Consider how a shipping company might use Suez Canal blockage probabilities to make routing decisions. Or how a pharmaceutical firm could monitor FDA approval odds to time capital allocation. These aren't hypothetical applications—corporations are beginning to treat prediction market data as operational intelligence rather than speculative entertainment.

This shift from curiosity to serious consideration happened faster than most allocators expected. Combined trading volume hit $44 billion in 2025, up from approximately $9 billion the prior year—roughly 400% growth. Platform valuations now exceed $20 billion combined. The NYSE's parent company committed $2 billion to Polymarket, a move that signals major financial infrastructure players see something worth backing at scale.

Is this early infrastructure for a new asset class, or peak enthusiasm before regulatory reckoning?

I don't have a confident answer. But I've developed a framework for evaluating the space that treats the opportunity seriously without ignoring the substantial risks.

Key Takeaways

- Combined trading volume hit $44 billion in 2025—roughly 400% growth from prior year. Platform valuations now exceed $20 billion combined

- Platform equity: Maximum upside, maximum regulatory risk. Kalshi ($11B) and Polymarket ($9B) remain private, requiring venture-style allocation capacity

- Public proxies: Robinhood (HOOD), DraftKings (DKNG), ICE, CME all have exposure. Prediction markets became Robinhood's fastest-growing product ever—$100M annualized revenue, on pace for $300M

- Infrastructure plays: Data aggregation, APIs, market making serve whoever wins the platform war. Platforms bear litigation; infrastructure serves whoever emerges

- Direct trading is negative-sum: Zero-sum before fees, negative-sum after. Entertainment expense unless you have genuine edge through domain expertise or algorithmic arbitrage

- Hedging may be the real opportunity: Institutional clients seeking event-contract derivatives to hedge policy, regulatory, and operational risks

- Regulatory timeline: 18-24 months before clarity. Torres Bill Q2 2026, state appeals late 2026, potential SCOTUS 2027-2028. Positions taken now are implicitly bets on that resolution

- Sizing guidance: Venture-style allocation bucket. 1-3% of alternatives capacity for those with appropriate risk tolerance

How These Markets Differ From Traditional Forecasting

The mechanism itself is straightforward: a contract pays $1 if an event occurs, $0 if it doesn't. The current price represents the market's implied probability. A contract trading at $0.65 means the crowd collectively believes there's a 65% chance the event will happen.

What makes this interesting isn't the binary structure—options traders understand contingent payoffs. It's what financial stakes do to information quality.

Polls carry no accountability. Respondents face zero consequence for inaccuracy. They might tell you who they think will win an election, but they have no skin in the game. Prediction markets penalise overconfidence directly. If I'm convinced an outcome is 90% likely and the market prices it at 60%, I can profit by buying—but only if I'm actually right. This mechanism forces participants to reveal genuine beliefs rather than preferences, hopes, or tribal loyalties.

The theoretical foundation traces to Hayek's insight about decentralised information aggregation: no single person knows everything, but market prices synthesise dispersed knowledge into usable signals. Prediction markets apply this logic to events rather than goods.

Two platforms dominate the current landscape, and the regulatory and operational differences between them create real tradeoffs for institutional participants.

Kalshi operates as a CFTC-regulated Designated Contract Market, treating event contracts as derivatives under federal oversight. The company raised a $1.1 billion Series E in December 2025 at an $11 billion valuation, led by Paradigm, with participation from Sequoia and a16z. Their distribution strategy emphasises integration with established financial infrastructure—partnerships with Robinhood, Coinbase, CNN, and CNBC bring event contracts to existing user bases. Kalshi's pitch to institutions centres on regulatory legitimacy and compliance-first positioning. Weekly trading volume now exceeds $1 billion, up over 1,000% from 2024.

Polymarket is built on blockchain infrastructure and originally offered global accessibility through crypto-settled contracts. U.S. users were blocked following a 2022 CFTC settlement, but the platform acquired QCEX, a CFTC-licensed exchange, for $112 million in mid-2025 and has received approval to relaunch domestically. ICE's $2 billion strategic investment valued Polymarket at approximately $9 billion and established ICE as the global distributor of Polymarket's event-driven data to institutional investors.

The regulatory and operational differences create distinct value propositions. Kalshi offers institutional trust and compliance infrastructure at the cost of some market diversity and speed. Polymarket offers global reach and arguably purer information signals—including from participants who might have inside knowledge—but carries residual regulatory uncertainty from its crypto origins. Both platforms have demonstrated substantial traction and institutional backing.

The Accuracy Record: What the Data Actually Shows

The 2024 U.S. presidential election was the highest-profile test of prediction market accuracy, and the results merit careful examination.

Polymarket showed Trump as the favourite through most of the campaign, with probabilities that moved dynamically in response to events. When the first assassination attempt occurred in July, Trump's odds climbed immediately. When Kamala Harris entered the race, they dropped. When Harris performed well in the September debate, the market reflected that within minutes. Traditional polls remained essentially static throughout—hovering around 50-50 regardless of campaign developments.

Researchers at UCLA Anderson found that prediction markets provided nearly immediate feedback, responding faster than polls to debates, breaking news, and economic data releases. The markets also captured expectations and information asymmetries that polls couldn't access.

But the accuracy advantage needs qualification.

A study by Vanderbilt researchers analysed over 2,500 prediction markets across four platforms during the 2024 election and found significant inefficiencies. Prices for identical contracts diverged across exchanges. Daily price changes were weakly correlated across platforms. Arbitrage opportunities persisted right up to election day—a sign that information wasn't being efficiently synthesised across the ecosystem.

The accuracy findings were nuanced: PredictIt correctly predicted outcomes better than chance 93% of the time. That figure dropped to 78% on Kalshi and 67% on Polymarket. The study's authors, political science professor Joshua D. Clinton and researcher TzuFeng Huang, attributed PredictIt's higher accuracy partly to its bet-size caps, which discouraged massive "whale" positions and favoured a larger number of smaller, more deliberate participants.

The Iowa Electronic Markets, which have been running since 1988, offer the longest track record. Research published in the International Journal of Forecasting found that their election-eve predictions averaged 1.33 percentage-point absolute error, compared to 1.62 for polls conducted in the same window. More importantly, markets maintain this accuracy advantage even 100 days before elections, when polls are notoriously unreliable due to preference volatility.

Internal corporate prediction markets tell a similar story. Hewlett-Packard experimented with employee prediction markets from 1996 to 1999 and found they outperformed official corporate forecasts in six of eight cases. Google ran extensive internal markets with over 175,000 predictions from 10,000+ employees. The forecasts proved accurate and decisive, delivering useful predictions on everything from product launch timing to COVID-19 outcomes.

The measured conclusion: prediction markets aggregate available information efficiently and update faster than alternatives. They cannot predict truly unknowable events, and thin liquidity can create opportunities for manipulation. More volume doesn't automatically mean more accuracy—market structure and participant composition matter. For investors evaluating the space, the accuracy proposition is real but modest. The more compelling thesis involves what happens when this infrastructure scales and whether institutions adopt prediction market data as a standard input for decision-making.

Five Approaches to Exposure

The menu for gaining exposure has expanded considerably over the past eighteen months. Each approach carries distinct risk characteristics and return profiles.

Platform Equity

Kalshi and Polymarket remain private companies despite their massive valuations. Access requires either direct relationships with their investors or participation in secondary markets where shares occasionally trade.

The investment case rests on prediction markets becoming a mainstream asset class. Citizens Financial Group projects industry revenues will grow 5x to over $10 billion by 2030. Some industry projections suggest trading volume could reach $1 trillion annually by decade's end. If these projections materialise, early equity holders would benefit enormously—Kalshi's December valuation of $11 billion implies the market is already pricing significant growth.

The risk is equally substantial. Regulatory resolution could go either direction. A Supreme Court ruling affirming state authority over event contracts would force fundamental restructuring. Platform valuations would compress, and the unified national market these companies have built would fragment.

For allocators with venture capacity, this resembles early crypto exchange equity circa 2017-2018. Coinbase shares were accessible only through private markets before the 2021 IPO. Those who gained exposure saw extraordinary returns. Many similar bets went to zero. Position sizing should reflect this potential for a binary outcome.

Public Market Proxies

Several publicly traded companies offer indirect exposure without the binary risk of private platform equity.

Robinhood (HOOD) integrated Kalshi contracts directly into its trading app, and the results have been striking. Prediction markets became Robinhood's fastest-growing product line by revenue in company history, with 11 billion contracts traded by more than 1 million customers. The business has already brought in $100 million in annualised revenue, and based on October figures, is on pace to become a $300 million business. Robinhood has driven more than 50% of Kalshi's total trading volume and recently acquired its own CFTC-regulated exchange to reduce its dependence on third parties.

DraftKings (DKNG) moved aggressively into the space in late 2025, acquiring Railbird Exchange—a CFTC-licensed futures exchange—and launching DraftKings Predictions in 38 states. At launch, trades route through CME Group, giving that exchange exposure to its infrastructure as well. DraftKings brings substantial distribution advantages: an existing user base comfortable with event-based wagering, brand recognition, and regulatory relationships across multiple states.

Intercontinental Exchange (ICE) committed $2 billion to Polymarket. The parent company of the New York Stock Exchange's strategic investment of this magnitude signals institutional conviction about the category's future. ICE's involvement also means integration with traditional financial infrastructure—the agreement makes ICE a global distributor of Polymarket's event-driven data, providing institutional clients with real-time sentiment indicators on market-moving events.

Interactive Brokers (IBKR) has begun offering event contracts, expanding access to their institutional and sophisticated retail client base.

The advantage of public proxies is liquidity and diversification. These companies have revenue streams beyond prediction markets, so exposure is diluted, but so is risk. The disadvantage: prediction market success may represent only a portion of their total business—material enough to matter at the margin but unlikely to drive transformative returns unless the category scales dramatically.

Infrastructure: Picks and Shovels

The thesis that worked in previous market emergences applies here. When everyone's digging for gold, sell shovels.

Dome, backed by Y Combinator and founded by former Alchemy engineers, is building a unified API across Polymarket, Kalshi, Myriad, and Manifold. As the ecosystem fragments across platforms, infrastructure that aggregates data and enables cross-platform trading becomes essential. Hedge funds and market makers need consistent data feeds and execution capabilities regardless of which exchange ultimately dominates.

Data and analytics providers represent another infrastructure opportunity. The sports betting industry spawned Sportradar and Genius Sports—companies that broker game data and provide odds modelling to sportsbooks. Prediction markets have analogous needs for data feeds and predictive algorithms, but the equivalent infrastructure doesn't yet exist at scale. How do you price the probability of a Federal Reserve rate cut? How do you model the odds of a corporate acquisition completing? Institutions will pay for tools that systematically answer these questions.

Resolution infrastructure deserves attention. Trustworthy event resolution isn't trivial, particularly for subjective or contested outcomes. The "Maduro trade" that drew headlines in January 2026 highlighted this—Polymarket initially hesitated to pay out "Yes" bets when U.S. forces captured the Venezuelan president, sparking accusations of arbitrariness in its role as an "arbiter of truth." Platforms that solve verification problems elegantly create defensible value.

Market making itself functions as infrastructure. Susquehanna International Group and Jane Street dominate institutional market making on Kalshi, ensuring liquidity for contracts that would otherwise be too thin for professional use. The average trade size has evolved from $300 in early 2024 to nearly $4,800 today, reflecting institutional participation. Algorithmic trading firms are hiring specialists at $200,000+ salaries to build positions in this space.

Infrastructure offers exposure to the growth of prediction markets without direct regulatory risk. If Kalshi wins, infrastructure serves Kalshi. If Polymarket wins, infrastructure serves Polymarket. The platforms bear litigation costs while infrastructure serves whoever emerges. For risk-adjusted returns, this layer may prove most attractive for allocators uncomfortable with binary platform outcomes.

Direct Trading

Prediction markets are zero-sum before fees and negative-sum after. This basic math shapes everything about the opportunity for individual traders.

Unlike equity investing, where companies create value through productive activity, and shareholders participate in that creation, prediction markets merely redistribute wealth among participants. For every winner, there is a corresponding loser. The platforms extract fees through bid-ask spreads and transaction costs, making the aggregate outcome negative for traders as a group.

The "Maduro trade" illustrates both the opportunity and its limits. A Polymarket user reportedly netted approximately $400,000 by betting on Nicolás Maduro's capture hours before international news outlets confirmed it, turning roughly $32,000-$34,000 in wagers into a massive payout. Whether this reflects remarkable analytical skill or actual inside knowledge is debatable. What's clear is that the trader had an informational edge that the market hadn't yet priced.

Algorithmic arbitrage strategies have generated documented profits by exploiting 4-6 cent price spreads between platforms for events expiring within 24 hours. These opportunities are fleeting and systematically captured by automated bots capable of executing trades in milliseconds. Manual traders cannot compete in this high-frequency environment.

One notable feature distinguishes prediction markets from securities: insider trading is not prohibited. Someone with material non-public information about a corporate event or political development can legally trade on that knowledge. This creates a legitimate edge for participants with access to private information—industry insiders, policy professionals, or domain experts—while raising questions about market fairness for retail participants.

For most individual investors without a systematic edge, direct trading should be sized as an entertainment expense rather than a wealth-building activity.

Hedging Applications

The most legitimate use case for sophisticated allocators may be hedging rather than speculation.

Consider concrete applications:

- A crypto-focused fund with regulatory exposure can use prediction market contracts on SEC enforcement outcomes to hedge portfolio risk directly—far cleaner than constructing synthetic positions through traditional derivatives

- A logistics company can monitor blockage probabilities for shipping chokepoints and adjust routing or inventory accordingly

- Energy companies can hedge climate policy changes by taking positions on specific regulatory outcomes

- Pharmaceutical companies can hedge drug approval timelines, adjusting R&D spending or partnership negotiations based on market-implied probabilities

Goldman Sachs has noted that institutional clients are seeking "event-contract derivatives" cleared through regulated exchanges to hedge macro risks. Hedge funds are using these platforms as a VIX alternative, deploying prediction markets to hedge against specific news risks, such as CPI prints, Federal Reserve rate decisions, and regulatory changes.

This enterprise's demand for hedging instruments may ultimately exceed retail speculation in scale and stability. A major logistics firm monitoring "Suez Canal Blockage Risk" markets to decide whether to reroute ships represents a shift from prediction markets as entertainment to prediction markets as operational infrastructure.

Regulatory Landscape

No assessment is complete without confronting the central uncertainty that hangs over this space.

The core legal question appears simple but has proven contentious: Are prediction markets CFTC-regulated financial derivatives, subject to federal oversight and preempting state authority? Or are they state-regulated gambling products, requiring licenses in each jurisdiction and potentially facing prohibition in states that don't permit certain forms of wagering?

Kalshi has staked its business model on federal preemption. The company operates as a CFTC-regulated Designated Contract Market and has expanded into all 50 states, arguing that federal derivatives regulation supersedes state gambling laws. This position has met fierce resistance.

State opposition has been substantial. More than 30 states filed amicus briefs supporting state regulatory authority over event contracts. Nevada, New Jersey, and Maryland have moved to block Kalshi's sports contracts specifically. The Massachusetts attorney general sued Kalshi in September 2025, alleging the company provides sports wagering under the guise of event contracts. A preliminary injunction in January 2026 barred certain Kalshi contracts in that state. Nevada recently won a ruling dissolving Kalshi's preliminary injunction, and Robinhood has agreed to cease offering new sports event contracts there pending further proceedings.

Litigation outcomes have been inconsistent. At least 12 lawsuits are working through federal and state courts. A Nevada judge initially sided with Kalshi, then reversed. Maryland ruled for state regulators. New Jersey granted Kalshi a preliminary injunction. California sided with Kalshi against tribal gaming interests. No clear pattern has emerged, and the fragmented rulings create uncertainty about which jurisdictions will ultimately permit which types of contracts.

Tribal gaming interests have entered the fray. The Ho-Chunk Nation filed suit in Wisconsin, and their legal arguments have prompted Robinhood to file court papers defending its access to Kalshi's platform. The tribal gaming industry views prediction markets as direct competition and has meaningful political influence in multiple states.

Legislative action may provide a resolution. The Torres Bill (H.R. 7004), introduced by Representative Ritchie Torres, offers a potential path forward. The bill would ban government insiders from trading on prediction markets while legitimising platforms as forecasting utilities for the broader public. If passed, it could provide the federal framework that enables institutional adoption while addressing concerns about manipulation.

Timeline markers for allocators: The Torres Bill could see committee action in Q2 2026. The Massachusetts and Nevada cases are expected to reach appeals by late 2026. A Supreme Court case, if it materialises from the current circuit splits, would likely be decided in the 2027-2028 term. This suggests 18-24 months before definitive regulatory clarity emerges. Positions taken now are implicit bets on that resolution.

For allocators, regulatory barriers create both risk and opportunity. A definitive ruling against federal preemption would force industry restructuring. Platforms would need state-by-state licenses, sports contracts might face prohibition in many jurisdictions, and the unified national market that Kalshi has built would fragment. Platform valuations would compress dramatically.

The flip side: regulatory barriers create moats for well-capitalised, legally sophisticated players. If federal preemption ultimately prevails, early movers will have established dominant positions that later entrants cannot easily challenge. The current uncertainty is precisely why platform valuations haven't already reached $100 billion.

Enterprise Opportunity

Most coverage focuses on consumer trading—individuals betting on elections, sports, and cultural events. The less visible but potentially larger opportunity involves enterprise applications.

Internal corporate prediction markets have a longer history than most realise. Google launched its internal market ("Prophit") in 2007, allowing employees to bet with play money on outcomes such as product launch dates, new office openings, and strategic milestones. Over eight quarters of operation, the market delivered accurate predictions, surfacing information that management wouldn't have accessed through traditional channels—employees provided honest assessments when they had a stake in accuracy rather than career incentives to present an optimistic outlook.

HP, Microsoft, Intel, Eli Lilly, Pfizer, Qualcomm, and Siemens all experimented with similar systems. The consistent finding: markets outperformed traditional forecasting methods.

Why haven't internal prediction markets achieved widespread adoption?

Analysis of Google's prediction market experience reveals that the markets failed to scale not because they were inaccurate but because managers preferred plausible deniability when projects failed. Transparent probabilistic forecasts created accountability that executives found uncomfortable. When Google's supply chain teams evaluated using prediction markets to improve data centre purchasing decisions—where overprovisioning could cost hundreds of millions—the accuracy benefit was acknowledged, but implementation was rejected.

The forecasting process served functions beyond accuracy: resource allocation negotiations, political cover for uncertain decisions, and coordination among teams. A more accurate but less politically flexible system threatened those functions. The executive incentive was to maintain control over forecasts rather than maximise their accuracy.

What's changed is that external platforms now provide infrastructure without requiring internal political battles. A corporate treasury team can monitor publicly traded contracts on economic indicators, regulatory outcomes, or competitor milestones without building internal markets or navigating organisational resistance. The forecasting intelligence becomes a purchased input rather than an internal initiative requiring executive sponsorship.

Industry analysts expect B2B value to surpass retail B2C usage within the next few years. Institutions increasingly view prediction markets as consensus pricing tools—mechanisms for aggregating distributed information into actionable signals. Supply chain analytics represents a natural integration territory.

Anthropic recently announced an internal prediction market with an explicit "focus on decision-makers"—a signal that sophisticated technology companies continue finding value in collective forecasting.

For founders with enterprise software experience, the gap is concrete. Tooling for corporate use of prediction market data doesn't exist at scale:

- Compliance wrappers for regulated industries (financial services, healthcare, government contractors) that need audit trails and governance frameworks

- Integration layers connecting prediction market data to SAP, Oracle, and other enterprise planning systems

- Vertical applications that translate raw probability signals into industry-specific decision support—demand forecasting for retail, clinical trial planning for pharma, policy risk assessment for multinationals

The platforms are building consumer products. The enterprise layer remains largely unconstructed. This resembles the early SaaS opportunity around Salesforce or AWS: foundational infrastructure exists, but vertical applications that make it usable for specific industries have yet to be built. Someone will build the equivalent of Datadog for prediction market analytics or Stripe for event contract compliance.

Risk Framework

The risks are substantial, correlated, and in some cases non-diversifiable.

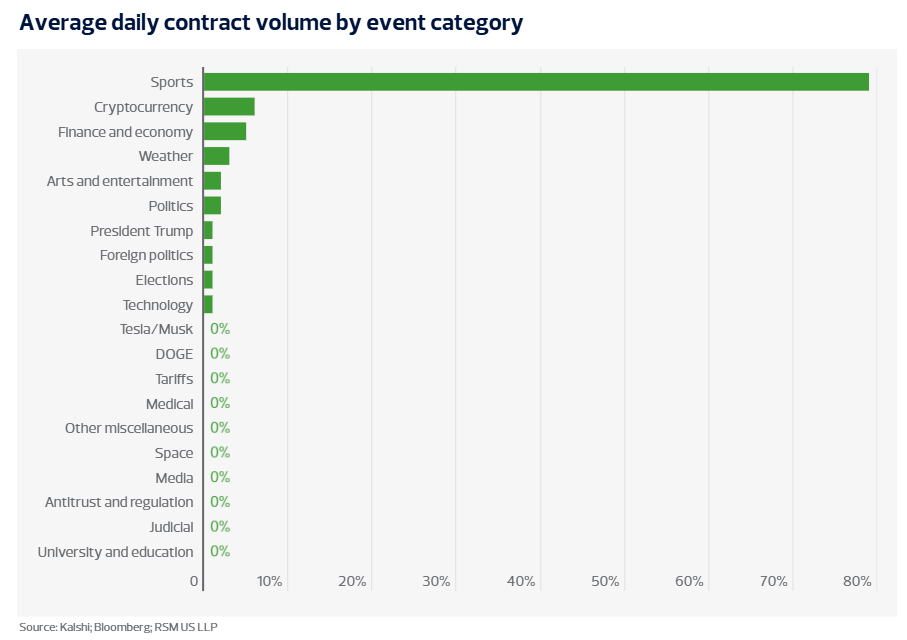

Regulatory risk dominates. A definitive ruling against federal preemption would force industry restructuring. States hostile to gambling would become inaccessible markets. Sports contracts, which represent the majority of current volume on Kalshi, could be prohibited in many jurisdictions. Platform valuations would compress dramatically, and infrastructure investments predicated on a unified national market would face impairment.

Competitive dynamics present concentration risk. Network effects in trading platforms typically produce winner-take-most outcomes. Liquidity begets liquidity—traders go where other traders are. Kalshi and Polymarket currently dominate, but DraftKings has meaningful distribution advantages through its existing user base, and traditional exchanges like CME Group have infrastructure capabilities that startups cannot match. Robinhood's acquisition of its own exchange introduces another well-capitalised competitor. Today's leaders are not guaranteed tomorrow's winners.

Manipulation risk shouldn't be dismissed. Large traders can move thin markets, potentially exploiting retail participants or creating artificial price signals. The Vanderbilt study found that arbitrage opportunities persisted even in the final weeks before the 2024 election—a sign that sophisticated actors weren't efficiently correcting mispricings. As institutional capital enters, the incentives for manipulation increase alongside the sophistication of defensive measures.

Volume sustainability is uncertain. The 2024 election and 2025 NFL season drove extraordinary trading volumes. What happens in 2027, when no presidential election dominates attention? Sports may provide baseline volume, but the category-defining events that generate massive liquidity are inherently episodic. Platforms need to demonstrate sustainable engagement between major events. Piper Sandler anticipates over 445 billion contracts will trade in 2026, but that projection depends on continued regulatory tolerance.

Market structure creates headwinds. Prediction markets are zero-sum by design. Sustained participation requires a continuous influx of new traders willing to take the other side of informed positions. If sophisticated algorithmic players increasingly dominate, retail participation may decline, potentially creating liquidity problems. This dynamic has played out in other trading markets and could repeat here.

I've taken a small position in one infrastructure company—small enough that being wrong won't matter, large enough that I'll pay attention to developments. That sizing logic reflects how I think about venture-style allocations in uncertain categories: meaningful optionality, acceptable downside.

Framework for Allocators

The industry sits at an inflexion point. Regulatory clarity may emerge in 2026 or 2027, either through legislative action or definitive court rulings. The 2026 FIFA World Cup, hosted in North America, will test infrastructure at an unprecedented scale. Institutional adoption is accelerating but remains early—most family offices and wealth managers have not yet allocated to this category.

Early positioning creates optionality value. Waiting for certainty means paying certainty pricing. The question is whether the current risk/reward compensates appropriately for regulatory uncertainty.

On sizing: This belongs in a venture-style allocation bucket—not in the core portfolio, not in income-generating holdings. One to three per cent of alternatives capacity is reasonable for allocators with appropriate risk tolerance. Those requiring greater certainty or shorter time horizons should wait for regulatory resolution.

On selection: Infrastructure offers the most attractive risk-adjusted positioning for most allocators. The platforms bear litigation costs while the infrastructure serves whoever wins. Public market proxies provide liquid exposure with limited downside. Platform equity demands comfort with binary outcomes.

On usage: Even without investing, prediction market data has value. Monitoring probabilities on economic indicators, policy outcomes, or sector-specific events provides a real-time signal that can inform investment decisions across the portfolio. Goldman Sachs has begun integrating prediction market data into client briefings. Google tested displaying market probabilities directly in search results. The information layer may prove valuable regardless of whether the investment layer generates returns.

Four questions can guide individual allocation decisions:

Do you have venture allocation capacity and genuine risk tolerance for binary outcomes? If platform equity goes to zero, will that impair your financial position or merely represent an acceptable loss in a diversified alternatives portfolio?

Do you have domain expertise in any event category? Healthcare regulation, energy policy, sports analytics, geopolitical risk? Domain knowledge creates an edge in evaluating which infrastructure or trading opportunities might succeed—and potentially in trading directly.

Are you willing to actively monitor regulatory developments? This space requires ongoing attention. Positions that made sense pre-ruling may need adjustment post-ruling. Passive allocation isn't well-suited to a category with this much legal uncertainty.

Can you accept that early infrastructure bets often fail even when the category succeeds? Many crypto infrastructure companies from 2017-2018 no longer exist despite the broader category's growth. Prediction market infrastructure will likely follow similar patterns—some massive winners, many failures.

Final Thoughts

We're watching something interesting emerge. Whether information finance—markets that price truth rather than assets—becomes a permanent feature of the financial landscape depends on regulatory, competitive, and adoption factors that remain genuinely uncertain.

The institutional signals are worth noting. The parent company of the New York Stock Exchange doesn't commit $2 billion to passing fads. Wall Street firms don't hire specialists at $200,000 salaries for curiosity projects. Major broadcasters don't integrate probability data into election coverage for novelty value. Something substantive is happening.

At the same time, thirty-plus states don't file amicus briefs against regulatory preemption unless they perceive real threats to their authority. Class action lawyers don't file gambling lawsuits without belief in viable claims. The resistance is also substantive.

The next few years will determine whether this becomes foundational financial infrastructure or a regulatory casualty. I don't know which outcome will prevail.

What I do know: corporations are beginning to use prediction market probabilities for operational decisions—routing shipments, timing capital allocation, assessing policy risk. Whether you invest in the platforms, the infrastructure, or nothing at all, start paying attention to what these markets are telling you. The institutions with analytical resources that most of us lack already have them.

Capital Founders OS is an educational platform for founders with $5M–$100M in assets. We focus on frameworks for thinking about wealth—so you can make better decisions.

If it's your first time here, don't forget to Subscribe.