IPO valuation gaps are widening. Secondary tender offers are replacing exits as the default liquidity tool for founders. Private credit yields are compressing below 10% for the first time in three years. And UK founders relying on Business Asset Disposal Relief may not even qualify. Five stories this week, one theme: the money is available, but the price keeps moving.

This Week in 30 Seconds

IPO candidates are pulling back despite an open window. Multiple US and European issuers are postponing listings after investors pushed back on pricing. The distance between what founders believe their businesses are worth and what public markets will pay is widening. Having a ready business isn't enough if the bid isn't there.

Employee tender offers are becoming a standard retention tool. Clay, ElevenLabs, and Linear all ran structured secondary sales for employees in recent weeks. Secondary SPV capital raised jumped 1,340% since 2023. Liquidity is being engineered inside companies now, not just at exit.

AI just repriced what wealth management costs. Altruist launched an agentic AI tax-planning tool that does in minutes what senior advisers bill hours for. Schwab, LPL, and Raymond James shares dropped high single digits. If you're paying 1% AUM, the business model behind that fee shifted this week.

UK founders: the rate is only half the problem. BADR rises to 18% on April 6th, but dilution from funding rounds, changes in role, and timing errors mean many founders won't qualify at all. Eligibility is the real risk, not the rate.

Valuation Gap Is the New Bottleneck

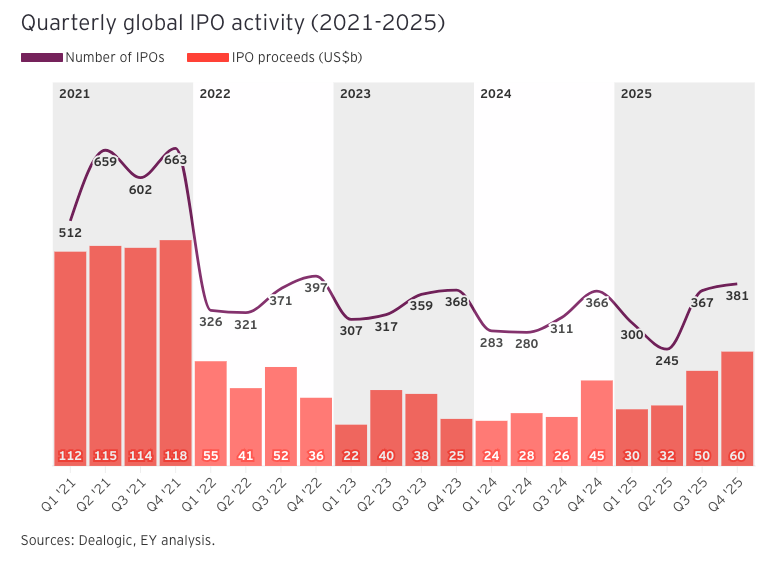

Last week, we covered the IPO window opening: Clear Street filing at $11.8 billion, eight companies raising $100M+ each, the busiest week for sizable offerings since 2021. That momentum hasn't disappeared. But a more complicated picture is forming alongside it.

Reuters reported that several US and European IPO candidates have postponed listings after investor feedback indicated pricing well below issuer expectations. Bankers cited AI-driven software, multiple compression and broader volatility as the primary causes.

This shouldn't surprise anyone who watched the SaaSpocalypse unfold in real time. When an entire sector reprices by 25%, the knock-on effects don't stay contained to public equities. Private company boards that were modelling IPO valuations based on 2024 comps are now staring at a different set of numbers. The window is open, but the price written on the ticket isn't what they expected.

Investor selectivity rose sharply in 2025, according to EY's global IPO trends report, with profitability pathways, governance rigour, and clarity around AI monetisation becoming non-negotiable. Narrative-driven stories struggled. Cash-generative companies with defensible forecasts did better. That filter is only getting tighter in 2026.

The pipeline is enormous. Dealroom's analysis of the 2026 IPO pipeline lists Databricks at a $134 billion valuation, Stripe at $106 billion, Canva at $42 billion, SpaceX potentially the largest IPO in history. Renaissance Capital expects 200 to 230 IPOs raising $40 to $60 billion this year. But when that much capital is competing for investor attention, smaller issuers get crowded out. Two-thirds of unicorn IPOs in 2025 were priced below their last private valuation.

For founders running a family office under $100M: maintain parallel exit routes. If your IPO timeline depends on a single pricing window holding, you're running a concentrated bet disguised as a plan. Trade sales, structured secondaries, and partial liquidity should run simultaneously, not be held in reserve.

Tender Offers Are the New Retention Playbook

Something quietly shifted in startup liquidity over the past six months, largely unnoticed outside VC circles.

TechCrunch reported that employee-focused tender offers are proliferating at fast-growing startups. Clay, an AI sales automation company, ran its second tender in under a year, letting employees sell shares at a $5 billion valuation after tripling ARR to $100 million. ElevenLabs authorised a $100 million secondary sale for staff at a $6.6 billion valuation, double its previous round. Linear completed a tender at its $1.25 billion Series C price.

What separates this from the 2021 era: these aren't founder cashouts at unproven companies. They're structured programs designed to retain high-performers who would otherwise leave for OpenAI or SpaceX, both of which regularly run their own tender sales. Boards are now attaching eligibility criteria tied to tenure, capping founder participation, and linking tender timing to milestone plans.

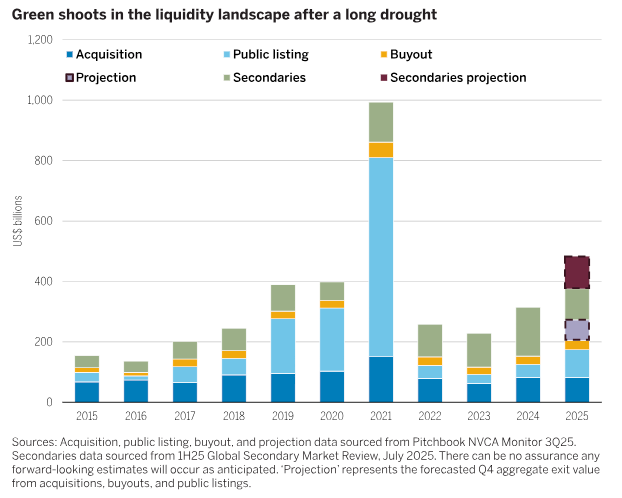

The broader numbers back the trend. Secondary SPVs increased 682% since 2023, and capital raised into those vehicles jumped 1,340% year-to-date, according to Wellington's 2026 VC outlook. Only about 2% of unicorn market value currently trades on the secondary market, indicating a vast addressable opportunity. Wellington expects secondaries to become a core liquidity tool in 2026, as pricing tightens with more capital flowing in.

Regular tenders let companies stay private longer. Ken Sawyer at Saints Capital flagged the downstream effect: delayed distributions to VC funds, which makes LPs more reluctant to re-up. If tenders become a permanent substitute for IPOs rather than a bridge, the venture ecosystem loses a critical feedback loop.

Most cap tables and shareholder agreements weren't drafted with structured secondaries in mind. Founders discovering this mid-process usually find it costs them time, pricing leverage, or both. Secondary discounts have narrowed from 9% to 6% of NAV, but that's an average. The specific discount depends on information asymmetry, transfer restrictions, and how badly the buyer wants in.

Private Credit Is Crowded. That Changes the Maths.

If you exited recently and your wealth manager is pitching private credit as a stable, high-yielding alternative to bonds, the pitch isn't wrong. But the market beneath that pitch has changed meaningfully over the past 12 months.

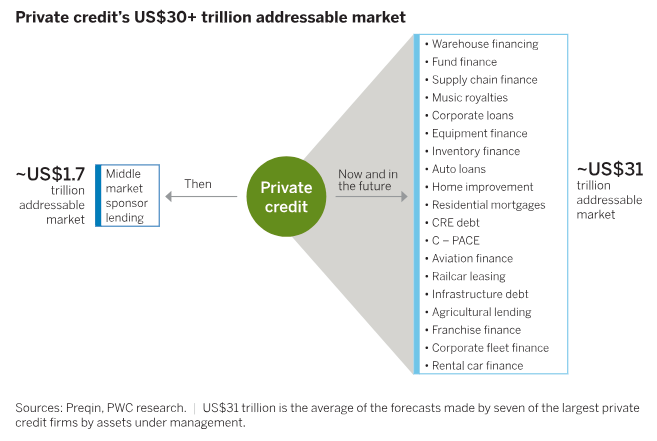

Direct lending yields fell below 10% for the first time in three years, according to CreditSights' 2026 outlook. Spreads have compressed to multi-year lows. The broadly syndicated loan market recaptured roughly $48 billion from private credit in 2025 as borrowers shopped for cheaper terms.

Where does that leave yields? Morgan Stanley projects first lien loans to be in the 8.0% to 8.5% range in 2026. Semi-liquid vehicles for the wealth channel now command almost a third of the $1 trillion US direct lending market. Demand isn't slowing. Supply of quality deals is the constraint.

The bigger risk is competitive erosion. Private credit has grown roughly five times faster than the broader leveraged credit market over the past decade, as Wellington's outlook details, and that growth is increasing the risk of aggressive underwriting and weaker covenant protections. Middle market direct lending is now roughly the same size as the large syndicated loan and high-yield markets. That's not a cyclical blip.

And the regulatory advantage is shrinking. The withdrawal of leveraged lending guidelines in December 2025, analysed by PitchBook, allows banks to compete more aggressively at higher leverage levels, potentially eroding one of private credit's core advantages. The moat that benefited direct lenders for a decade just got shallower.

None of this means private credit is suddenly a bad allocation. It means the easy returns are behind us. If you're allocating post-exit capital into this space, ask your manager three questions: what's the average spread on new originations versus twelve months ago, what percentage of deals have covenant-lite structures, and how much of the portfolio was originated in competitive auctions versus proprietary relationships. The answers will tell you whether you're getting compensated for illiquidity or just accepting it.

Read Private Markets Are Eating the Balanced Portfolio to see why family office investors are changing their allocations.

Your Financial Adviser's Business Model Just Got Repriced

On February 10, Altruist launched AI-powered tax planning inside its Hazel platform. The tool ingests 1040 tax forms, trust agreements, pay stubs, and account statements, then generates personalised tax strategies in minutes. Pricing: $125 per seat per month.

The market's read on what this means for traditional wealth management was immediate. Schwab dropped 11% over four sessions. LPL Financial fell 8.3%. Raymond James had its worst single-day decline since the pandemic. Morgan Stanley lost 5% in a week. Bloomberg Intelligence analyst Neil Sipes attributed the selloff to "concerns around efficiencies being competed away, fee compression long-term and potential market share shifts."

This matters to founders because tax planning is one of the primary services justifying the standard 1% AUM fee. If you hold $20M with a traditional adviser, you're paying roughly $200,000 a year. A meaningful portion of what that fee covers (document analysis, scenario modelling, tax-loss harvesting strategy) just got automated at a cost of $1,500 per year. Altruist's CEO put it bluntly: the tool "makes average advice a lot harder to justify."

None of this means human advisers are finished. Complex trust structures, cross-border tax planning, behavioural coaching during drawdowns: these aren't automatable yet. But the portion of advisory work that is routine and document-driven? That just repriced toward zero. The founders paying attention are the ones asking their advisers what, specifically, they're getting for their fee that a $125/month tool can't replicate.

Smart money, family office and private equity investors are very active in the financial advice and wealth management space. Investors back buy-and-build and roll-up strategies where integration, scale and a recurring revenue model can deliver significant upside returns.

Smart Money's Next Big Bet: Wealth Platforms

There is also a new trend in AI-Enabled Roll-Ups that can deliver SaaS-like returns in the Service Industries.

BADR: The Eligibility Trap

We covered the rate change last week. Business Asset Disposal Relief goes from 14% to 18% on April 6th. That's settled. What isn't settled is whether you actually qualify.

Bird & Bird's analysis of BADR qualifying conditions highlights several failure points that catch founders off guard. You need at least 5% of the ordinary shares and 5% of the voting rights, held continuously for 2 years before disposal. You also need to be either an officer or an employee of the company. And the company must be a trading company, not just an investment holding vehicle.

The 5% threshold creates a specific trap during funding rounds. If a new share issue dilutes you below 5% immediately before completion, HMRC may treat the full gain as taxable at the standard 24% CGT rate rather than the BADR rate. HMRC has confirmed that it doesn't consider same-day dilution from option exercises to disqualify a claim, but the position on earlier dilution events is less forgiving.

Founders who've changed roles during the two-year qualifying period face similar exposure. Cowgills' tax guidance, published this week, flags that companies shifting from trading to investment activity during the holding period may also fall outside the relief entirely. Restructuring takes time, and backdating isn't an option.

The Financial Bill 2019 introduced rules allowing founders who get diluted below 5% by an external investment to elect to crystallise their gain at the point of dilution and defer it. But that election must be made proactively. If you didn't file it, you've potentially permanently lost BADR on those shares.

For UK founders in the £5M-£50M range, the practical action is time-sensitive: get your tax adviser to confirm BADR eligibility in writing before April 6th. Not "probably qualifies." Confirmed, with shareholding percentages, role documentation, and trading company status verified. If something is wrong, seven weeks are enough to fix some issues. Seven days isn't.

Check out how founders evaluate tax strategies and jurisdictions without chasing the lowest rate.

Until next time.

Capital Founders OS is an educational platform for founders with $5M–$100M in assets. We focus on frameworks for thinking about wealth—so you can make better decisions.

If it's your first time here, don't forget to Subscribe.