Part 7 of The Founder's Guide to AI-Enabled Roll-Ups

The deal closes on a Tuesday. Your lawyer calls to confirm the wire landed. You take your team to lunch and tell them what's been in the works for months. Everyone congratulates you. Someone asks what happens now.

You realise you don't entirely know.

The pitch deck outlined a 12-month roadmap for AI transformation. The conversations with the platform CEO were full of phrases like "operational integration", "technology deployment", and "synergy capture." But what does that actually mean for Monday morning? How will you spend the next six months? Will your best people still be there at the end of it?

This chapter is about the reality of post-close integration—the timeline nobody shows you in the LOI, the technology rollout that takes longer than anyone admits, and how to survive the transition without losing your team, your clients, or your sanity.

Key Takeaways

- First 100 days are decisive: Integration failures cluster in this period—not because problems are unfixable, but because they compound quickly when ignored. Day 1-7 is anxiety management; Day 7-30 expect 20+ hours/week in meetings; Day 60-100 brings first real friction

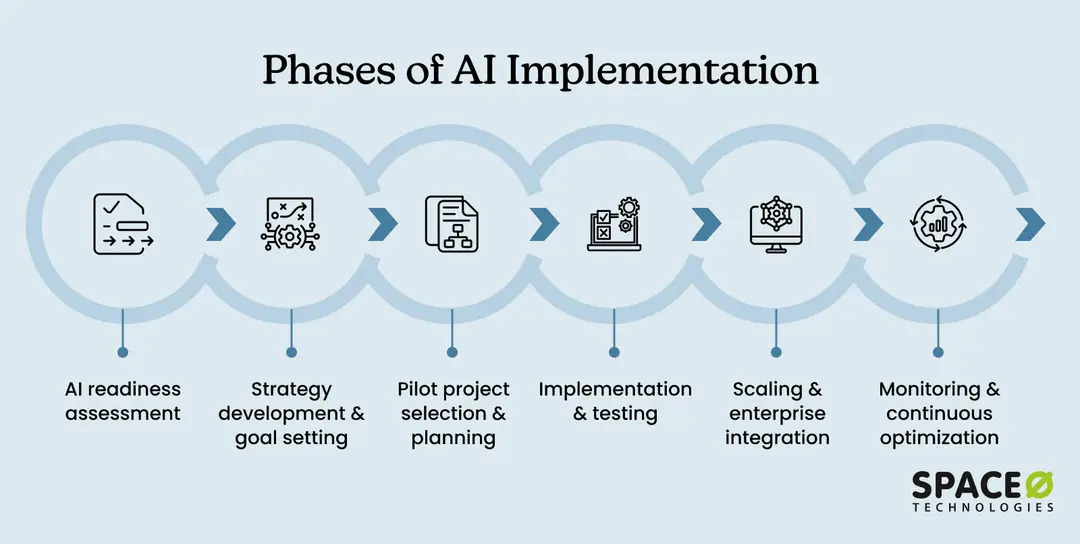

- AI deployment takes 18 months, not 12: Pitch decks promise rapid transformation. Reality: Assessment (months 1-3), infrastructure (months 2-5), pilot deployment (months 4-8), scaled deployment (months 8-18). If earnouts are tied to year-one performance, you're structurally set up to miss

- Employee turnover can reach 47% in year one: Retention bonuses buy time, not loyalty. Middle managers are most at risk—they lack negotiated roles but carry institutional knowledge. Invest in this layer explicitly or face operational gaps

- Client retention is communication, not service: 85-95% retention in good integrations; 80% or worse in poor ones. Difference is communication quality. Top clients get personal calls; over-communicate means monthly check-ins even when nothing's urgent

- Integration differs by acquirer type: PE-backed roll-ups (Crete model) follow standardised playbooks over 18 months. VC-backed builders (General Catalyst) deploy tech faster but you're beta-testing. Tech acquirers (Crescendo) expect full integration in 6-9 months

- Watch for warning signs early: Weekly syncs moving to monthly. Response times slowing from same-day to 48+ hours. Learning platform news from LinkedIn. Technology timelines slipping without explanation. Escalate before problems compound

- Contrarian insight: Founders who resist integration longest often have worst outcomes. Adaptation isn't surrender—platforms notice who's constructive vs. obstructive. The former get latitude; the latter get managed

One Firm's Integration: What It Actually Looked Like

Before the frameworks and timelines, here's what integration looked like for one 14-person accounting firm acquired by a PE-backed AI roll-up in late 2024.

Week 1: The announcement went smoothly. Platform CEO flew in for the all-hands. Staff seemed cautiously optimistic. Two junior associates asked privately whether they should start looking for other jobs. The founder told them no, but wasn't entirely sure himself.

Week 3: Integration team arrived. Four people spent three days mapping every system, every client, every workflow. The founder spent 22 hours that week in meetings—more than he'd spent in meetings during any month of running his own firm. His actual client work backed up.

Week 6: The senior manager—the one who ran day-to-day operations and knew every client's quirks—resigned. She'd been approached by a competitor and decided the uncertainty wasn't worth it. The founder had known she was unhappy but hadn't had time to address it. The retention bonus offer came two days after she'd already accepted the other role.

Week 10: Payroll migrated to platform systems. Benefits transitioned. The new email domain went live. Staff complained about having to learn new software while trying to do their actual jobs. One client called, confused by the email address change, wondering if the firm had been sold. "Yes," the founder said, "but nothing's changing for you." He wasn't sure that was true.

Month 4: First AI tools arrived, document processing for tax returns, and automated data extraction from client financials. The pilot covered three staff members and twenty clients. Results were mixed. The extraction worked well on clean digital documents; it struggled with scanned PDFs and handwritten notes, which comprised half the client base.

Month 8: The pilot expanded. Staff training intensified. Productivity metrics showed modest improvement—maybe 15% time savings on covered workflows. Not the 40% the pitch deck had promised, but measurable. The founder began to believe the transformation might actually work.

Month 12: Integration officially "complete." In practice, the firm was still adapting. Two more staff had left; four new hires had joined from other platform acquisitions. The client base was stable—94% retention—but the firm felt different. Better resourced. Less personal. Neither purely good nor bad.

The founder's verdict at the one-year mark: "I'd do it again, but I'd do it differently. I underestimated how much time integration would consume. I should have fought harder to keep Sarah [the senior manager]. And I wish someone had told me that 'twelve-month transformation' really means 'eighteen months if everything goes well.'"

First 100 Days: What Nobody Tells You

The first hundred days after an acquisition determine whether the deal creates value or destroys it. Research from BCG consistently shows that integration failures cluster in this period—not because problems are unfixable, but because they compound quickly when ignored.

Here's what actually happens, and what your calendar looks like while it's happening.

Day 1-7: The Announcement Period

The ink dries. Announcements go out. Your staff learns about the deal, usually the same day or within hours of close.

This is the moment of maximum anxiety for everyone except you. You've had months to process this. Your team has had hours. Their immediate thoughts are not about AI transformation. They're about whether they still have jobs, whether their health insurance is changing, and whether the new owners will fire everyone over 40.

Smart acquirers schedule all-hands meetings within 48 hours of close. They bring the platform CEO or integration lead to explain the vision, answer questions, and make explicit commitments about job security. The worst acquirers send an email and disappear for two weeks.

What you can control: Be present. Be visible. Answer questions honestly, including "I don't know" when you don't. The narrative you establish in the first week will define how your team interprets everything that follows.

Day 7-30: The Discovery Period

Integration teams arrive. They're mapping your systems, cataloguing your clients, and understanding your workflows. This feels invasive because it is. Strangers are auditing your business.

Here's what your week actually looks like:

Monday: Integration kickoff with platform leadership—three hours reviewing the timeline, introducing workstreams, and establishing communication cadence.

Tuesday: Back-to-back sessions on HR alignment (morning), technology assessment (afternoon), client communication strategy (late afternoon).

Wednesday: You planned to catch up on client work. Instead, you're responding to seventeen follow-up requests from Tuesday's meetings and joining an "urgent" call about payroll transition timing.

Thursday: First combined team meeting with staff from another recently acquired firm. Awkward introductions. Unclear why this meeting exists.

Friday: Actual work, finally—but you're now a week behind on deliverables that clients expected days ago.

Repeat for four weeks.

During this period, expect requests for access to everything: financial systems, CRM data, client files, employee records, and technology infrastructure. Some of this was covered in due diligence; much of it wasn't. Due diligence examines whether to buy. Integration examines how to operate.

What actually slows things down: Missing documentation, unclear processes, tribal knowledge that exists only in specific employees' heads. Integration specialists note that firms documenting operations before close integrate significantly faster.

Day 30-60: The Parallel Running Period

This is when technology migration typically begins—but not the AI transformation. First comes the boring infrastructure: payroll systems, benefits administration, email domains, financial reporting.

The platform needs your firm on their systems before they can do anything interesting. That means learning new software, adopting new processes, and doing your actual job while simultaneously adapting to change.

Client-facing work continues. Tax returns still need filing. Audits still need to be completed. The business doesn't pause for integration. You're running two races at once.

The psychological shift happens here.

You're no longer the final decision-maker. Purchase approvals now route through someone else. Hiring requires platform sign-off. Vendor changes need an integration team review. You still have your title, but the authority underneath it has changed.

This is when you first feel like an employee rather than an owner. The sensation is disorienting even when you expected it.

Day 60-100: The Integration Sprint

By day 60, the urgent infrastructure is usually handled. Now comes the operational integration—standardising workflows, implementing platform methodologies, beginning technology training.

This is also when the first real friction emerges. Your way of doing things aligns with theirs, but they don't always do. Maybe you've always handled client communications one way, but the platform handles them differently. Maybe your filing system makes perfect sense to you, but doesn't fit their taxonomy.

Successful integration requires letting go of practices you've refined over the years. That's harder than it sounds.

The hundred-day mark is significant because it's when platforms typically expect "stabilisation"—meaning the urgent fires are out, the basic systems are working, and the focus can shift from emergency response to value creation.

Whether you've actually reached stability depends on execution quality, not calendar time.

AI Deployment Timeline: Expectations vs. Reality

Here's what the pitch deck says: AI transformation begins immediately, margins improve within months, and your firm becomes meaningfully more efficient within the first year.

Here's what actually happens.

Phase 1: Assessment (Months 1-3)

Before any AI tools arrive, the platform needs to understand your current state. What's your technology stack? How clean is your data? What workflows are candidates for automation?

This assessment often reveals uncomfortable truths. Your data isn't as organised as you thought. Your processes have more manual steps than you realised. The firm you've run successfully for fifteen years looks messier from the outside than it felt from the inside.

A typical assessment checklist:

- Data inventory: Where does client information live? How many systems? How consistent is formatting?

- Process mapping: What are the actual steps in a tax return, an audit, a monthly close? Not the documented steps—the real ones.

- Technology audit: What software do you use? What integrations exist? What's cloud-based vs. local?

- Automation candidates: Which tasks are repetitive, rule-based, and high-volume enough to justify AI investment?

Assessment isn't passive. It requires significant time from you and your senior staff—walking integration teams through how things actually work, not how the documentation says they should work.

Phase 2: Infrastructure (Months 2-5)

AI tools require a foundation. You can't automate workflows that aren't documented. You can't apply machine learning to data that isn't structured. You can't integrate systems that don't talk to each other.

This phase involves migrating to platform-standard technology, cleaning and organising historical data, and establishing the integrations that AI tools will eventually use.

The timeline varies dramatically based on your starting point. A cloud-native firm with clean data might complete its infrastructure in two months. A firm running legacy software with 15 years of inconsistent filing might take 6 months or longer.

Industry data suggests small business AI pilots typically require 3-4 months from assessment to deployment, while enterprise implementations span 12-18 months for comprehensive rollouts.

Most platforms underestimate this phase when selling the deal. It's not deliberate deception—they genuinely believe transformation will be faster because they've seen it work elsewhere. But each firm is different, and the messy realities only emerge during integration.

Phase 3: Pilot Deployment (Months 4-8)

AI tools typically arrive as pilots—limited rollouts to specific teams, specific workflows, or specific client types. This is where you finally see the technology in action.

What day one of AI training actually looks like:

Three staff members gather in a conference room. A platform technologist shares their screen. The demo looks impressive—documents processed in seconds, data extracted automatically, draft work papers generated instantly. Everyone nods appreciatively.

Then they try it on real client files. The first document works perfectly. The second throws an error, the PDF was scanned at an angle, and the OCR can't read it cleanly. The third document extracts data but maps it to the wrong fields because the client's chart of accounts uses non-standard naming.

The technologist takes notes. "We'll need to train the model on your specific data patterns," they say. "Give us two weeks."

Two weeks become four. Four becomes six. Eventually, the tool works reliably on the document types it's been trained on. New edge cases require additional training cycles.

This is normal. It's also slower than the pitch deck suggested.

Phase 4: Scaled Deployment (Months 8-18)

Successful pilots expand. Failed pilots get reworked or abandoned. More sophisticated applications come online—workflow automation, predictive analytics, and AI-assisted advisory tools.

Metrics platforms typically track:

- Task completion time (before vs. after automation)

- Error rates (human-only vs. AI-assisted)

- Staff utilisation (hours on billable work vs. administrative tasks)

- Client capacity (clients served per FTE)

This is where the margin expansion that justified the deal begins to materialise. Or doesn't.

Earn-out Connection Nobody Mentions

Here's the problem: If your earn-out targets are based on year-one performance—margin improvement, revenue growth, EBITDA expansion—and the realistic transformation timeline is eighteen months, you're structurally set up to miss.

The models that justified your deal price assumed AI deployment would follow the pitch deck timeline. Reality follows its own schedule.

This creates a perverse dynamic. You're incentivised to push for faster deployment, which increases the risk of errors. The platform is incentivised to move methodically, which delays your earn-out achievement. Your interests diverge precisely when they should align.

The founders who navigate this successfully have one thing in common: They negotiated earn-out structures that accounted for realistic timelines, not pitch deck timelines. If you didn't—and most don't—you're now managing expectations rather than outcomes.

Integration Differs by Acquirer Type

Not all platforms integrate the same way. The experience varies meaningfully by acquirer type:

PE-Backed Roll-Ups (Crete Professionals Model)

Integration follows a playbook refined across dozens of acquisitions. Standardisation is the goal—your firm should operate like every other firm in the portfolio within 12-18 months.

Pros: Proven processes, experienced integration teams, clear expectations. Cons: Less flexibility for firm-specific needs, "that's how we do it across the platform" as a conversation-ender.

Typical timeline: 100-day stabilisation, 12-month operational integration, 18-month full transformation.

VC-Backed Technology Builders (General Catalyst Model)

Integration prioritises technology deployment over operational standardisation. You're a proving ground for tools they're developing.

Pros: Access to cutting-edge AI, a genuine partnership in product development, and your feedback shapes the platform. Cons: You're beta-testing. Things break. The playbook is still being written.

Typical timeline: Faster technology deployment (often month 2-3), slower operational standardisation, ongoing iteration as tools evolve.

Tech Companies Acquiring Distribution (Crescendo Model)

Your firm is a channel for their existing technology. Integration means adopting their tools immediately because the tools already exist.

Pros: No waiting for technology development, proven systems from day one. Cons: Less customisation, tools built for different contexts may not fit yours perfectly.

Typical timeline: Aggressive—technology deployment often starts week 2, full integration expected within 6-9 months.

Understanding your acquirer's model helps you calibrate expectations. A founder who expected a Crete-style methodical integration and got a Crescendo-style aggressive deployment will feel whiplash. A founder expecting cutting-edge AI from a playbook-driven PE shop will be disappointed.

Understanding the Platform's Perspective

Integration friction often comes from misaligned incentives. Understanding what the platform is optimising for explains decisions that otherwise seem arbitrary or frustrating.

They're running multiple integrations simultaneously.

Your acquisition may be one of the eight they're managing this quarter. Their attention is distributed. What feels like neglect may be a capacity constraint.

They have playbooks that work at scale.

The platform methodology was designed to be repeatable across dozens of firms. It may not fit your specific situation perfectly, but customisation for every acquisition isn't sustainable. They're optimising for portfolio-wide outcomes, not your individual experience.

They're measuring success by aggregate metrics.

Platform leadership reports to investors on metrics like "average integration timeline," "aggregate margin improvement," and "portfolio-wide client retention." Your individual results matter, but they matter as one data point among many.

Their timeline pressure comes from fund reporting.

PE funds have reporting cycles. GPs need to demonstrate value creation to LPs. This creates pressure to show integration "wins" on schedules that may not align with operational reality. When your platform contact seems stressed about the timeline, it's often because their leadership is stressed about board meetings.

They've seen this before—including the complaints.

Every acquired founder thinks their situation is unique. Platforms have heard the same concerns dozens of times. This can manifest as dismissiveness ("we know what we're doing") or as genuinely useful pattern recognition ("here's what worked for other founders in your situation"). Which one you get often depends on the individual integration lead assigned to you.

None of these excuses poor execution. But it does explain why certain decisions get made and why certain frustrations feel structural rather than personal.

Your Team: The Human Side of Integration

Employee turnover after acquisitions can reach 47% in the first year. For professional services firms, where relationships drive revenue, that number can be devastating.

People leave for predictable reasons: uncertainty about the future, culture mismatch with the new owners, loss of autonomy in their roles, or simply a sense that "this isn't what I signed up for."

First-Week Conversations

Your senior staff need private conversations within days of the announcement. Not group meetings—individual conversations where they can ask real questions and express real concerns.

What they want to know:

- Is my job safe?

- Will my compensation change?

- Who will I report to?

- How will my day-to-day work change?

- Do I have a future here, or am I being managed out gracefully?

Some of these questions you can answer. Others you can't, because the integration plan hasn't been finalised. Honesty about uncertainty is better than false reassurance that unravels later.

Retention Bonuses Buy Time, Not Loyalty

Retention bonuses are common—nearly 60% of organisations now use them during acquisitions. Key employees receive cash incentives tied to staying through the transition period, typically 12-24 months post-close.

But an employee who stays for the retention bonus while mentally checking out on day one isn't providing value. The goal is creating conditions where people want to stay, not just where they're financially handcuffed.

What actually retains people:

- Clear communication about their role in the combined organisation

- Genuine inclusion in integration planning, not just announcement of decisions

- Visible investment in their development, not just the extraction of their knowledge

- Respect for the expertise they bring, not dismissal of how things were done before

What drives people away:

- Feeling like their input doesn't matter

- Discovering promises made during the sale aren't being kept

- Culture clash with new management

- Workload increases without corresponding compensation

- Loss of autonomy in roles they'd previously owned

Middle Manager Problem

Integration is hardest on middle managers. Partners and senior leaders typically have negotiated roles. Junior staff adapt or move on. Middle managers—the directors, senior managers, and practice leads who actually run day-to-day operations—often find themselves in limbo.

Their responsibilities may shift. Their authority may diminish. Their career paths, once clear within the firm they knew, become uncertain in a larger organisation where in they're still learning.

Platform acquirers who retain talent invest explicitly in this layer. Those who ignore it often find themselves six months post-close with operational gaps they didn't anticipate, because the people who knew how things worked have left.

Client Communication: The Retention Playbook

Client retention rates after professional services acquisitions typically range from 85-95% in well-executed integrations. Poorly executed integrations see defection rates of 20% or higher in the first year.

The difference is usually in communication quality, not service quality. Clients leave when they feel surprised, ignored, or deprioritised—not because the work declined.

The Announcement

Client communication should happen the same day as employee communication. Segment your approach:

Top 20% of clients (by revenue or relationship importance): Phone calls from you personally, ideally before the public announcement if your purchase agreement allows. Script: "I wanted you to hear this directly from me. We've joined [Platform Name]. Here's what it means for you—and more importantly, here's what's not changing."

Middle tier: Personalised emails referencing your specific relationship. Not a form letter with their name mail-merged in—an actual message that acknowledges your history together.

Everyone else: The announcement with a genuine offer to discuss. "If you have questions, please call me directly" should mean you'll actually answer.

Handling the Inevitable Objections

Client: "I liked working with your firm, not some platform."

Response: "That's exactly why I'm still here. The team you work with isn't changing. The attention you receive isn't changing. What is changing is the resources behind us—we now have technology and support that lets us serve you better than I could alone."

Client: "Are you going to raise my fees?"

Response: "Any fee discussions will happen the way they always have—directly between us, based on the scope of work, not based on corporate mandates. If your fees ever change, you'll understand why before it happens."

Client: "This sounds like you sold out, and I'm going to get worse service."

Response: "I understand the concern. Can I ask you to judge us on what actually happens? If, six months from now, you feel service has declined, I want to hear it directly. And if it hasn't—if we're actually serving you better—I hope you'll tell me that too."

What "Over-Communicate" Actually Means

For your top clients during the first year:

- Monthly check-in calls (even when there's nothing urgent)

- Proactive updates on how you're serving them ("I wanted to share how we're approaching your Q3 work differently this year")

- Immediate communication if anything changes that affects them

- Quarterly relationship reviews that aren't tied to billing

The goal is making them feel more attended to post-acquisition, not less. That requires conscious effort because your attention is being pulled in many directions.

What Goes Wrong: Integration Failure Patterns

Not every integration succeeds. Understanding failure patterns helps you spot warning signs early.

Pattern 1: The Abandoned Acquisition

The platform completes the transaction, announces the integration plan, then fails to execute. Resources promised don't arrive. Technology deployment stalls. The integration team moves on to the next deal.

Observable warning signs:

- Your weekly sync moved to biweekly, then monthly, then "as needed"

- Your integration lead stopped responding same-day; now it takes 48 hours or longer

- You found out about a platform-wide initiative from LinkedIn rather than internal communication

- The questions you escalated three weeks ago remain unanswered

- The technology deployment timeline has slipped twice without a clear explanation

What to do: Escalate early. Document commitments that aren't being met. Request a meeting with platform leadership—not your integration contact, but their boss. Use whatever governance mechanisms your deal structure provides.

Pattern 2: The Culture Collision

The platform's operating style fundamentally clashes with how you've run your firm. They're process-driven; you're relationship-driven. They're metrics-focused; you're judgment-focused. They want standardisation; you've thrived on customisation.

Research suggests nearly 30% of failed mergers stem from cultural misalignment.

Observable warning signs:

- Every integration decision feels like a fight you lose

- Your feedback is solicited but never incorporated

- "That's how we do it across the platform" appears in every conversation

- You're being asked to implement practices you believe will harm client relationships

- Your staff report feeling like "cogs in a machine"

What to do: Pick your battles. Accept standardisation where it doesn't affect client value. Push back hard where it does. If you can't find workable compromises after a genuine effort, consider whether the deal structure allows you to exit earlier than planned.

Pattern 3: The Technology That Doesn't Work

The AI tools promised in the pitch don't deliver in practice. Automation fails. Integrations break. Staff spend more time fighting the technology than using it.

Observable warning signs:

- Pilots consistently fail or underperform projections

- The same problems keep recurring despite "fixes"

- Platform technologists blame your data, your staff, or your processes, rather than acknowledging tool limitations

- Staff have stopped using tools that were deployed months ago

- Workarounds have become standard practice

What to do: Document outcomes objectively. Compare promised results to actual results with specific metrics. Engage platform leadership directly if implementation teams are deflecting accountability. Be clear about whether this is a deployment problem (fixable) or a fundamental capability gap (not fixable).

Pattern 4: The Talent Exodus

Your best people leave. Then more leave. Within eighteen months, the institutional knowledge that made your firm valuable will walk out the door.

Observable warning signs:

- Senior staff start asking about references

- Morale in team meetings has visibly declined

- Internal complaints about workload, culture, or management have increased

- Recruiters report that your employees are unusually responsive to outreach

- Exit interviews reveal consistent themes about the acquisition

What to do: Advocate loudly for retention investment. Make the business case—calculate the cost of replacing key people, the revenue at risk from relationship disruption, and the integration delay from knowledge loss. If the platform won't act, prepare for the operational consequences and adjust your own plans accordingly.

When Integration Actually Works

It's not all cautionary tales. Well-executed integrations create genuine value.

A founder of an 11-person tax practice acquired by a PE-backed roll-up in 2023 described her experience:

"The first six months were hard. More meetings than I'd ever had, constant change, moments where I genuinely questioned whether I'd made a mistake. But by month nine, something shifted. The AI tools were working—actually working, not just demoed working. My staff could handle more clients without burning out. I had time for strategic work I'd been putting off for years.

"A year and a half later, I wouldn't go back. We serve 40% more clients with the same team. My best people have clearer career paths than I could have offered them alone. I'm making more money with less stress than when I ran everything myself.

"Was it worth it? Yes. Would I want to do it again? God, no. But I'd tell other founders it can work—it just takes longer and hurts more than anyone admits upfront."

Successful integrations typically share common patterns:

Clear communication from day one. The platform explained what would happen, when, and why. Surprises were rare.

Respect for what existed. The acquisition was treated as bringing capability to the platform, not as fixing something broken. The founder's expertise was valued.

Realistic timelines. Expectations were achievable. When delays occurred, they were communicated openly and addressed practically.

Investment in people. Retention wasn't an afterthought. Staff felt valued, not exploited.

Technology that actually worked. AI tools delivered measurable improvement. Training was sufficient. Support was available when things broke.

Founder autonomy within boundaries. Clear expectations about what is required for platform approval and what can be decided locally. Enough freedom to feel like leadership, enough structure to feel like partnership.

When these conditions exist, integration can be energising rather than exhausting. That outcome is possible. It's just not guaranteed.

Contrarian View: What Most Founders Get Wrong

Most integration advice focuses on protecting yourself from the platform. Here's what that advice often misses:

The founders who resist integration the a longest often have the worst outcomes.

There's a difference between advocating for your firm's needs and fighting every change because it's a change. Platforms notice which founders they have acquired are constructive partners and which are constant obstacles. The former get more latitude and more resources. The latter gets managed more tightly.

Adaptation isn't surrender. It's recognising that you joined a larger organisation and that your job now includes making it work.

Your best people might be happier post-acquisition than you expect.

Many employees prefer working for larger organisations. Clearer career paths. Better benefits. More specialisation. Less "everyone does everything" chaos. The staff member you're worried about losing might actually be relieved by the structure.

Don't assume your preferences are universal. Ask your people what they want.

The platforms that integrate fastest aren't necessarily the best partners.

Aggressive integration timelines can mean less customisation, less attention to your specific needs, and more "just make it work" pressure that creates technical debt and cultural friction.

A platform that takes eighteen months to integrate thoughtfully may preserve more value than one that claims to be "done" in six months but leaves problems festering beneath the surface.

Speed is not the only measure of quality.

Honest Uncertainty: What We Don't Know

This chapter presents patterns and frameworks, but the honest truth is that AI roll-up integration is a young phenomenon. Most of these platforms are less than five years old. The longest track record covers perhaps 30 acquisitions.

What we don't know:

- Long-term founder satisfaction. We have 12-18 months of data, not 5 years. Founders who are satisfied at month 12 may feel differently at month 48.

- Survivorship bias in reports. The founders who share their experiences publicly are disproportionately those who stayed. The ones who left, bought out their earnouts early, or quietly regret the deal aren't giving interviews.

- How integration patterns will evolve. Platforms are learning. The integration experience in 2027 may look different from 2025 as best practices emerge and tools mature.

- What happens in a downturn. Most AI roll-up integrations have occurred during relatively stable economic conditions. How these structures perform in a recession—when client budgets tighten, platform funding becomes scarcer, and earn-outs become harder to achieve—remains untested.

The frameworks in this chapter are useful. They're also incomplete. Your experience will add data points to a picture that's still being drawn.

Founder's Survival Guide

You've gone from owner to employee. From final decision-maker to participant in a larger system. From building your legacy to supporting someone else's vision.

This transition is disorienting even when the deal goes well.

Emotional Reality

You will resent this at times. That's normal.

Some days you'll wonder why you sold. That's also normal.

The relationship with your business has fundamentally changed. Grief is appropriate. You built something. Now it belongs to someone else, even if you're still there running it.

Give yourself permission to feel whatever you feel. Then do the work anyway.

Protect Your Energy

Integration is exhausting. The volume of meetings, decisions, and demands increases dramatically while the rewards—the satisfaction of building something that's yours—diminish.

Set boundaries where you can. Not every integration meeting requires your presence. Not every platform request deserves your time on the weekend. The transition will take years; you can't sprint the whole way.

Stay Engaged Without Overcommitting

The temptation is to either disengage entirely or to work harder than ever to prove your value. Both are traps.

Disengagement signals to the platform that you're checked out, which makes them less likely to involve you in decisions. Over-commitment leads to burnout and builds expectations you can't sustain.

Find the middle path: engaged where it matters, appropriately boundaried where it doesn't.

Build Relationships Across the Platform

Your success post-close depends partly on the execution of integration and partly on your relationships with platform leadership. The founders who thrive in roll-up structures are the ones who become known quantities—trusted voices whose input is valued.

Invest in relationships beyond your integration team. Attend platform events. Connect with other acquired founders. Build the network that will support you as the combined organisation evolves.

Keep Your Options Open

Even in the best integrations, you may decide this isn't where you want to spend the next decade. The non-competes eventually expire. The earnouts eventually vest. Your obligations eventually end.

Maintain relationships outside the platform. Stay current on market developments. Don't let the integration consume so much attention that you lose sight of what comes after.

Integration Decision Points

At several moments during integration, you'll face decisions that shape your experience:

Week 1: How Do You Show Up?

Your team is watching. Your clients are watching. The platform is watching. How you carry yourself in the first week sets the tone for everything that follows.

Show up as a partner, not a victim. As engaged, not resentful. As someone building toward something, not someone mourning what's lost.

Month 3: What Are You Willing to Fight For?

Not every integration decision merits resistance. But some do. Figure out what matters to you—which practices, which people, which principles—and advocate for those.

The founders who thrive post-acquisition know when to adapt and when to push back.

Month 6: Is This Working?

By six months, the trajectory is usually clear. The technology is deploying, or it isn't. The culture is meshing, or it isn't. Your team is stabilising, or it isn't.

This is the moment for honest assessment. If the integration is working, commit more fully. If it's failing, start planning accordingly.

Month 12: What's Next?

A year in, you know what you've bought into. The platform has revealed itself. The experience has revealed you.

Whatever comes next—deeper engagement, patient waiting, early exit—make that choice consciously, based on evidence rather than hope.

The Bottom Line

Integration is where deals succeed or fail. The pitch deck is just words. The purchase agreement is just paper. What happens in the 12 to 18 months after close determines whether you made a good decision.

Go in with realistic expectations. The timeline will be longer than promised. The friction will be greater than anticipated. The emotional toll will be higher than you imagine.

Go in with clear priorities. Know what matters to you. Know what you're willing to compromise and what you're not.

Go in with open eyes. Watch for warning signs. Escalate problems early. Don't let hope substitute for evidence.

And go in knowing that the experience—whatever it is—will end. The earnouts will vest. The non-competes will expire. The obligations will conclude.

What you do with what remains is still your choice.

← Back to Chapter 6: The Investment Thesis

Continue to Chapter 8: Due Diligence in Reverse →

Or return to: The Founder's Guide to AI-Enabled Roll-Ups (Hub)

Capital Founders OS is an educational platform for founders with $5M–$100M in assets. We focus on frameworks for thinking about wealth—so you can make better decisions.

If it's your first time here, don't forget to Subscribe.