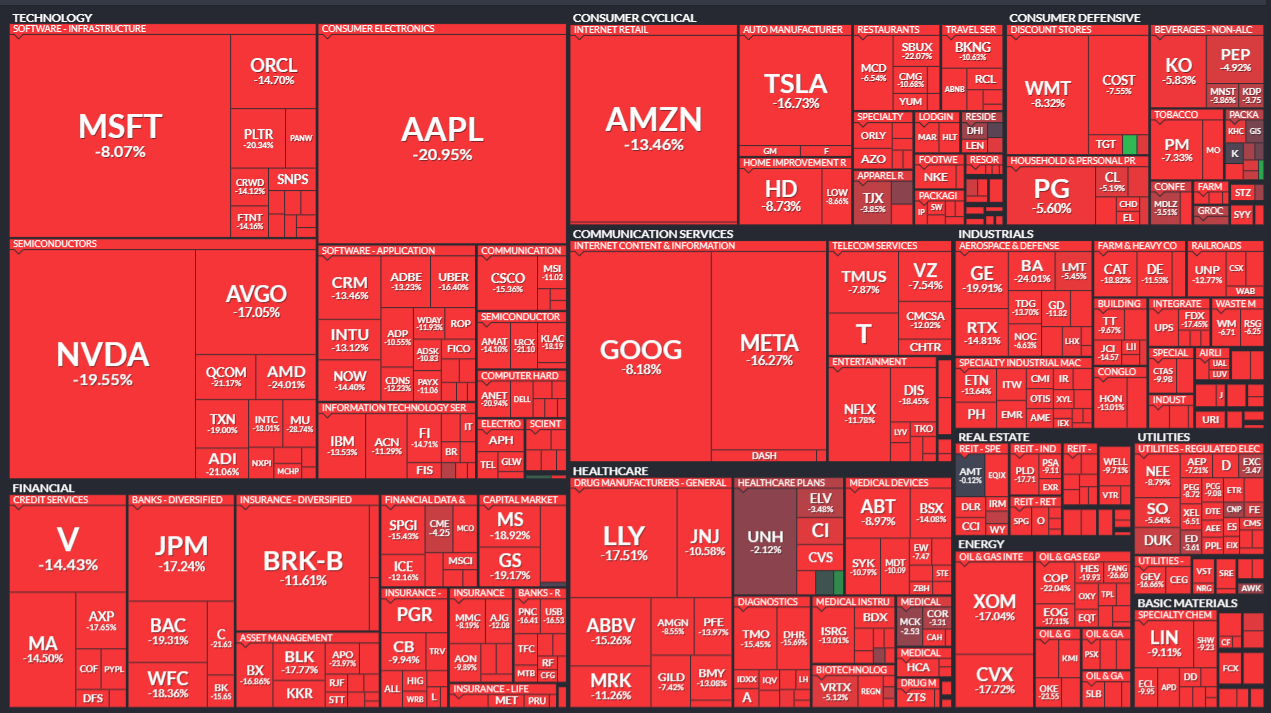

As I was about to start writing this post, the markets went into turmoil, wiping out billions of dollars in value thanks to Trump's latest tariffs. Just look at this S&P500 chart as of 7 April 2025 👇

Markets are down. Volatility is up. Investors are panicking. Fear is everywhere. And your Twitter feed is probably full of people claiming they saw it all coming.

That is when you need a solid investment philosophy the most.

This post isn't going to tell you what stocks to buy. I'm not here to analyse Trump's latest tariffs or predict the Fed's next move. Instead, I want to talk about something more fundamental: how to think about investing, especially when it feels like the world is losing its mind (again!). Because your strategy is only as good as the foundation supporting it.

Investment philosophy is like a compass in a storm. Without one, every market sell-off feels existential (a special thanks to mainstream media). With one, you're just adjusting your sails while staying on course.

TL;DR

A solid investment philosophy should help you:

- Keep calm and carry on when markets go crazy (as they will)

- Make decisions that actually align with your real goals

- Avoid mistakes that can wipe you out

- Play your own game – not the one everyone else is playing

This is my philosophy and view on managing wealth. It's built on painful lessons, a few lucky breaks, and everything I've learned.

Take what works for you. Ignore the rest. But develop something to guide you.

Start With Why: Know Your Reason for Investing

I can't tell you how many people I meet who are investing without asking themselves, "What am I trying to accomplish here?"

In my "From Cashflow to Capital: A Founder’s Guide to Building Generational Wealth" piece, I discussed the game levels in the Capital Founders' Quest.

The first level is about building a portfolio of assets that generates enough income so you don't have to work unless you want to.

Once this level is complete, you can move to the next one. Your progress can look like this.

Level 1: Replace your "time for money" income with passive returns

Level 2: Fund the bigger dreams or toys (villa with a sea view, sports car, kids' education, or whatever you always wanted)

Level 3: Preserve your wealth to pass it on

Level 4: Invest for impact, curiosity, or just because it's fun

Different levels require different approaches. What you require when building wealth is not what you need when preserving it.

I saw it first-hand when some people who made fortunes in business decided to play a different game and start investing. Although they had a higher-than-usual risk tolerance and tendency toward overconfidence from past successes, they focused solely on high-risk investments. Unfortunately, this strategy ultimately led to significant financial losses.

Here's the truth about money that took me a while to learn.

Its value isn't what you can buy with it. It's the freedom it gives you over your time.

Figure out your "Magic number", then build everything around that.

Understand Risk (Actually Understand It)

Everyone says "investing is risky", but ask them what that means, and very few can explain anything beyond the fact that you can lose money.

The financial markets are basically a giant machine for transferring risk:

- Entrepreneurs take concentrated bets to build companies and create wealth. They risk almost everything, if not all.

- Investors buy pieces of that risk in exchange for potential returns.

- Different asset classes are just different types of risk—from "risk-free" Treasury bonds not yielding more than 5% to early-stage start-ups where you can get 100X your money or lose it all.

The more risk you take, the more return you should expect – but that doesn't mean you'll get it. And sometimes, the significant risks are hiding in perfectly safe places. Remember private banking giant Credit Suisse?

Risk isn't just volatility. It's the permanent loss of capital, not having cash when you desperately need it, and being forced to sell at the wrong time.

The Black Swan or Tail Risk

A "Black Swan" isn't just a bad day in the market, even if it declines 10-20%. It's not a recession that everyone sees coming. It's an event beyond normal expectations that reshapes everything we thought we knew.

- The 2008 financial crisis saw two major investment banks (Lehman Brothers and Bear Stearns) collapse, turning AAA-rated securities into toilet paper.

- COVID-19 locked everyone in their homes, sending oil futures negative (remember when oil producers were paying people to take their oil?).

- The Russia–Ukraine war for Ukrainian citizens who saw their entire lives turn upside down overnight.

History has many examples that "couldn't happen" – until they did.

And the funny thing about Black Swans? If all financial experts are predicting it, it's not a Black Swan. It's just noise. Ignore.

Always Protect the Downside

Regardless of your net worth and current situation, remember that things can change in the blink of an eye.

"Just because you're paranoid doesn't mean they aren't after you."

Joseph Heller, Catch-22

Wall Street rewards risk-takers. However, paranoid control freaks build the most resilient portfolios and long-term returns.

Ask anyone who's ever lost a fortune – capital preservation isn't just some boring conservative strategy. That's everything. No matter how much you have, it can vanish faster than you think.

Some of history's best investors understood this:

- John Paulson made $20 billion betting against subprime mortgages during the financial crisis.

- Mark Spitznagel's Universa Investments delivered a mind-blowing 4,144% return in Q1 2020 using tail-risk hedges.

- Bill Ackman turned a $27 million investment in CDSs into $2.7 billion in 30 days, leading some to refer to it as the greatest trade ever.

These strategies are called Tail Risk strategies and work as insurance. You pay a premium for them, but when something happens, the return from such strategies can offset losses in your overall portfolio and give you cash to buy good assets at highly discounted prices.

Successful investors who survived major crashes not because they timed markets perfectly, but because they had built-in circuit breakers:

- Serious cash reserves (not just a tiny emergency fund)

- Assets that don't all move in the same direction at once

- Position sizes that ensure no single investment can sink them

- Insurance against tail risk

Ask yourself:

- Could your portfolio take a 40% hit and you'd still be okay?

- Do you have any downside protection, or are you just hoping for the best?

- What's your "sleep-at-night" number in the bank that keeps you calm during crashes?

Hope for the best. Plan for the worst. That's how you stay in the game long enough to win.

Concentration vs. Diversification: Know Your Stage

There are two schools of thought here:

"Don't put all your eggs in one basket."

That's probably what your grandparents told you.

"Put all your eggs in one basket — and watch that basket like a hawk." — Andrew Carnegie

Which approach is the right one? Both.

But it depends entirely on what stage you are in your Quest.

If you're building wealth

Concentration can work wonders. Almost every fortune was created that way – founders betting everything on their company, employees loading up on stock options, and VCs looking for the next unicorn.

If you're preserving wealth

Diversification isn't just smart – it's essential. Your returns might not make for exciting dinner conversation, but you'll never have to worry about money again.

You don't have to pick one approach forever. Know where you are now, and act accordingly. You can also allocate your capital to different risk buckets and have some money to play with but not risk it all.

Disregard the Noise

The financial media isn't designed to help you invest better. It's designed to keep you watching and clicking. Brokers incentivise you to trade so they can earn their commissions. But it will make them rich, not you.

Markets can move for thousands of reasons that never make the headlines:

- Massive index funds rebalancing their portfolios

- Hedge funds are getting margin calls and liquidating positions

- Pension funds deploying billions on predetermined schedules

- Trading algorithms triggering cascading buy or sell orders

- Options expiration mechanics are distorting underlying stock prices

None of these make for sexy headlines, but they move markets. Today, with so much fake news and misinformation, you can never know the reasons behind certain events.

That is why I don't have a TV and rarely watch or read the news. It feels like everyone lies and doesn't tell the truth.

Again, here is another recent example:

The market just popped 7% in just a few minutes on a complete rumor of a 90 day pause in tariffs which apparently started on X. Then crashed just as fast when White House said it's "fake news"... Interesting... pic.twitter.com/cQw3ngTc4s

— Dan Elton (@moreisdifferent) April 7, 2025

Unless you're sitting at a trading desk with a dozen screens, institutional-grade infrastructure and proper research, stop trying to outsmart the market's every move.

Investing isn't about reacting to headlines. It's about methodically allocating your capital (as well as time and resources) toward long-term goals while everyone else is distracted by the noise.

Investing is a long-term game - think years and decades.

Investing is About Psychology More Than Numbers

Unless you are a professional investor who manages money for a living, I recommend reading some books about behavioural finance to understand the driving forces behind our decisions.

Your most significant investment risk isn't inflation, interest rates, or recessions. It's YOU—your fear, greed, and FOMO when your neighbour's crypto goes 10x.

How do you fight your own worst instincts? By building systems that protect you from yourself:

- Create rules before you need them. When you think clearly, decide what would make you buy or sell.

- Keep an investment journal. Write down what you're buying or selling, WHY, and how you feel about it. You'll be shocked at what patterns can emerge.

- Build in cooling-off periods. Give yourself 48 hours to think it over for any significant investment decision. The best decisions rarely happen in moments of peak emotion.

- Find someone who can give you an honest opinion. Whether it's a friend or professional advisor, you need someone who can say, "You're not thinking clearly right now."

I highly recommend reading Morgan Housel's "The Psychology of Money" or Daniel Kahneman's "Thinking, Fast and Slow."

Here is an interesting video where Andrew Huberman interviews Morgan.

Know Your Investor Archetype

As with the role-playing game, knowing what character archetype you are helps you navigate the Quest much better.

After years of working with wealthy clients, I've noticed a few distinct types of investors.

The Operator-Turned-Investor

You built and sold a business (or plan to). You want to stay active, so now you're investing that capital. You bring real operational expertise, but might struggle with the passive nature of investing. As your tolerance to risk is high, you might go all-in on higher-risk investments, which you might not fully understand. You can learn it, but it will take time. This is where the danger zone is. Public markets work differently from the business world.

So, this is what you can do.

Hire a financial adviser or wealth manager. Allocate most of your assets to a long-term diversified portfolio to help you achieve your investment goals and preserve wealth.

Put aside some capital you can play with. You can invest in start-ups or private companies—a space that you understand well and can bring much value. You can also mentor founders, which could be a satisfactory endeavour.

The Capital Preserver

You're focused on not losing what you've built or inherited. Often, this is second or third-generation wealth that's seen what can go wrong. But it can also be a first generation where you decided you played that game well and want to change the direction.

The advice here would be similar. Find a financial adviser who can help you create a long-term portfolio, and you can focus on things that you enjoy.

The Allocator

This is institutionalised private wealth—a family office set up. You need to have at least $250M+ in assets and hire a professional investment team. You will need to run it as a business, where the costs of running such a family office must cover its expenses and generate significant returns.

The Moonshot Maximalist

You're comfortable putting money into high-risk, high-reward opportunities. You know most will fail, but you're hunting for those asymmetric returns that change everything. This is the rare type.

Elon Musk is a good example, and many people do not know the following part of his story.

In 2002, when he sold PayPal to eBay, he made $180M from this deal. Musk allocated $100M to SpaceX (founded in 2002) and $70M to Tesla (joined in 2004 as lead investor), leaving him minimal liquidity. By 2008, only $40M remained after mounting costs.

In 2008, both companies nearly failed simultaneously. For SpaceX, the third Falcon 1 rocket failure threatened closure, and Tesla faced bankruptcy two days before Christmas 2008. Musk later described being "more than broke"—Tesla required emergency funding rounds while SpaceX scrambled to secure NASA contracts. His brother Kimbal confirmed Musk was "in debt" during this period.

Then luck turned in Elon's favour. Later that year, NASA awarded SpaceX the $1.6B contract (12 flights to the ISS), which became the lifeline. Tesla's 2009 Daimler investment and 2010 IPO marked the turnaround.

Today, Elon Musk's net worth is about $350 billion (that said, looking at the markets right now, it can easily shrink by $50 billion by the end of the week). Nevertheless)

The Most Important Decision: Philosophy Before Tactics

After years of doing this, I've learned that most people don't have an investment philosophy. They have a collection of reactions to market events. They chase returns. They follow trends. They buy high and sell low repeatedly.

If you have ever run a business, you know the importance of a business plan and strategy. An investment plan is the same.

But you're different. You're building wealth intentionally. And that starts with clear thinking about why you're investing in the first place.

Your investment philosophy isn't just about making money. It's about aligning your capital with your values, goals, and the life you want. It's about creating a framework that lets you act decisively when everyone else is frozen with fear or drunk on greed.

Know your why. Protect your downside. Play your own game.

You don't need to be the most intelligent person in the market. You must stay in the game long enough to let compounding work magic.

Remember: Survive first. Thrive later.