Traditional entrepreneurship is brutal. Of every 10 startups that launch, 9 fail within their first 5 years. The fortunate survivors often spend a decade reaching profitability—burning savings, diluting ownership, pivoting repeatedly, and fighting for survival without a salary.

There's another path. Entrepreneurship Through Acquisition (ETA) lets you skip the hardest years entirely. Instead of building from scratch, you buy an existing business with proven revenue, established customers, and real cash flow. You begin where most entrepreneurs hope to end up.

This isn't a new idea. Search funds have existed since 1984, and the model has produced some remarkable outcomes. What's new is the scale of opportunity. Baby boomer business owners are retiring in unprecedented numbers. Over 12 million businesses could change hands this decade, representing more than $10 trillion in value. Most of these owners have no succession plan in place.

In my business lines, we are executing a buy-and-build strategy in the UK wealth management space. I've seen firsthand how fragmented industries consolidate, how multiple arbitrage creates value, and where the real challenges lie. This playbook shares what works, what doesn't, and where the opportunity exists today.

Key Takeaways

- Search funds deliver 35.1% IRR: across 681 funds since 1984, including the ~43% that never acquire—outperforming VC, PE, and public markets

- $14 trillion succession wave: 78% of baby boomer business owners have no exit plan, and 73% expect to exit within the next decade

- More than half of searches fail: acquisition rates hover around 57%—go in with realistic expectations, not guaranteed outcomes

- Multiple arbitrage is real but conditional: buy at 5x EBITDA, combine into a platform at 8-10x—but only if you can actually integrate

- Five strategies, not one: buy-and-hold, buy-and-build, programmatic acquisitions, traditional search fund, or self-funded search—match the model to your capital and ambition

- Leverage cuts both ways: banks finance 70-80% of acquisition value, but aim for debt service coverage of at least 1.5-2x to survive downturns

- Fragmented industries are consolidating fast: financial advisory, dental, veterinary, and home services are mid-cycle—the best entry window is narrowing

- The first 100 days decide everything: listen more than you talk, keep the seller involved, and defer major changes until you understand what's actually working

Why Buy Instead of Build

The numbers tell the story.

According to the Stanford GSB 2024 Search Fund Study, search funds have delivered a 35.1% internal rate of return and 4.5x return on investment across 681 funds formed since 1984. These returns include the roughly 43% of searchers who never successfully acquire a company—the failures are baked into the numbers.

Compare that to venture capital (average 12-15% IRR), private equity (15% IRR), or public market indices (10% for the S&P 500). Search funds compete with the best asset classes and consistently outperform.

The risk profile is fundamentally different from startups. When you acquire an existing business:

You inherit cash flow from day one. Most acquired companies are profitable, often generating enough to pay the new owner a salary immediately. No more years of zero income while hoping for product-market fit.

You're buying proven demand. The product or service works. Customers exist. The question is whether you can operate and improve—not whether anyone will buy.

You can use leverage. Banks will lend against established cash flows. SBA loans in the US and specialist lenders in the UK regularly finance 70-80% of acquisition value. Seller financing often covers another 10-20%. Your actual equity at risk can be surprisingly small.

You become CEO immediately. No founders to report to. No board that can fire you. You own the company and make the decisions.

The trade-off is upside. ETA won't create a unicorn. The businesses typically acquired—service companies, niche manufacturers, B2B software—might grow to £20-50M in revenue over a decade. That's unlikely to make you a billionaire. But it's also unlikely to leave you bankrupt.

Entrepreneurship Through Acquisitions Reality

Here's the contrarian take that most ETA content glosses over: more than half of all search funds fail to acquire a company.

The Stanford data shows acquisition rates have hovered around 57% for the past decade. In the most recent 2023 cohort, 63% successfully acquired—better than average but still meaning more than one in three searchers spent 18-24 months looking and came away with nothing.

Why do searches fail? Several factors:

Valuation expectations. Sellers often believe their businesses are worth more than buyers can justify. When interest rates rose in 2022-2023, the gap between buyer and seller expectations widened. Many deals simply don't pencil at asking prices.

Competition. Private equity firms, strategic acquirers, and other searchers compete for the same quality businesses. The best targets attract multiple buyers, driving prices up or triggering auction dynamics that favour deep-pocketed competitors.

Deal fatigue. The median search takes 20-23 months. Reviewing hundreds of opportunities, conducting diligence on dozens, and watching deals fall apart at the final stages wears people down. Some quit before finding the right target.

Financing challenges. Particularly for first-time buyers, securing debt can be difficult. Letters of Intent sometimes collapse when financing doesn't materialise—wasting months of effort and damaging relationships with sellers.

This doesn't mean ETA is a bad bet. The 35.1% IRR includes these failures. The point is to go in with realistic expectations. This is hard work with meaningful risk of failure, not a guaranteed path.

Five ETA Strategies

There isn't just one way to acquire a business. Different approaches suit different situations, capital bases, and ambitions.

1. Buy-and-Hold

The simplest approach. Acquire a single stable business. Run it for cash flow and gradual growth. Hold for the long term—potentially decades.

This works for entrepreneurs who want to own a lifestyle business, aren't seeking a quick exit, and value stability over rapid growth. You might focus on operational improvements, geographic expansion, or adding complementary services. The goal is sustainable cash generation, not maximising enterprise value for sale.

Best for: First-time entrepreneurs who want to learn ownership with minimal complexity. Those not seeking a quick exit.

2. Buy-and-Build (Roll-Up)

Acquire multiple businesses in the same sector. Combine them into a larger entity worth more than the sum of its parts.

This is where multiples arbitrage comes in. Small companies trade at lower valuation multiples than large ones. Buy five businesses at 5x EBITDA, combine them into one platform, and the merged entity might trade at 8-10x EBITDA or higher. That mathematical uplift—before any operational improvement—creates substantial value.

Academic research confirms this effect. A 2022 study by Heisig, Kick, and Schwetzler analysed 161 buy-and-build transactions and found the "add-on sourcing effect"—buying smaller firms at lower multiples—contributed roughly 8% annually to equity value growth. Remove this effect, and buy-and-build returns fall back to ordinary buyout levels.

Value also comes from operational synergies: centralised back-office functions, bulk purchasing, shared technology platforms, cross-selling opportunities, and enhanced market position.

One of the most recent emerging trends is AI-enabled rollups. It targets service industries such as accounting, call centres, financial advice, and other services, where automation and AI can achieve SaaS-like profitability and investment returns.

Best for: Experienced operators with industry knowledge who spot consolidation opportunities in fragmented markets.

3. Programmatic Acquisitions

Rather than one transformational deal, pursue multiple smaller acquisitions consistently over time. Not one big bet, but a systematic strategy of several deals per year.

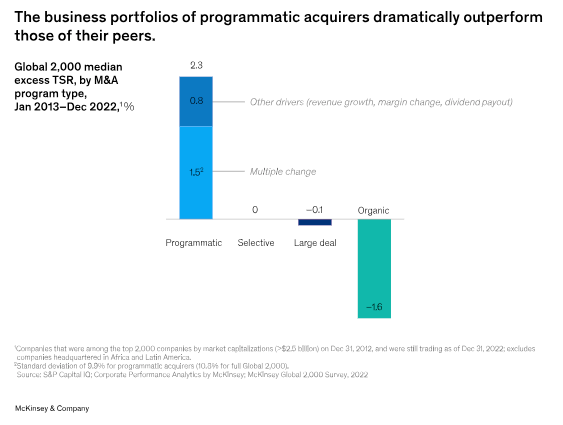

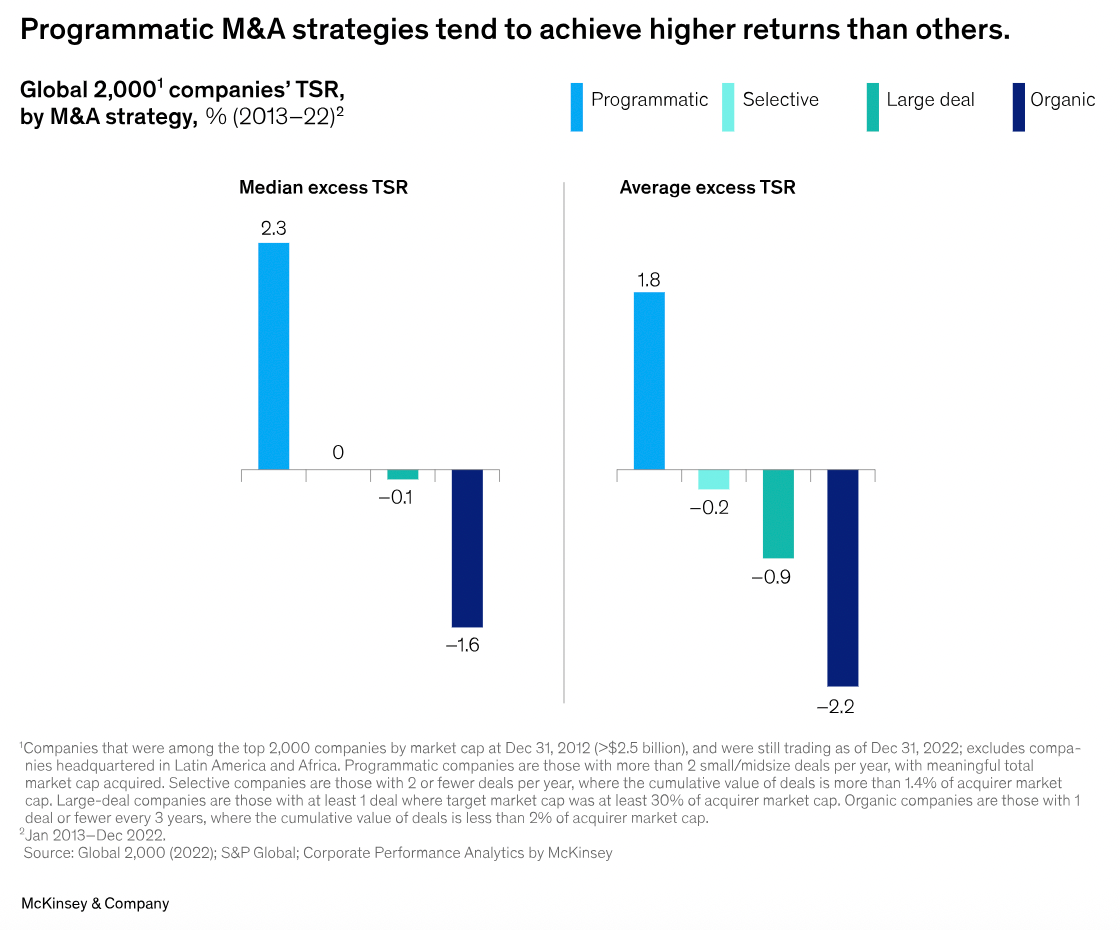

McKinsey's research on the Global 2,000 companies shows this approach delivers the best risk-adjusted returns. According to their 2023 analysis, 65-70% of programmatic acquirers outperform their peers. The more deals a company completes, the higher the probability of earning excess returns.

Why it works: you develop "muscle" for finding, closing, and integrating deals. Mistakes on small deals won't sink you. Learning compounds over time. And crucially, programmatic M&A is actually less risky than organic growth alone—McKinsey found that companies pursuing no M&A had the highest standard deviation in performance.

Best for: Growth-oriented entrepreneurs who enjoy the deal process and want to build larger enterprises through systematic expansion.

4. Traditional Search Fund

The classic ETA model with two stages:

Search phase: Raise £250,000-£400,000 from 10-20 investors to fund your search. This covers salary, travel, professional fees, and operating costs for 18-24 months while you find the right target.

Acquisition phase: Once you identify a business, return to your investors to secure funding for the purchase. They provide equity; you arrange the debt; the deal closes.

Post-acquisition, you operate as CEO with investor backing. The model typically targets businesses with £800K-£4M in EBITDA. Returns are split between investors and the entrepreneur, with the searcher earning substantial equity for finding and successfully operating the company.

The Stanford 2024 study shows the median search fund acquisition at a purchase price of £11.5M, a 27% EBITDA margin, and a 7x EBITDA multiple.

Best for: MBA graduates and professionals with strong credentials but limited personal capital who want to buy a substantial business with investor support.

5. Self-Funded Search

Not everyone needs formal funding. Some entrepreneurs use personal savings, bank loans, or small investor groups to search and buy directly.

You'll likely target smaller businesses—often under £800K EBITDA—but retain more equity and control. Personal guarantees on debt are common. The search itself is self-financed, meaning you bear more risk but keep more upside.

Self-funded searches have grown substantially as the model has proven itself. More lenders now understand the asset class, and more entrepreneurs recognise that smaller acquisitions can still generate meaningful wealth.

Best for: Entrepreneurs with some capital or access to financing who value independence and are willing to start smaller.

Generational Transfer Opportunity

Why now? Because the largest wealth transfer in business history is underway.

According to Guidant Financial research, over 40% of small businesses in the US are owned by baby boomers—those born between 1946 and 1964. Similar demographics apply in the UK and Europe. About 10,000 boomers reach retirement age every day.

The challenge is succession. Studies consistently show that 78% of baby boomer business owners have no formal exit or succession plan in place. They've spent decades building their companies but haven't prepared for what comes next.

Fewer businesses are passing to family members. Only 4% of small businesses survive to the fourth generation. Children increasingly pursue different careers. The traditional assumption—that the next generation will take over—no longer holds.

This creates a massive supply-demand imbalance. Millions of businesses need new ownership. Many owners are motivated sellers who would prefer to see their companies continue under capable leadership rather than simply close. They'll accept reasonable terms from buyers who can demonstrate competence and cultural fit.

The Exit Planning Institute estimates 73% of business owners expect to exit their companies within the next ten years, representing a $14 trillion opportunity in the US alone.

Industry Spotlight: Financial Services Consolidation

Financial advisory services—IFAs in the UK, RIAs in the US—represent one of the most active consolidation sectors. The dynamics illustrate buy-and-build mechanics clearly.

UK IFA Consolidation

The UK has approximately 6,000 Independent Financial Adviser firms, according to the Financial Conduct Authority. Most are small—often a single adviser or small partnership—and the population is ageing. Around 75% of IFAs are nearing retirement age.

This fragmentation makes the sector attractive for consolidation. According to Heligan Group's 2025 market review, M&A activity surged over the last few years with over 40 PE-backed IFA consolidators.

Quality IFA firms command 8-10x EBITDA valuations, but for smaller businesses, the multiples are typically 7-8x. And there been some exits recently where firms with £5bn+ were sold at 15-17x to Adjusted EBITDA. Private equity-backed consolidators focus on firms with strong recurring revenue models, scalable operations, and solid earnings quality. Rising compliance costs and increasing regulatory complexity under Consumer Duty rules make it harder for smaller firms to operate independently, pushing more toward sale.

Key acquirers include Titan Wealth, Foster Denovo, Söderberg & Partners, and Perspective Financial Group. Perspective surpassed its 100th acquisition milestone in recent months, adding over £375M in assets under advice through multiple transactions.

Specialist lenders like ThinCats have projected significant capital injections—potentially £200 million over three years—into wealth management and IFA businesses, according to Shaw & Co research.

US RIA Consolidation

The US Registered Investment Adviser market tells a similar story on a larger scale.

According to ECHELON Partners' Q3 2025 RIA M&A Deal Report, 345 transactions closed year-to-date through September—a 44% increase over 2024 and already surpassing the full-year record set in 2022. Total transacted assets reached $1.22 trillion.

ECHELON projects 440 deals by year-end 2025, making it the most active year in RIA M&A history. The firm forecasts continued elevated activity into 2026.

Private equity dominates. According to DeVoe & Company, 79% of transactions in the RIA space are now directly or indirectly influenced by private equity. PE firms participated in 231 transactions through Q3 2025—already exceeding their full-year total from 2024.

Major transactions include Creative Planning's acquisition of SageView Advisory Group ($290 billion AUM), Corient's twin acquisitions of Stonehage Fleming ($175 billion AUM) and Stanhope Capital ($40 billion AUM), and Stone Point Capital's majority investment in OneDigital ($143 billion AUM) valued at over $7 billion.

Approximately 37% of RIA advisers will retire in the next decade, representing roughly 35% of industry assets. Only 42% of firms have a written succession plan. The combination of ageing owners, attractive recurring-revenue models, and private-equity capital creates powerful consolidation dynamics.

QUICK ASK — Everything here is free. If you're finding this useful, subscribing helps me understand what's working — and keeps you updated when new pieces come out.

Other Industries Ripe for Consolidation

Financial services aren't unique. Similar dynamics play out across multiple sectors.

Dental Practices

The dental industry has seen aggressive consolidation through Dental Service Organizations (DSOs). According to Lincoln International, the sector recorded over 120 add-on acquisitions in 2024 alone—the highest volume among all healthcare services categories.

Currently, 20-25% of dental practices are DSO-affiliated, up from approximately 8% a decade ago. Industry projections suggest consolidation could reach 60-70% within ten years.

Valuations remain elevated at 9-12x EBITDA for premium assets, though buyers have become more disciplined. The global DSO market was estimated at $68 billion in 2024 and is projected to reach $294 billion by 2033, according to Grand View Research.

Private equity has poured over $51.6 billion into the veterinary and dental sectors combined since 2017, according to PitchBook data.

Veterinary Services

Veterinary practice consolidation has been particularly aggressive. According to a KPMG report, veterinarians owned 51% of pet clinics in 2023, private equity held 29%, and corporate owners held 19%.

Mars Petcare—the candy conglomerate—is the largest corporate owner with approximately 3,000 veterinary clinics (45% of corporate ownership). The company acquired VCA for $9.1 billion in 2017 and has continued acquiring since.

About a quarter of general veterinary practices and roughly three-quarters of speciality practices (emergency and surgery care) are now corporate-owned, according to Brakke Consulting. Americans spent a record $147 billion on pet products and services in 2023.

Home Services (HVAC, Plumbing, Electrical)

The home services sector exemplifies fragmentation. There are over 100,000 HVAC companies in the United States alone. The same holds for plumbing and electrical.

According to PKF O'Connor Davies, the residential HVAC services segment is now midway through its consolidation cycle, while commercial HVAC is still in early stages. Transaction multiples have remained elevated—north of 10x EBITDA—particularly for businesses with high recurring revenue and strong service components.

Global HVAC M&A volume reached 77 deals year-to-date through mid-2025. Private equity add-ons rose 88.2% year-over-year, according to Capstone Partners.

Goldman Sachs completed a $1.7 billion acquisition of Sila Services (HVAC, plumbing, electrical) in late 2024. Orion Group has made over 35 acquisitions since Alpine Investors formed the platform in 2020. FirstCall Mechanical has made 15 acquisitions since 2022.

The broader home services market grew from $657 billion in 2022 to $679 billion in 2023. Private equity interest continues expanding because these businesses generate stable, recurring revenue and are relatively recession-resistant—homeowners must fix broken furnaces and plumbing leaks regardless of economic conditions.

Buy-and-Build Playbook

If you're pursuing a buy-and-build strategy, here's what actually matters.

Start with the Right Platform

Your first acquisition is the most important. It becomes the foundation for everything that follows. Look for:

Management depth. You need people who can run the business while you focus on acquisitions and integration. A company entirely dependent on the owner is hard to scale.

Scalable infrastructure. Systems, processes, and technology that can absorb additional businesses without having to rebuild from scratch.

Geographic or service gaps. Room to grow through add-ons that fill white space rather than just adding more of the same.

Strong financial fundamentals. Clean books, recurring revenue, reasonable customer concentration, and defensible margins.

Source Deals Proactively

The best businesses rarely appear on listing sites. Brokers show their best deals to buyers who can execute quickly and pay top dollar. If you're relying entirely on inbound deal flow, you're seeing what others have already passed on.

Build relationships with accountants, attorneys, and other advisors who work with business owners. They often know who's thinking about selling before anyone else. Industry conferences and trade associations surface opportunities. Direct outreach—letters, LinkedIn, calls—works if done professionally and persistently.

Most ETA entrepreneurs review 100+ opportunities before finding the right one. The Aurias search fund, which acquired Saepio in 2024, reportedly reviewed over 4,000 companies before selecting its target.

Understand Multiple Arbitrage

The mathematics are straightforward but powerful.

Small businesses typically trade at 4-6x EBITDA. Larger platforms trade at 8-12x EBITDA. If you buy five £500K EBITDA businesses at 5x each (£12.5M total investment) and combine them into a £2.5M EBITDA platform, that platform might be worth £20-25M at 8-10x. You've created £7.5-12.5M in value purely through aggregation.

But there's a catch. Multiple arbitrage only works if you can actually integrate the businesses, retain the customers, and operate as a coherent platform. A collection of poorly integrated bolt-ons doesn't command premium multiples. Private equity buyers will pay for scale and synergy—not chaos.

Watch for the Barbelling Problem

Bain & Company research highlights a common failure mode. As consolidation progresses, mid-sized targets disappear. The sector "barbells"—companies are either too small to bother with or too large to acquire.

When this happens, the multiple arbitrage opportunity evaporates. Everyone is chasing the same remaining targets. Prices rise. Returns compress.

Successful consolidators time their entry. They invest early in the consolidation wave when attractive targets remain available. They have a clear exit strategy: either the sector offers runway for the next buyer to continue consolidating, or the exit story shifts to something else—perhaps a strategic buyer valuing the scaled-up platform.

Acquisition Process

Regardless of strategy, acquisitions follow a similar process.

Stage 1: Preparation

Define your criteria. What industries do you understand? What size and geography fit your capital and capabilities? What's the owner involvement requirement—can you run this directly, or do you need management in place?

Secure your financing. Understand what resources you have and what you'll need. In the UK, specialist lenders like ThinCats, Shawbrook, and the British Business Bank offer acquisition financing. In the US, SBA 7(a) loans cover up to $5M and require 10-20% equity. Seller financing often covers 10-30% of the purchase price and signals seller confidence.

Build your team. Legal counsel experienced in transactions. An accountant who understands due diligence. Advisors who've done this before. Their fees are worth it.

Stage 2: Deal Sourcing

Proprietary outreach. Direct mail, LinkedIn, industry networking. Higher effort but higher quality—you're not competing in auctions.

Broker relationships. Develop relationships with reputable brokers in target markets. Better businesses often don't appear on listing sites.

Online marketplaces. BizBuySell, BizQuest, Acquire.com (for digital businesses). Variable quality but useful for learning market dynamics.

Expect to screen hundreds of opportunities to find a handful worth pursuing seriously.

Stage 3: Evaluation

Initial screening. Review financials for consistent revenue and profits. Check customer concentration—avoid businesses where a single client accounts for more than 20% of revenue. Assess owner dependency.

Deeper diligence. Meet the owner in person. Visit the business. Interview key employees (with permission). Review detailed financial statements and tax returns. Analyse revenue quality—recurring versus one-time.

Red flags to watch: Declining revenues without explanation. Overly complex structures. High customer or employee turnover. Deferred maintenance. Reluctance to share information.

Stage 4: Making Offers and Closing

Valuation. Most small businesses sell for 2-6x EBITDA. Larger, higher-quality businesses command 6-10x. Structure matters as much as price—seller financing, earnouts, and consulting agreements affect total value.

Letter of Intent. A non-binding LOI outlines key terms and gives you exclusivity to complete diligence. Expect 60-90 days from accepted LOI to closing.

Due diligence. Professional review of legal, financial, and operational matters. Verify everything the seller claimed. Prepare your integration plan.

Financing and closing. Finalise your capital structure. Satisfy lender requirements. Sign documents. Wire funds. Take the keys.

Stage 5: Transition and Integration

The first 100 days matter enormously. Listen more than you talk. Build relationships with key employees and customers. Defer major changes until you understand the business deeply.

Keep the seller involved temporarily. A 6-12 month consulting arrangement ensures knowledge transfer and signals continuity to customers and employees.

Common Mistakes and How to Avoid Them

Overpaying for Mediocre Businesses

First-time buyers often get excited to close a deal. They overlook fundamental problems. They pay too much.

Solution: Establish strict investment criteria before you begin searching. Get professional valuation help. Be willing to walk away. If you're doing buy-and-build, start with a smaller acquisition where mistakes cost less.

Underestimating Integration Challenges

The human element causes the biggest problems. Employee resistance. Customer uncertainty. Culture clash. Systems that don't talk to each other.

Solution: Spend time with the team before closing. Create a detailed transition plan. Listen in the early days. Defer significant changes until you understand what's actually working.

Excessive Leverage

Leverage amplifies returns but increases risk. If business performance dips, debt payments become crushing.

Solution: Structure deals with breathing room. Aim for debt service coverage of at least 1.5x, ideally 2x or more. Include contingency reserves.

Ignoring Seller Motivation

Understanding why the owner is selling is crucial. Retirement after decades of success is very different from someone trying to exit a declining business.

Solution: Ask direct questions. Verify through diligence. Watch for inconsistencies. Talk to others in the industry about the company's reputation.

Going It Alone

ETA can be lonely, especially during the search phase. Without support, you make preventable mistakes or give up too soon.

Solution: Build a network. Join communities like SearchFunder. Consider a partner who complements your skills. Find mentors who've done this before.

Your Action Plan

Ready to explore acquisition entrepreneurship?

Months 1-3: Self-Assessment and Education

Inventory your skills. What industries do you understand? What functional strengths do you bring? How much capital can you access?

Read the foundational texts: "Buy Then Build" by Walker Deibel, "HBR Guide to Buying a Small Business" by Ruback & Yudkoff.

Connect with the community. Join ETA groups on LinkedIn, SearchFunder.com, and local meetups. Talk to people who've done this.

Months 4-6: Structure Your Search

Choose your model. Traditional search fund, self-funded, or hybrid? Define your target parameters: industry, size, geography.

Assemble your team. Legal counsel, accountant, advisors with transaction experience.

Secure search capital if using the funded model. Build your deal sourcing systems.

Months 7-18: Execute Your Search

Set up your CRM and tracking systems. Implement outreach—direct mail, broker relationships, networking. Develop a consistent evaluation framework.

Set weekly goals. Track your metrics. Expect rejection. Keep going.

Months 18-24: Close and Transition

Negotiate the deal. Conduct thorough diligence. Secure financing. Close the transaction.

Implement your transition plan. Build relationships. Learn the business. Start creating value.

Self Assessment

ETA works. The returns are real. The opportunity is substantial. Thousands of entrepreneurs have built meaningful wealth through acquisition.

But it's not easy. More than half of searchers never acquire. Integration is harder than expected. Some businesses underperform after acquisition. Private equity competition is intense in attractive sectors.

The window won't last forever. As baby boomers complete their exits, the supply of quality businesses will diminish. Consolidation in many sectors is already well advanced. The best time to enter was five years ago. The second-best time is now.

What makes ETA different from startups isn't lower risk in absolute terms. It's a different kind of risk. You're trading uncertain product-market fit for execution risk. You're trading the potential for unlimited upside for more predictable returns. You're trading building from zero for improving what already exists.

For the right person—someone who wants to operate, who can execute, who prefers proven models to blue-sky innovation—this is the most asymmetric opportunity in entrepreneurship.

Useful Resources

The ETA community has grown substantially. Rich resources for aspiring acquisition entrepreneurs.

Books

- "Buy Then Build" by Walker Deibel - Most accessible introduction to ETA

- "HBR Guide to Buying a Small Business" by Richard Ruback & Royce Yudkoff - Harvard's structured approach

- "The Messy Marketplace" by Brent Beshore - Insights on buying small businesses from a leading investor

Online communities and courses

- SearchFunder.com is a hub for search fund entrepreneurs and investors

- Acquisition Lab (Walker Deibel) - Structured courses and community for first-time business buyers

- Contrarian Thinking (Codie Sanchez) - Newsletter and community focused on acquiring "boring" businesses

Podcasts

- "Think Like an Owner" (Alex Bridgeman) - Interviews with acquisition entrepreneurs

- "Acquiring Minds" (Will Smith) - Stories of people who bought businesses

- "Buy and Build" (UK-based) - European perspective on ETA

People to follow

- Sieva Kozinsky - Sieva's Business Building Academy

- Ben Kelly - Acquisition Ace Academy

- Dan Peña - QLA

- Codie Sanchez - Contrarian Thinking

Business school ETA programs

Many schools now have ETA programs. Harvard Business School. Stanford GSB. INSEAD. Chicago Booth. London Business School. IESE (Barcelona). And many more.

I write when there’s something worth sharing — playbooks, signals, and patterns I’m seeing among founders building, exiting, and managing real capital.

If that’s useful, you can subscribe here.