role in private wealth. Knight Frank's latest Wealth Report shows 81% of ultra-high-net-worth individuals own their primary residence. No surprise there. But here's what's interesting—30% actively invest in additional properties. Commercial buildings. Rental portfolios. Even tokenised real estate.

Why the obsession?

Simple. Real estate isn't just an asset—it's a system. It generates income, fights inflation, and comes with almost unfair tax benefits. When done right, it scales beautifully across borders.

Here's what a sophisticated real estate strategy looks like in 2025 and beyond.

Why property wins: real assets, inflation hedge, steady demand.

Durable income: lease mechanics, resilient sectors, occupancy drivers.

Tax levers: depreciation, interest deductibility, deferrals that compound.

Commercial vs. residential: when to pick each, 2025 hotspots.

Global diversification: balance markets, currencies, and cycles.

Access routes: direct ownership, REITs, and private funds.

Smart leverage & hedging: LTV ranges, rate and FX protection.

Systems to scale: ops stack, managers, and reporting across borders.

Why Real Estate Remains Essential for Wealthy Investors

Inflation Protection That Works

Real estate is real. You can touch it. Walk through it.

Its value ties to actual land and buildings, not market sentiment. That makes it one of the best long-term hedges against inflation. Prices rise? So do rents. Construction costs go up? Your property value follows.

It's that straightforward.

Income You Can Count On

Residential and commercial properties generate steady, contractual income. Tenants sign leases. They pay monthly. No drama.

Multifamily housing barely noticed COVID. Logistics centres thrived. Medical offices stayed rock solid through the chaos. That isn't speculative income but reliable cash flow that hits your account like clockwork.

Tax Advantages Change Everything

That is where real estate gets interesting.

Depreciation is almost magic. You write off your building's value over time, cutting your tax bill. Meanwhile, the property appreciates. You save money on something that's making you money.

1031 exchanges let U.S. investors defer capital gains forever. Sell one property, buy another, pay zero tax. Keep rolling.

Interest deductibility means the government subsidises your borrowing costs. Local incentives sweeten the deal further.

The after-tax returns can be spectacular.

Commercial vs. Residential: Making the Choice

Commercial Real Estate Is Having Its Moment

20% of ultra-wealthy investors are eyeing commercial deals in 2025.

The hot sectors right now:

- Logistics: Warehouses and fulfilment centres are gold, especially in Europe and the U.S.

- Healthcare: Ageing populations need clinics, assisted living, and medical offices

- Premium offices: But only ESG-compliant, flexible spaces in prime locations

Commercial deals are bigger. More complex. But the yields? Often worth it.

Residential Keeps Winning in Tight Markets

Higher rates haven't killed prime residential markets. London, Singapore, Dubai, Miami—they're all structurally undersupplied. Too many buyers, not enough properties.

Smart money targets:

- Build-to-rent developments

- Short-term rentals in tourist destinations

- Multifamily buildings in growing cities

Everyone understands residential. People need places to live. It's not complicated.

Geographic Spread Is Your Friend

Concentration risk kills portfolios.

That's why HNWIs hold property in three or more countries. Mix lifestyle purchases (that villa in Portugal) with pure investments (London apartments) and strategic plays (warehouses near ports).

Different markets. Different cycles. Different opportunities.

How to Structure Your Real Estate Portfolio

Direct Ownership vs. REITs vs. Funds

Each approach has merit.

Many investors hold physical residential property locally. Then they access commercial real estate globally through funds or REITs. Direct ownership gives control and tax benefits. REITs offer liquidity. Private funds get you into institutional deals.

| Structure | ✅ Pros | ❌ Cons |

|---|---|---|

| Direct Ownership | Control, full return capture | Time-intensive, operational risk |

| REITs (Public/Private) | Liquidity, diversification | Less control, fee drag |

| Real Estate Funds | Access to scale and expertise | Illiquidity, performance dispersion |

Blend them based on your goals.

Syndications and Club Deals

Want to buy a €50 million shopping centre? You probably can't be alone. Get nine other investors together? Now you're talking.

Syndications work brilliantly for:

- Mid-market commercial assets

- Development projects

- Niche plays like data centres or cold storage

You get institutional-quality assets without institutional capital requirements.

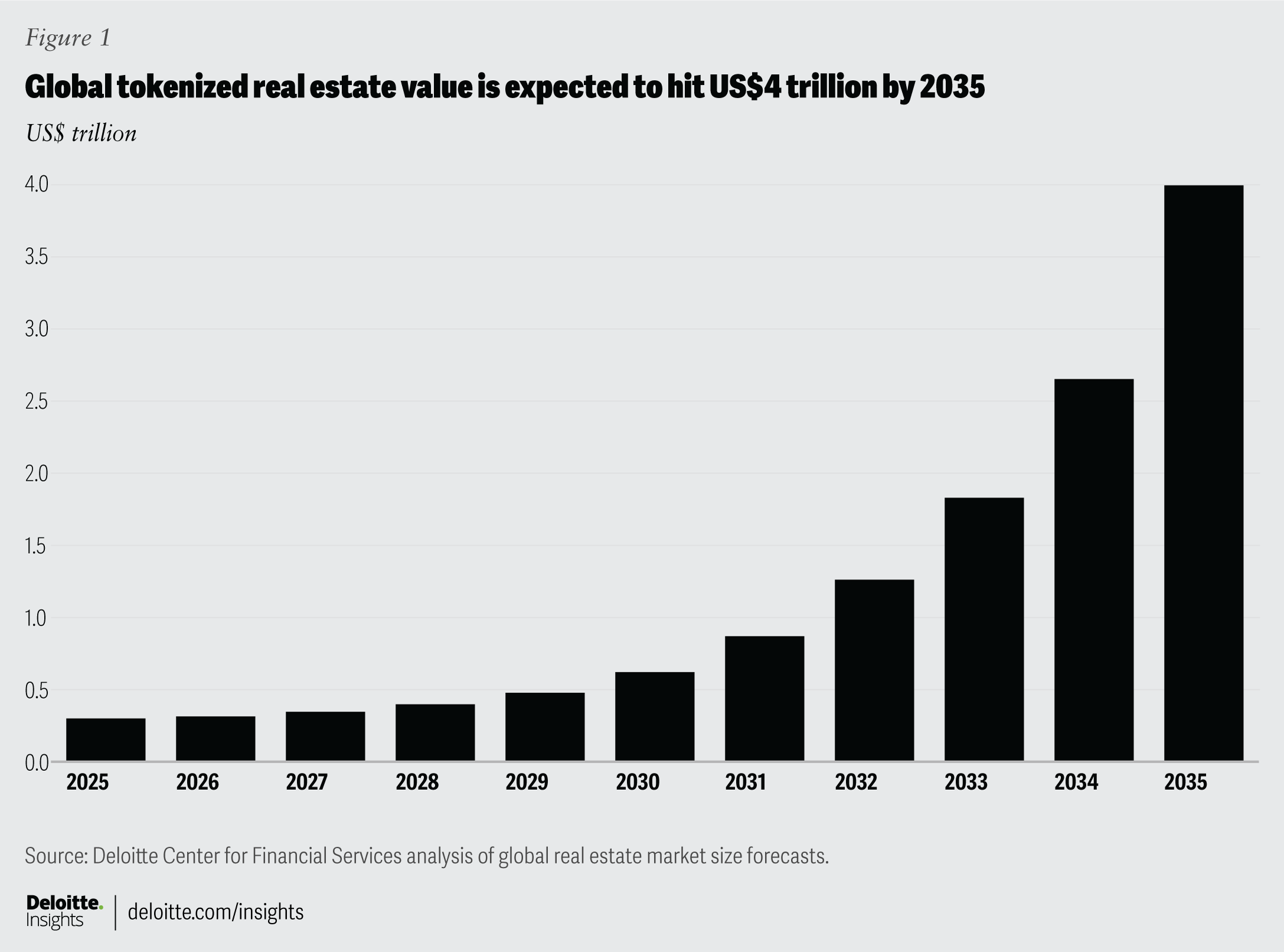

Tokenised Real Estate: The Next Frontier

Forget the crypto hype for a second. That is the real innovation. Blockchain enables you to buy fractional ownership of property. Think €10,000 for a slice of a Parisian office building. Trade it next month if you want—settlement in days, not months.

- 65% of HNWIs express interest in tokenised property, according to a 2024 Deloitte survey.

- Benefits include faster settlement, secondary liquidity, and global reach.

Example: A fractional interest in a €10M Paris commercial property, managed via a digital platform and held through a Swiss SPV.

Going International: What You Need to Know

Every Country Plays by Different Rules

The UK has a solid legal system, but stamp duty can add to the cost. But certain cities offer brilliant yields.

Switzerland? Stable as they come. Good luck finding anything available, though. Foreign ownership? Heavily restricted.

Dubai and Singapore keep it simple. Open to foreigners. Minimal taxes. Expat-friendly rules.

Know the game before you play.

Currency Risk Is Real

That London flat might appreciate 10%. Great.

But if sterling drops 15% against your home currency? Not so great.

Smart investors hedge. Forward contracts. Multi-currency mortgages. Or spread across currency zones. Don't let exchange rates eat your returns.

Structure It Right From Day One

Cross-border portfolios need proper planning:

- International trusts for estate planning

- Holding companies in the right jurisdictions (BVI, Luxembourg, wherever works)

- Tax treaty optimisation

Get a good international tax advisor. The savings will cover their fees many times over.

Advanced Moves Worth Knowing

Leverage: Your Best Friend or Worst Enemy

Debt amplifies returns. It also amplifies losses.

Most sophisticated investors stick to a 50-65% loan-to-value ratio. Enough leverage to boost returns. Not so much that a downturn destroys you.

Interest-only loans? Asset-backed structures? All are common internationally. Just don't get greedy.

The 1031 Exchange (U.S. Only)

Sell your LA rental for a million-dollar profit. Buy a Miami apartment building with the proceeds. Pay exactly zero in capital gains tax.

It's called a 1031 exchange which is completely legal but strict rules to qualify. It's a tax strategy that allows investors to pay defer paying capital gains tax on the sale of an investment or business-use real estate by reinvesting the proceeds in another "like-kind" property.

Scale Requires Systems

Managing five properties? Fine.

Fifteen properties across four countries? You need help.

The pros use:

- Management firms with global reach

- Digital platforms for everything—rent, repairs, reporting

- Family office integration to track it all

Don't try to do this yourself. Trust me.

The Bottom Line

Capital founders don't just buy real estate. They build systems.

Every property has a purpose. Cash flow. Inflation protection. Lifestyle. Wealth transfer. The best portfolios combine all of these.

Whether you go direct, use funds, or try tokenisation doesn't matter. What matters is having a strategy, thinking beyond that first house and building something that compounds over time.

Real estate isn't about transactions. It's about creating a machine that works while you sleep.

Once you understand that? Everything changes.

The path is more straightforward than most people think. Buy quality assets in growing markets. Use leverage wisely. Manage professionally. Be patient.