This is Capital Signal—timely briefings on what's changing in private markets, wealth structures, and founder behaviour. Playbooks explain the system. Signals track what's shifting.

This Week in 30 Seconds

Twenty percent of your portfolio in illiquid assets used to be aggressive. Now it's mainstream. BCG research shows wealthy North American investors already at 15-20% private market allocation—and the rest of the world is catching up.

EQT just paid $3.2 billion for secondaries pioneer Coller Capital. SpaceX lined up four banks for what could be history's largest IPO. Capital One acquired Brex for $5.15 billion.

Private markets aren't alternative anymore. They're default. And if your governance hasn't caught up to your allocation, that's a problem.

The Allocation Shift Nobody's Naming Clearly

Here's what your wealth manager probably isn't saying directly: private markets stopped being the "alternative" bucket. They became core.

BCG research from March showed wealthy North American investors already allocating 15-20% to private markets. European and Asian investors are catching up fast. The firm predicts $3 trillion in private market assets from individual investors by 2030.

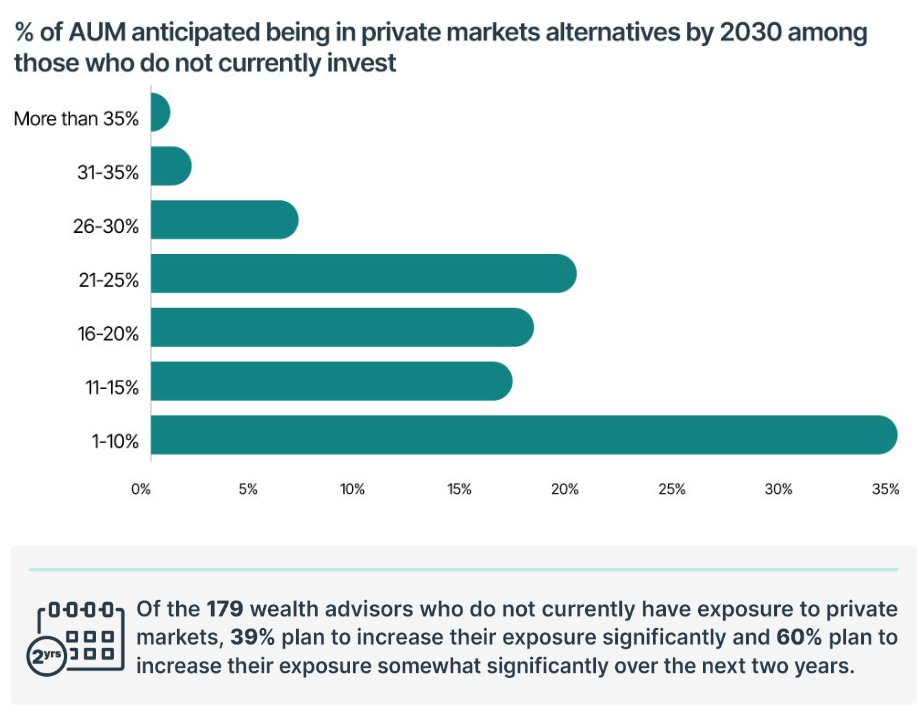

A BBH survey found institutional investors averaging 21.9% in private markets, with 39% of wealth advisors planning to "significantly" increase exposure. This isn't a trend anymore. It's the new baseline.

The issue isn't the allocation itself—the return premium is real. The issue is that most founders don't have governance to match. If your bank thinks 20% illiquidity is normal and you don't have a written policy for what happens when you need cash in a bad year, that's a gap. The old rule—keep three years of expenses liquid—doesn't account for a portfolio where a quarter of your assets can't be sold on demand.

Most founders I talk to don't have an illiquidity budget. They have an allocation their advisor recommended, based on models designed for institutions with perpetual time horizons. That mismatch matters when markets turn.

EQT Paid $3.2 Billion to Own Secondaries. Read That Again.

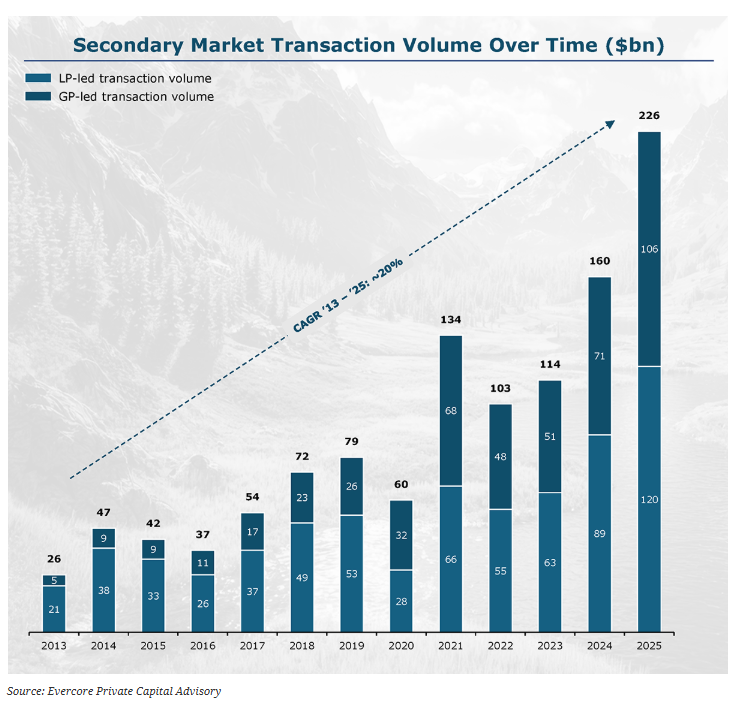

EQT announced this week it's acquiring Coller Capital for $3.2 billion in shares, with up to $500 million more in contingent consideration. Per Franzén, EQT's CEO, said they expect to double Coller's business "in less than four years."

That's not a bet on a niche market. That's pricing secondaries as core infrastructure.

The numbers support it. The secondaries market grew 41% in 2025, hitting $226 billion in transaction volume—smashing Evercore's original $171 billion prediction. LP-led transactions reached $120 billion. GP-led deals hit $106 billion, up 51% year-over-year. Average buyout stakes sold at 94% of NAV in H1 2025, up from less than 90% in 2022.

When pricing improves to 94 cents on the dollar, secondaries stop being a fire-sale option. They become a legitimate portfolio management tool.

If you hold LP positions in PE or VC funds, this changes how you should evaluate new commitments. Before you sign, ask: what's the secondary market like for this manager's funds? Is there an established buyer base? What have recent transactions priced at? Illiquidity exists on a spectrum. Funds with active secondary markets are materially less illiquid than funds without them. Price that in.

Private Credit Is Being Mis-Sold. Here's the Due Diligence Gap.

Private credit has become the default "bond replacement" recommendation. It's now over $2 trillion in assets. The pitch sounds reasonable: higher yields than public credit, floating rates that benefit from the current environment, lower volatility than equities.

The pitch often skips the part where manager selection matters enormously, structure matters, and most founders aren't asking the questions institutions ask.

Jamie Dimon has publicly used the cockroach analogy—when you find one problem in private credit, more are often nearby. Jeffrey Gundlach of DoubleLine has warned that private credit "may be the top candidate to start the next financial crisis." The Fed's Financial Stability Report listed it as a potential shock risk.

Sage Advisory flagged that a recent fee waiver by BlackRock after a private credit CLO breached over-collateralisation tests suggests real portfolio stress. That's not a headline most allocators saw.

As Carlyle noted in their 2026 outlook: "The easy beta of the last cycle is gone. Returns today are driven by the ability to originate with precision, structure with creativity, and manage risk with discipline."

Private credit isn't inherently bad—JP Morgan's research shows it has outperformed high yield by around 150 basis points over the past decade. But it's being sold as low-risk income without the accompanying due diligence infrastructure.

Before you allocate, ask your manager: where do losses show up first—NAV, distributions, or gates? What's their track record in workouts and restructurings, not just origination? How concentrated is the portfolio? What's the actual liquidity mechanism, and has it ever been tested? If they can't answer clearly, that tells you something.

Exit Windows Are Opening

Two deals this week signal that exit markets are functioning again.

SpaceX selected Bank of America, Goldman Sachs, JPMorgan, and Morgan Stanley for what could be the largest IPO in history—targeting over $30 billion raised at a potential $1.5 trillion valuation. For context, Saudi Aramco's 2019 IPO raised $29 billion.

When a listing like SpaceX prices successfully, it creates permission for everything behind it. Renaissance Capital estimates 200-230 IPOs in 2026. IPO windows don't open gradually—they open when giants move.

Meanwhile, Capital One acquired Brex for $5.15 billion—down from Brex's $12.3 billion 2022 valuation, but still a meaningful strategic exit. This is Capital One's second major acquisition in 18 months after the $35 billion Discover deal. Banks are buying capability, not just customers.

For founders with venture or growth equity exposure, these signals matter. The combination of improved secondary pricing (94% of NAV) and potential IPO activity creates exit optionality that didn't exist 18 months ago. Factor that into how you think about concentration risk in late-stage positions.

UK BADR: 72 Days

Quick one for UK founders planning exits.

Business Asset Disposal Relief rates are currently 14% on qualifying gains. On 6 April 2026—72 days from now—that jumps to 18%.

On the full £1 million lifetime allowance, that's a £40,000 difference. Not transformative for a large exit, but real money for a smaller one.

If you're already in exit discussions with a realistic path to completion before April 6, worth pushing for. If you're six months away, don't rush a transaction for £40k savings—the execution risk isn't worth it. Note the anti-forestalling rules: signing a contract early doesn't guarantee the lower rate if completion happens later.

Final Thoughts

Private markets have become default allocation. That's not a problem in itself—but it requires governance that most founders don't have.

Write your illiquidity budget before you need liquidity. Understand secondary options before you commit to funds. Run actual due diligence on private credit, not just yield comparisons. The allocation decision is the beginning, not the end.

Capital Founders OS is an educational platform for founders with $5M–$100M in assets. We focus on frameworks for thinking about wealth—so you can make better decisions.

If it's your first time here, don't forget to Subscribe.