Most people celebrate buying their first home as a financial milestone. For some, it's just the opening move.

The Knight Frank Wealth Report paints an interesting picture. Around 81% of ultra-high-net-worth individuals own their primary residence. That part isn't surprising. What caught the attention: 30% actively invest in additional properties, and nearly half of family offices plan to increase their real estate allocations over the next 18 months.

Why does property hold such a grip on serious wealth?

Because real estate isn't just an asset class. It's a system. One that generates income, fights inflation, offers substantial tax advantages, and can scale across borders when properly structured. The catch? Most resources either oversimplify ("just buy rental properties!") or assume institutional-level sophistication.

We're going to bridge that gap.

Key Takeaways

- Real estate isn't just an asset class—it's a system that generates income, fights inflation, and compounds tax advantages over decades

- Tax arbitrage is real: Depreciation, 1031 exchanges, and interest deductibility mean a 6% gross yield can deliver 8%+ after-tax returns

- UK landlords face headwinds: Section 24 caps mortgage relief at 20%, CGT allowance dropped to £3,000, and the 5% stamp duty surcharge makes structure planning essential

- Geographic concentration kills portfolios: Wealthy investors hold property in 3+ countries—not for returns, but for currency, political, and market cycle diversification

- Singapore is closed to foreign residential buyers: 60% ABSD makes entry prohibitive. Dubai charges 4% transfer fee and 0% on everything else

- Leverage sweet spot: Target 50-65% LTV on stabilised properties. At 80% LTV, a 20% value decline wipes out all equity

- Access routes matter less than strategy: Direct ownership, REITs, syndications, or tokenised assets—pick based on your control needs, liquidity requirements, and operational tolerance

- Family offices target 13.8% unleveraged returns: Achieved through income yield, rent growth, and modest leverage—not speculation

Why Investors Like Property

Let's start with what makes real estate different from other investments.

Inflation Hedge

Real estate is tangible. You can touch it, walk through it, improve it. Its value is tied to actual land and buildings rather than to market sentiment alone.

When prices rise, rents typically follow. When construction costs increase, existing properties become more valuable. This isn't theoretical. According to CBRE research, commercial property fundamentals have remained stable through recent inflationary periods, with same-store net operating income growth for REITs projected at around 3% for 2025.

The inflation protection happens on two fronts: capital appreciation (property values rise with replacement costs) and income (leases often include rent escalation clauses tied to inflation indices).

Predictable Income

Residential and commercial properties generate contractual income. Tenants sign leases. They pay monthly. The cash flow is more predictable than dividends from most public equities.

Some sectors proved remarkably resilient through recent volatility. Multifamily housing barely noticed the pandemic disruption. Logistics centres thrived on e-commerce acceleration. Healthcare real estate stayed solid through the chaos. The FTSE Nareit All Equity REIT Index delivered 14% total returns in 2024, outperforming private real estate by more than 17 percentage points according to Nareit research.

That isn't speculative income. It's contractual cash flow hitting accounts on a schedule.

Tax Advantages

Here's where real estate gets genuinely interesting for founders with liquidity.

Depreciation creates phantom losses. In the US, you can write off your building's value over time, cutting your tax bill while the property actually appreciates. The IRS lets you claim deductions on something that makes you money. It's one of the few remaining legal tax arbitrage opportunities for individual investors.

1031 exchanges defer gains indefinitely. Section 1031 of the Internal Revenue Code allows investors to sell one investment property and buy another of equal or greater value while deferring all capital gains taxes. According to the American Bar Association, this provision has existed since the Revenue Act of 1921. The tax deferral compounds over multiple exchanges. More importantly, if one dies holding the replacement property, their heirs receive a stepped-up basis. The deferred gains simply disappear.

Interest deductibility subsidises borrowing. Finance costs remain deductible against property income in most jurisdictions, effectively meaning the government subsidises part of the borrowing costs.

The after-tax returns from real estate often look dramatically different from pre-tax headline numbers. A property yielding 6% gross might deliver 8%+ after accounting for depreciation shields and leverage effects.

UK-Specific Considerations: The tax landscape for UK landlords has shifted significantly. Since the Section 24 reforms, mortgage interest relief is now capped at the basic rate (20%) regardless of the income tax band. Capital Gains Tax on residential property sits at 18% for basic-rate taxpayers and 24% for higher-rate taxpayers, with the annual CGT allowance reduced to just £3,000 for 2025/26. The stamp duty surcharge on additional properties increased to 5% following the October 2024 Budget. These changes make holding structure planning essential for UK investors.

Commercial vs. Residential

The choice between commercial and residential property isn't binary. Most sophisticated portfolios include both, weighted according to specific objectives.

Commercial Real Estate

Around 19% of UHNW individuals plan to invest in commercial real estate this year, according to Knight Frank's Attitudes Survey.

The sectors generating most interest right now:

Logistics and warehousing have been the standout performers. E-commerce penetration hit a record 23.2% of total US retail sales in Q3 2024 and is projected to reach 25% by the end of 2025, according to CBRE. E-commerce utilises three times as much warehouse space as traditional retail. The structural tailwinds here are real, though supply has caught up in some markets.

Healthcare real estate benefits from demographic certainty. Ageing populations need clinics, assisted living facilities, and medical offices. Healthcare REITs emerged as top performers in 2024.

Data centres represent the intersection of real estate and technology infrastructure. Equinix and Digital Realty have delivered over 2,800% total returns over the past two decades, according to Nareit data. The AI infrastructure buildout only accelerates demand.

Office remains polarised. Trophy assets in prime locations with ESG credentials are performing. Generic suburban offices face structural headwinds from hybrid work. J.P. Morgan Research expects vacancy rates to peak in late 2025 or early 2026, with the inflexion point becoming more visible as over 70% of office occupants have now had the opportunity to adjust their footprints post-pandemic.

Commercial deals typically involve larger capital requirements, longer holding periods, and more complex due diligence. The potential returns often justify the complexity.

Residential

Higher interest rates haven't killed prime residential markets. London, Singapore, Dubai, Miami, and other global cities remain structurally undersupplied. Too many buyers chasing too few properties.

Seoul led prime residential price growth at 18.4% in 2024, followed by Manila (17.9%) and Dubai (16.9%), according to Knight Frank's Prime International Residential Index. Meanwhile, some previously hot markets saw corrections, with Austin down 4.3% and Wellington down 4.9%.

Smart money in residential focuses on:

Build-to-rent developments, where institutional capital is displacing traditional landlords. The sector has matured rapidly with strong fundamentals.

Multifamily housing in growing cities with supply constraints and population growth. Residential real estate remains the most popular sector among family offices, with 81% of family offices investing in it, according to industry surveys.

Strategic lifestyle purchases that serve dual purposes: personal enjoyment plus capital preservation in stable jurisdictions.

The appeal of residential is universality. Everyone understands housing. Everyone needs somewhere to live. The asset class is less complex to underwrite than commercial property.

Geographic Diversification

Concentration risk destroys portfolios. It's the same lesson whether we're talking public equities or property holdings.

According to Knight Frank research, wealthy investors typically hold property in three or more countries. This isn't just about chasing returns. It's about managing currency exposure, political risk, and market cycle correlation.

Different Jurisdictions Play by Different Rules

United Kingdom offers strong legal protections and property rights. Transaction costs are meaningful, though. Stamp duty for additional properties now includes a 5% surcharge. Non-residents face additional complexities. That said, rental yields in certain cities remain attractive, and the legal system provides certainty.

Dubai and Singapore keep things simpler for foreign investors. Minimal property taxes, transparent processes, expat-friendly ownership rules. Dubai led prime residential growth globally in recent years, though valuations have caught up with fundamentals in some segments.

Switzerland offers stability, but good luck finding anything available. Foreign ownership restrictions make entry difficult. What you get in exchange: political neutrality, strong currency, and wealth preservation infrastructure.

Portugal attracted significant capital through its golden visa programme, though recent changes have reduced property investment options. The country still offers a Non-Habitual Resident tax regime that appeals to founders considering relocation.

Know the rules before committing capital. Legal systems, ownership restrictions, taxation of foreign owners, and repatriation of funds vary dramatically.

Currency Risk

That London flat might appreciate 10%. Excellent news, unless sterling drops 15% against your base currency. Suddenly, you lost money in real terms.

Sophisticated investors hedge currency exposure through forward contracts, multi-currency mortgages, or simply spreading holdings across currency zones. The goal isn't eliminating currency exposure entirely. It's managing it consciously rather than accidentally taking concentrated bets.

Structure Matters From Day One

Cross-border portfolios require planning before the first purchase:

Holding company structures in appropriate jurisdictions (Luxembourg, the BVI, and Jersey) can provide tax efficiency and estate-planning benefits. Get advice before buying rather than attempting to restructure later.

International trusts serve estate planning purposes, removing assets from your personal estate while maintaining some control. The structures differ by jurisdiction.

Tax treaty optimisation becomes material at scale. Double taxation treaties between countries determine how income and gains are taxed. Structure affects outcomes significantly.

The cost of good international tax advice typically pays for itself many times over. Don't economise here.

QUICK ASK — Everything here is free. If you're finding this useful, subscribing helps me understand what's working — and keeps you updated when new pieces come out.

How to Access Real Estate

There's no single correct way to invest in property. Each approach involves tradeoffs between control, liquidity, capital requirements, and operational burden.

Direct Ownership

Buying and holding physical property gives maximum control and typically the highest gross returns. You decide when to sell, how much to leverage, when to renovate, and which tenants to accept.

The tradeoffs: time commitment, operational complexity, concentration risk, and illiquidity. Managing five properties across four countries requires either significant personal bandwidth or reliable third-party management.

Direct ownership works best when you have: a genuine interest in the asset class, the ability to add value through local knowledge or relationships, sufficient scale to justify the operational overhead, and a tolerance for illiquidity.

REITs (Public and Private)

Real Estate Investment Trusts own and operate income-producing real estate across multiple property sectors. In the US alone, there are approximately 225 publicly traded REITs covering sectors from residential to healthcare to data centres.

The appeal: Liquidity (publicly traded REITs can be sold immediately), diversification (one holding gives exposure to hundreds of properties), professional management, and no operational burden. REITs also tend to pay attractive dividends. All equity REITs offered dividend yields of 3.8% as of February 2025 according to Nareit, with mortgage REITs offering 11.4%.

The drawbacks: Less control, fee drag from management expenses, and correlation with public equity markets during stress periods. When stocks sell off, publicly traded REITs often follow regardless of underlying property fundamentals.

REITs have historically delivered competitive total returns. The 25-year average annual return has been approximately 10-12%, with about half of total returns coming from dividends, according to Nareit research.

Private REITs offer another option: similar diversification benefits without the daily pricing volatility. The tradeoff is reduced liquidity and typically higher minimum investments.

Private Funds and Syndications

Want to buy a €50 million shopping centre? You probably can't do it alone. Pool capital with nine other investors, and suddenly it's feasible.

Syndications and club deals provide access to institutional-quality assets without requiring institutional capital. Family offices favour these structures. PwC research shows 69% of family office investments were "club deals" (investing alongside others) rather than sole investments in the first half of 2025.

Private funds work well for:

- Mid-market commercial assets

- Development projects where expertise matters

- Niche sectors like data centres, cold storage, or student housing

- Situations requiring speed or relationship access

The considerations: illiquidity (typically 7-10-year holds), performance dispersion across managers, fee structures, and limited control over asset-level decisions.

Tokenised Real Estate

Blockchain technology enables fractional ownership of property through digital tokens. A €10 million Paris commercial building can be divided into tokens representing small ownership stakes, tradeable on secondary markets with settlement in days rather than months.

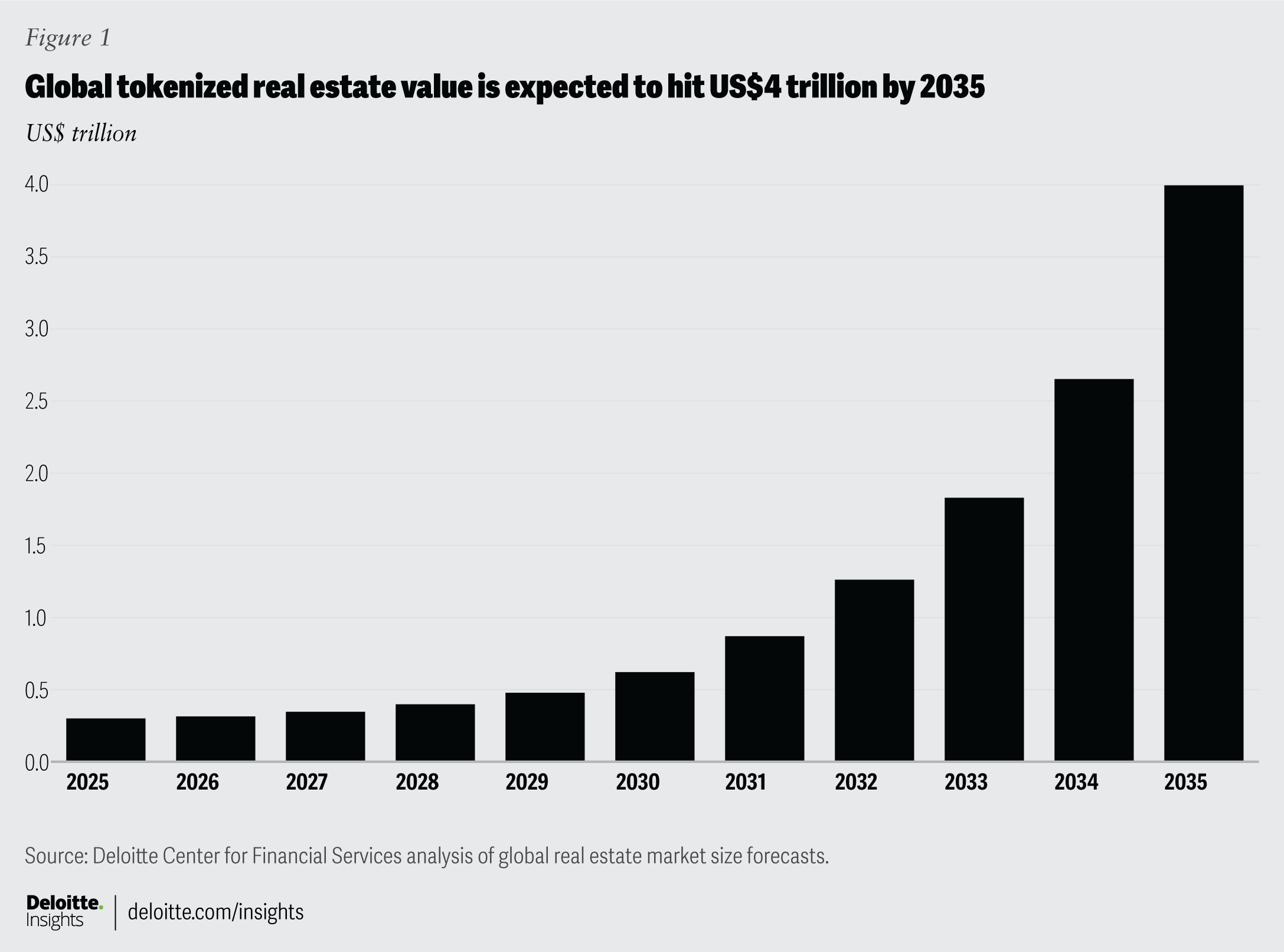

The numbers are compelling. The global tokenised assets market reached approximately $21 billion by April 2025, with real estate making up about 31% of tokenised issuance. Deloitte found that 12% of real estate firms globally had implemented tokenisation solutions by mid-2024, with another 46% piloting programmes.

What tokenisation solves: Traditional real estate's liquidity problem. Properties typically take months to sell. Tokenised stakes can potentially trade in days, though secondary market depth remains limited.

What it doesn't solve (yet): Regulatory clarity varies dramatically by jurisdiction. Secondary markets for real estate tokens remain thin. The technology infrastructure is maturing, but not mature.

Industry projections suggest the real estate tokenisation market could grow from around $3.5 billion in 2024 to over $4 trillion by 2035 according to Deloitte forecasts. Whether those numbers prove accurate depends largely on regulatory developments.

For now, tokenised real estate represents an interesting addition to allocation options rather than a replacement for traditional structures.

Leverage

Debt amplifies returns. It also amplifies losses. Getting leverage right matters more than most acquisition decisions.

The Numbers That Matter

Most sophisticated investors target 50-65% loan-to-value ratios on stabilised properties. Enough leverage to enhance returns meaningfully. Not so much that a modest decline in valuation wipes out equity.

At 50% LTV, a 20% property value decline leaves you with 60% of your equity intact. At 80% LTV, the same decline eliminates all equity and likely triggers covenant breaches.

Interest rates matter more at higher leverage levels. The difference between 5% and 7% financing costs barely registers on an unleveraged property. On a property with 75% leverage, that 200 basis point difference might eliminate half your cash-on-cash return.

Match Financing to Strategy

Different property types and strategies warrant different financing approaches:

Stabilised income properties support longer-term fixed-rate debt. You want certainty matching predictable income.

Value-add or development typically uses floating-rate construction loans with refinancing upon stabilisation.

Cross-border holdings may benefit from local currency financing that provides natural currency hedges. Borrowing euros to buy Paris property reduces currency mismatch versus financing in dollars.

Interest-only periods provide cash-flow flexibility during the initial ownership period but result in no principal paydown. Understand what you're accepting.

Making It Work at Scale

Managing five properties is manageable. Fifteen properties across four countries require infrastructure.

The Operational Stack

Professional property portfolios need:

Management partnerships with firms that have a genuine presence in your target markets. Local knowledge matters. The best London property manager likely isn't the right choice for Miami holdings.

Consolidated reporting that provides portfolio-level visibility rather than property-by-property updates. Platforms exist specifically for this purpose. QuickBooks isn't the answer.

Tax coordination across jurisdictions to ensure structures remain optimal as rules change. This requires advisors who communicate across borders.

Governance frameworks that define decision rights, approval thresholds, and reporting requirements. Who approves capital expenditure above £50,000? Who decides when to sell? Define these before questions arise.

What Family Offices Actually Do

According to Knight Frank's survey of 150 family offices, real estate fulfils different objectives in their broader portfolios:

- Growth and capital appreciation: 42%

- Wealth preservation: 23%

- Income generation: 19%

The average target unleveraged return is 13.8%. Most achieve this through a combination of income yield, rent growth, and modest leverage.

Family offices typically blend approaches rather than picking one: direct investments in markets they know well, private fund exposure for diversification into unfamiliar sectors or geographies, and REIT allocations for liquidity.

Where to Focus in 2026

Based on current market conditions, several themes deserve attention:

Logistics and industrial fundamentals remain strong despite some supply catch-up. E-commerce penetration continues growing. Nearshoring trends benefit warehousing near manufacturing hubs. Class A modern facilities with high ceilings and automation capability command premium rents and occupancy.

Residential in supply-constrained markets continues performing. Housing shortages across major economies drive both rental and price growth. Build-to-rent institutionalisation creates exit options that didn't exist a decade ago.

Opportunistic office for those with conviction. Prices are down roughly 20% from peaks. If you believe hybrid work will stabilise at current levels rather than continue toward fully remote, the entry point looks attractive. High conviction required.

Healthcare real estate benefits from demographic tailwinds that are visible decades ahead. Ageing populations need care facilities. New supply is constrained by regulation and complexity.

Tokenised real estate as a small allocation for those wanting exposure to the technology evolution. Treat it as venture-style allocation rather than core real estate.

Case Study: Building a £15M Property Portfolio

Let's walk through how an investor with £15 million in liquid assets might structure their property portfolio. This is illustrative, not prescriptive. Your situation will differ.

The Starting Point

Sold fintech company eighteen months ago. After taxes, she has £15 million in cash and liquid securities. Owns London home outright (worth approximately £3 million) but has no investment property experience. Objectives: generate £300,000+ annual income, preserve capital across generations, and build something that runs without consuming time.

The Allocation Framework

Working with advisors, investor developed this target allocation:

Direct UK Property (£4 million, 27%) Two prime London apartments in zones 1-2, each valued around £2 million. Target gross yield: 3.5-4%. These serve as core holdings investor understands deeply. Management outsourced to a local firm charging 12% of gross rent. Expected net yield after costs: approximately 2.8%, or £112,000 annually.

Why London? Our investor knows the market, can visit easily, and values the legal protections. The lower yields are acceptable for core holdings with strong capital preservation characteristics.

European Commercial via Fund (£3 million, 20%) Commitment to a diversified European logistics fund managed by an established operator. Target net IRR: 12-14% over a 7-year hold. Investor doesn't have expertise in continental warehousing, so engaging a specialist manager to access it makes sense. Capital calls spread over 18 months.

The fund focuses on last-mile logistics facilities in Germany, Netherlands, and France. E-commerce tailwinds support the thesis. Investors pay 1.5% management fee plus 20% carried interest above an 8% hurdle.

US Multifamily Syndication (£2.5 million, 17%) Two syndication investments: one in Austin (£1.5 million) focusing on value-add multifamily, another in Phoenix (£1 million) targeting new development. Both structured as Delaware LLCs with limited partners.

Target returns: 15-18% IRR over 5-year holds. Higher risk than the London apartments, but significant upside if execution goes well. Betting on continued Sun Belt population growth.

Public REITs (£2 million, 13%) Diversified REIT portfolio split across sectors: 40% industrial/logistics, 25% residential, 20% healthcare, 15% data centres. This provides immediate liquidity, sector diversification beyond direct holdings, and income (approximately 4% yield, or £80,000 annually).

Investor uses a tax-advantaged wrapper where possible (ISA, pension) to shelter REIT income from UK tax.

Dubai Apartment (£1.5 million, 10%) One luxury apartment in a prime Marina location. Purchased for lifestyle use (visits regularly) with rental income when not occupied. No annual property tax, no capital gains tax on eventual sale. Expected rental yield when let: 5-6%.

The Dubai purchase also provides geographic diversification outside Europe and sterling.

Tokenised Real Estate (£500,000, 3%) Small allocation to tokenised commercial property through a regulated platform. Treats this as venture-style exposure to the technology evolution rather than core real estate. High risk, potentially high reward if the sector matures.

Cash Reserve (£1.5 million, 10%) Held for opportunistic acquisitions, capital calls on fund commitments, and general liquidity. Earning approximately 4.5% in money market funds while waiting.

The Numbers

| Holding | Value | Expected Yield | Annual Income |

|---|---|---|---|

| London Apartments | £4.0M | 2.8% net | £112,000 |

| European Logistics Fund | £3.0M | N/A (IRR target) | Reinvested |

| US Multifamily | £2.5M | N/A (IRR target) | Reinvested |

| REIT Portfolio | £2.0M | 4.0% | £80,000 |

| Dubai Apartment | £1.5M | 4.0% net (when let) | £60,000 |

| Tokenised RE | £0.5M | Variable | Variable |

| Cash | £1.5M | 4.5% | £67,500 |

| Total | £15.0M | £320,000+ |

in this example, investor exceeds £300,000 income target from day one, with significant additional returns expected from the fund and syndication investments as they mature.

Structure Decisions

Holds the UK properties personally (simplest approach given current scale). The Dubai apartment is held in a BVI company for estate-planning purposes. US investments flow through Delaware LLCs. The fund and REIT investments are held partly in tax-advantaged accounts.

Total annual advisory costs: approximately £25,000 for tax structuring, £15,000 for property management, and £8,000 for consolidated reporting. About £48,000 total, or 0.32% of assets. Reasonable for the complexity involved.

Three Years Later

Fast forward. The London apartments appreciated 8% total. The European logistics fund is performing above target (current projected IRR: 15%). One US syndication is ahead of plan, the other is slightly behind due to construction delays. The Dubai apartment appreciated 22% (got lucky with timing). Tokenised holdings are roughly flat but gaining liquidity as secondary markets develop.

Total portfolio value: approximately £17.8 million, up 19% from the starting point. Annual income now exceeds £350,000, including distributions from maturing fund investments.

More importantly, investor spends perhaps five hours monthly on the property portfolio. The machine runs itself.

Due Diligence Checklist

Before committing capital to any real estate investment, work through these questions systematically. Skip nothing.

Direct Property Purchases

Market Fundamentals

- What's the vacancy rate in this submarket? Trend over five years?

- Net migration patterns: is the population growing or shrinking?

- Major employers in the area: concentration risk?

- New supply pipeline: what's under construction within 3km?

- Historical rent growth: compound annual rate over 10 years?

Property Specifics

- When was the building constructed? Major systems ages (roof, HVAC, elevators)?

- Deferred maintenance estimate from an independent inspector?

- Current tenant roster: lease terms, renewal history, creditworthiness?

- Tenant concentration: does any single tenant exceed 25% of income?

- Historical operating expenses: trend over three years?

- Environmental issues: Phase I assessment completed?

Financial Analysis

- Cap rate relative to comparable recent sales?

- Rent per square foot versus market average?

- Operating expense ratio: reasonable for property type?

- Capital expenditure forecast for next five years?

- Stress test: what happens if vacancy doubles?

Legal and Structural

- Title clear? Encumbrances understood?

- Zoning permits current use? Risks of changes?

- Any pending litigation involving the property?

- Holding structure appropriate for your tax situation?

- Exit options: who would buy this property?

Fund or Syndication Investments

Manager Assessment

- Track record: actual realised returns on prior funds (not just IRR projections)?

- Team stability: key person risk?

- Assets under management: are they capacity-constrained?

- Alignment: how much of their own capital is invested?

- References from existing LPs?

Strategy Fit

- Does the strategy match current market conditions?

- Vintage year risk: are they deploying capital at market peaks?

- Geographic focus: markets you understand and believe in?

- Leverage policy: maximum LTV? Recourse vs. non-recourse?

Terms and Fees

- Management fee: reasonable for the strategy?

- Carried interest: threshold rate? Catch-up provisions?

- Preferred return structure?

- Fee offsets for transaction or property management fees?

- Key person provisions: what happens if principals leave?

Legal Protections

- LPAC (Limited Partner Advisory Committee) rights?

- Excuse and exclusion provisions?

- Reporting requirements: frequency and detail?

- Audit requirements?

- Transfer restrictions: can you sell your interest?

REIT Investments

Company Quality

- Balance sheet strength: debt-to-EBITDA ratio?

- Interest coverage ratio?

- Weighted average debt maturity?

- Dividend coverage: FFO payout ratio?

- Track record of dividend growth?

Portfolio Quality

- Asset quality: average age, location grades?

- Tenant quality: average credit rating?

- Lease duration: weighted average lease term?

- Occupancy rates versus peers?

- Same-store NOI growth history?

Valuation

- Price-to-FFO relative to the historical average?

- Premium or discount to NAV?

- Dividend yield relative to sector average?

- Implied cap rate versus private market transactions?

Property Tax Comparison

Tax treatment varies dramatically across markets. This table summarises the key taxes affecting property investors in six popular jurisdictions. Rates current as of late 2025.

United Kingdom

| Tax Type | Rate | Notes |

|---|---|---|

| Purchase (Stamp Duty) | 0-12% + 5% surcharge | Surcharge applies to additional properties over £40,000 |

| Annual Property Tax | Council Tax varies | Based on property band, location; £1,500-5,000+ typical |

| Rental Income Tax | 20/40/45% | Personal rates; mortgage interest capped at 20% relief |

| Capital Gains Tax | 18% or 24% | £3,000 annual allowance (2025/26) |

| Inheritance Tax | 40% | Above £325,000 threshold (or £500,000 with residence nil-rate) |

Key Consideration: Section 24 mortgage interest restrictions make corporate structures worth evaluating for portfolio landlords. A reduction in the CGT allowance from £12,300 to £3,000 significantly increases tax on sales.

United States

| Tax Type | Rate | Notes |

|---|---|---|

| Purchase (Transfer Tax) | 0.1-2.5% | Varies dramatically by state |

| Annual Property Tax | 0.5-2.5% | Of assessed value; varies by state/county |

| Rental Income Tax | 10-37% | Federal rates; plus state tax; depreciation offsets |

| Capital Gains Tax | 0-20% + 3.8% NIIT | Long-term rate; depreciation recapture at 25% |

| Estate Tax | 40% | Above $13.61 million federal exemption (2024) |

Key Consideration: Depreciation (27.5 years residential, 39 years commercial) significantly reduces the current tax burden. 1031 exchanges allow indefinite deferral of capital gains. State taxes vary enormously.

Dubai (UAE)

| Tax Type | Rate | Notes |

|---|---|---|

| Purchase (Transfer Fee) | 4% | Split equally buyer/seller in practice |

| Annual Property Tax | 0% | No annual property tax |

| Rental Income Tax | 0% | No personal income tax |

| Capital Gains Tax | 0% | No capital gains tax |

| Inheritance Tax | 0% | No inheritance tax (Sharia law may apply) |

Key Consideration: Extremely tax-efficient for holding period returns. Foreigners can only purchase in designated freehold zones. Registration fees and service charges are the main ongoing costs. 5% municipality tax on rental value paid by tenants.

Singapore

| Tax Type | Rate | Notes |

|---|---|---|

| Purchase (BSD + ABSD) | 4-6% BSD + 60% ABSD | ABSD for foreigners is 60%; citizens 0% on first property |

| Annual Property Tax | 0-36% | Of annual value; owner-occupied rates lower |

| Rental Income Tax | 0-24% | Progressive rates; deductions available |

| Capital Gains Tax | 0% | No capital gains tax |

| Estate Tax | 0% | Abolished in 2008 |

Key Consideration: The 60% ABSD makes residential property in Singapore essentially prohibitive for foreign investors. However, commercial and industrial properties are exempt from ABSD. No capital gains tax makes long-term holds attractive despite high entry costs.

Portugal

| Tax Type | Rate | Notes |

|---|---|---|

| Purchase (IMT + Stamp) | 0-8% IMT + 0.8% stamp | IMT varies by property value and type |

| Annual Property Tax (IMI) | 0.3-0.45% | Of tax value (VPT); municipalities set rate |

| Rental Income Tax | 25-28% flat or progressive | Can elect flat 25-28% or add to income |

| Capital Gains Tax | 50% taxed at marginal rate | Residents: 50% of gain added to income (14.5-48%) |

| Inheritance Tax | 0% (direct family) | 10% stamp duty for others |

Key Consideration: The NHR regime will be eliminated for new applicants from 2024. The Golden Visa program no longer accepts residential property investment in Lisbon/Porto. IMI rates are low, but AIMI (additional) wealth tax applies to holdings over €600,000.

Switzerland

| Tax Type | Rate | Notes |

|---|---|---|

| Purchase (Transfer Tax) | 0-3.3% | Varies by canton |

| Annual Property Tax | 0.05-0.3% | Of assessed value; very low |

| Rental Income Tax | 0-40%+ | Progressive cantonal + federal rates |

| Capital Gains Tax | 0% (federal) | Cantons may tax; often exempt if held >2 years |

| Wealth Tax | 0.3-1% | Annual tax on net worth; varies by canton |

Key Consideration: Foreign ownership is severely restricted. Lex Koller law limits purchases by non-residents. Those who qualify benefit from low property taxes but face a wealth tax on net worth. Lump-sum taxation is available for non-working foreign residents in some cantons.

Comparison Summary

| Jurisdiction | Entry Cost | Annual Cost | Exit Cost | Foreign-Friendly |

|---|---|---|---|---|

| UK | High (17%+) | Medium | Medium (24%) | Yes |

| US | Low-Medium | Medium-High | Low-Medium | Yes |

| Dubai | Low (4%) | Very Low | None | Yes |

| Singapore | Very High (64%+) | Medium | None | Residential: No |

| Portugal | Medium (9%) | Low | Medium | Yes |

| Switzerland | Low (3%) | Very Low | Very Low | Very Limited |

Entry costs include stamp duty/transfer taxes on a £1M+ property. Annual costs reflect property taxes. Exit costs reflect capital gains tax.

Exit Strategy

Every property investment needs an exit plan. Not because investors expect to sell soon, but because clarity about eventual disposition shapes decisions throughout the holding period.

The Four Exit Paths

Path 1: Sale to Third Party

The most common exit is to sell the property on the open market to an unrelated buyer.

When it works best:

- Market conditions favour sellers (low supply, strong demand)

- Property has appreciated significantly

- Need liquidity for other opportunities

- Tax situation allows crystallising gains efficiently

Key considerations:

- Transaction costs: agent fees (1-3%), legal fees, potential CGT

- Timing: property sales take 3-12 months, depending on asset type

- Market cycle: selling into weakness compounds losses

- 1031 exchange potential (US): rolling gains into replacement property

Planning implications:

- Maintain property condition to maximise sale price

- Keep tenant relationships strong (occupied properties sell better in most markets)

- Understand comparable sales and realistic pricing

- Build relationships with potential buyers before you need them

Path 2: Refinance and Hold

Extract equity through refinancing rather than selling. The property stays, but capital comes out.

When it works best:

- Strong cash flow supports higher debt service

- Property has appreciated significantly

- Want to maintain ownership and income stream

- Tax-efficient: no CGT triggered on refinancing

Key considerations:

- Debt service coverage must remain healthy

- Interest rates affect feasibility

- Loan-to-value limits constrain extraction

- Refinancing costs (1-2% of loan amount typically)

Planning implications:

- Maintain flexibility in existing debt (avoid prepayment penalties)

- Track property value appreciation annually

- Build banking relationships before the need to refinance

- Consider debt structure that allows partial prepayment

Path 3: Transfer to Next Generation

Pass property to children or other heirs, during lifetime or at death.

When it works best:

- Long-term family wealth preservation is the primary goal

- Heirs want to maintain the property

- Tax planning structures are in place

- Property generates income to support multiple generations

Key considerations:

- Inheritance tax implications (UK: 40% above thresholds)

- Gift tax in some jurisdictions (US: part of lifetime exemption)

- Stepped-up basis benefits (US: heirs receive at current market value)

- Family governance: who manages the property going forward?

Planning implications:

- Structure holdings appropriately from purchase (trusts, family investment companies)

- Document intentions clearly

- Discuss with heirs before committing them to illiquid assets

- Consider the liquidity needs of the estate (other assets to pay taxes?)

Path 4: Contribution to Charitable Vehicle

Donating property to charity or contribute to a charitable remainder trust.

When it works best:

- Philanthropic goals align with tax planning

- Highly appreciated property with low basis

- Don't need full liquidity

- Income stream is an acceptable substitute for the full asset value

Key considerations:

- Charitable deduction limitations

- Appraisal requirements

- Selection of an appropriate charitable vehicle

- Loss of control over the asset

Planning implications:

- Identify charitable interests early

- Work with advisors experienced in charitable giving

- Understand timing constraints

- Consider donor-advised funds for flexibility

Exit Timing Indicators

Sell signals:

- Cap rates compressing to historically low levels

- Rent growth decelerating or turning negative

- New supply overwhelming demand in your submarket

- Property reaching end of economic life (major capex looming)

- Better opportunities available elsewhere

- Personal circumstances changing (need liquidity, simplifying)

Hold signals:

- Cash flow remains strong and growing

- Market fundamentals healthy

- Tax consequences of sale outweigh benefits

- No better alternatives for the capital

- Heirs want to maintain ownership

- Refinancing achieved liquidity objectives

Exit Planning Checklist

Before any exit, work through these questions:

- Tax Consequences: What's the total tax bill? CGT, depreciation recapture, state/local taxes?

- Timing Optimisation: Can you time the sale across tax years? Use instalment sales?

- Reinvestment Plans: Where does the capital go next? 1031 exchange opportunities?

- Transaction Costs: All-in costs of sale? Negotiate agent fees at this property value?

- Tenant Notification: Lease provisions regarding sale? Notice requirements?

- Document Preparation: All property records, leases, financials organised?

- Advisor Coordination: Tax advisor, property lawyer, wealth advisor aligned on strategy?

Key Takeaways

Smart investors don't just buy real estate. They build systems.

Every property serves a purpose: cash flow, inflation protection, lifestyle, wealth transfer, or some combination. The best portfolios combine multiple access routes, balance geographic and sector exposure, maintain appropriate leverage, and match liquidity profiles to actual needs.

Whether it's direct ownership, REITs, private funds, or tokenised assets matters less than having a coherent strategy. Buying opportunistically without a framework leads to portfolios that look like accidents.

The path forward is more straightforward than most people assume: buy quality assets in growing markets, structure holdings appropriately, use leverage wisely, manage professionally, diversify across geographies, and be patient.

Real estate rewards patience more than almost any other asset class. Build the machine properly. Let it compound. Everything else is details.

I write when there’s something worth sharing — playbooks, signals, and patterns I’m seeing among founders building, exiting, and managing real capital.

If that’s useful, you can subscribe here.