Part 6 of The Founder's Guide to AI-Enabled Roll-Ups

In 2022, David Mendelsohn sold his 42-person tax advisory firm to a PE-backed roll-up platform. The integration went reasonably well. His earn-out hit projections. Eighteen months later, he was sitting on $9 million in proceeds, looking for deployment opportunities.

Then a different AI roll-up sponsor approached him—not as a potential seller, but as a potential investor. The pitch deck promised 25% IRRs, "transformational AI capabilities," and "unprecedented consolidation opportunities" in the accounting sector. They wanted $1.5 million for a co-investment alongside their fund.

David had seen roll-ups from the inside. He knew what integration actually looked like—the gap between what was promised during courtship and what arrived after closing. He'd watched the platform's technology roll out eighteen months behind schedule, delivering efficiency gains that were real but modest compared to the pitch. He understood why three of his colleagues who sold alongside him had left before their earnouts were completed.

That experience made him both a better evaluator of the opportunity and a more sceptical one.

His questions weren't the questions a first-time allocator would ask. He didn't accept the projected IRR at face value. He wanted to know the DPI—distributions to paid-in capital. How much money had actually returned to investors versus sitting as unrealised gains marked at sponsor-determined valuations? He asked about integration timelines on previous acquisitions. He requested references from founders who had completed their earnouts and departed—people no longer contractually obligated to speak positively.

The sponsor, accustomed to investors who accepted marketing materials as diligence, found these questions uncomfortable. That discomfort told David something important.

This chapter is for founders like David—people who understand professional services from the operating side, have capital to deploy, and are now evaluating the same AI roll-up strategies from the investor's perspective. The knowledge you've built over the preceding chapters of this playbook isn't just relevant for sellers. It's equally valuable for allocators.

Key Takeaways

- AI roll-ups are private equity with a technology overlay: The return mechanics—multiple arbitrage, operational improvement, leverage—follow the standard PE playbook. The AI thesis adds potential upside but also execution risk that traditional roll-ups don't carry

- Return expectations should be tempered by limited track records: Most AI roll-up platforms are less than five years old. Target 18-25% net IRR, but recognize that claimed returns often include unrealized gains marked at sponsor-determined valuations

- Due diligence for investors differs fundamentally from seller diligence: As an LP or co-investor, you're evaluating the platform's ability to execute repeatedly—not just one acquisition. GP track record, team stability, and technology deployment evidence matter more than any single deal

- Co-investment offers better economics but demands independent evaluation: Reduced fees and direct ownership come with the obligation to perform your own diligence. If you can't assess technology claims independently, the fee savings may not compensate for concentrated risk

- Position sizing matters enormously: A 2-4% allocation to a single roll-up is appropriate diversification within alternatives. A 15% allocation is a concentrated bet requiring conviction that most investors don't actually possess

- The best AI roll-up investments might succeed even if the AI thesis fails: Look for platforms where traditional roll-up economics provide a return floor, with AI capabilities representing option value rather than the entire thesis

What You're Actually Buying

Before discussing return expectations and due diligence, let's be precise about what AI roll-up investments actually are.

At their core, these are private equity investments. The return mechanics are familiar: acquire companies at lower multiples, improve operations, achieve scale, and exit at higher multiples. According to Cambridge Associates benchmarking data, the US Private Equity Index has delivered pooled net returns of approximately 12-14% over the past 25 years, compared to roughly 9-10% for the S&P 500. Roll-up strategies within PE have historically performed well when executed competently in fragmented industries.

The "AI-enabled" modifier adds a technology thesis to the standard playbook. The claim is that artificial intelligence will accelerate the operational improvements that justify premium exit multiples—reducing labour costs, improving client outcomes, and enabling faster integration of acquired firms.

This technology overlay creates both potential upside and additional execution risk. If the AI capabilities deliver as promised, returns could exceed traditional roll-up expectations. If they don't—if the technology remains perpetually "in development" or delivers modest improvements rather than transformational ones—you've accepted venture-style uncertainty layered on top of PE illiquidity.

Understanding this hybrid nature is essential. You're not investing in a technology company where growth rate justifies high multiples despite current losses. You're not investing in a traditional roll-up where the playbook is well-established. You're investing in something that requires both operational excellence and technology delivery to hit return targets.

The honest framing: treat AI roll-ups as traditional PE with technology optionality attached. If returns require the AI thesis to fully materialise, you're making a bet that historical PE data can't validate. If returns are acceptable even under modest technology assumptions, you have genuine upside with a defensible floor.

Return Expectations: What's Realistic (And What Isn't)

What should you expect from an AI roll-up investment? The answer depends on the specific structure, but reasonable benchmarks exist—along with reasons for scepticism about projected returns.

Fund investments (LP commitments):

If you're investing as a limited partner in a fund executing an AI roll-up strategy, target net IRR should fall in the 18-25% range over a 5-7 year fund life. This is consistent with top-quartile PE performance and reflects the illiquidity premium you should demand for locking up capital.

But here's what marketing materials won't emphasise: most AI roll-up platforms are less than five years old. There's limited realised return data. Claimed returns often include unrealised gains marked at valuations determined by the sponsor, not at arm's-length transactions. According to Neuberger Berman's analysis, global private equity funds have generated approximately 13.7% net IRR over the past 20 years—that's the benchmark, not the floor.

PE returns follow a J-curve. Here's what that actually looks like in practice:

- Year 1: -5% to -8% (fees paid, investments made, no appreciation yet)

- Year 2: -2% to +3% (more fees, early marks, perhaps some write-downs)

- Year 3: +3% to +8% (operational improvements beginning to show)

- Year 4: +10% to +15% (first exits possible, marks improving)

- Year 5-6: +15% to +22% (harvest period, major distributions)

- Year 7+: Returns crystallise based on exit outcomes

Expect years one through three to look unimpressive. Judgment comes at year five and beyond. If a sponsor is showing you returns from a three-year-old fund, those returns are largely theoretical.

Multiple on invested capital (MOIC) targets should be 2.0-2.5x for a well-executed roll-up strategy. Some sponsors report higher multiples—Shore Capital Partners claims median returns of 5.5x, Synova reports 6.2x—but these represent exceptional outcomes, not reasonable baseline expectations. Underwriting to 3x+ MOIC means betting on exceptional execution, favourable market conditions, and technology delivery all aligning.

The DPI question:

When evaluating any PE investment, ask about DPI—distributions to paid-in capital. This measures the cash actually returned to investors, not paper gains. A fund showing 25% IRR with 0.3x DPI has returned 30 cents on the dollar in actual cash. The remaining "returns" exist only as marks on portfolio companies that haven't been sold.

DPI below 1.0x in a fund older than five years is a yellow flag. It suggests either the portfolio isn't performing well enough to exit, or the sponsor is avoiding crystallising returns at prices below their marks.

Co-investments:

Co-investing alongside a sponsor typically offers better economics—reduced or eliminated management fees, lower carry—in exchange for the obligation to perform your own diligence and accept concentrated exposure to individual deals.

According to reporting from CNBC's Inside Wealth, co-investment arrangements have grown significantly as family offices seek direct exposure without full fund economics. Private equity firms offer co-investment rights to induce larger fund commitments, while family offices gain access to deals they couldn't source independently.

For AI roll-up co-investments, target returns should be modestly higher than fund investments—20-30% gross IRR—reflecting both reduced fee drag and concentrated risk. But recognise the trade-off: you're betting on specific acquisitions rather than a diversified portfolio. If you can't evaluate each opportunity independently, the fee savings don't compensate for that concentration.

Direct platform investments:

Some family offices invest directly in roll-up platforms—taking equity stakes in the holding company itself rather than committing to a fund. This offers maximum control and potentially maximum returns, but also maximum operational burden.

Research from Family Wealth Report notes a sobering reality: only half of family offices making direct private investments have PE professionals on staff trained to structure and evaluate opportunities. Just 20% take board seats as part of their investments, suggesting limited bandwidth for the oversight that direct investing demands.

If you're considering direct investment in an AI roll-up platform, be honest about whether you have the resources to evaluate technology claims, assess management capability, and monitor integration execution over a 5-7 year holding period.

How This Compares to Alternatives

Before committing to an AI roll-up, consider how it compares to other ways you might deploy capital in adjacent opportunities.

Traditional PE roll-ups (without AI thesis):

Same mechanics, lower technology risk. If traditional roll-ups deliver 15-20% net IRR with established playbooks, AI roll-ups need to justify their additional execution risk with meaningfully higher return potential. If the projected returns are similar, why accept the technology uncertainty?

Venture capital in AI companies:

If you're bullish on AI, you could invest in technology companies directly rather than betting on AI applications within roll-ups. VC offers higher potential returns (3-5x+ MOIC for top-quartile funds) but with higher failure rates and longer time horizons. The risk profile is different—you're betting on technology success directly rather than technology application in operations.

Public market AI exposure:

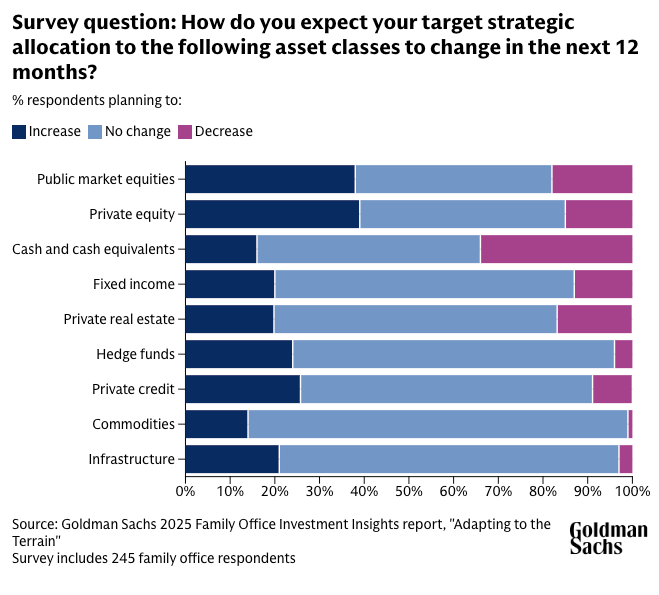

Large-cap technology companies (Microsoft, Google, Amazon) offer liquid exposure to AI development. Returns are likely lower than PE, but you can exit at will, and the companies are already profitable. According to the Goldman Sachs 2025 Family Office Investment Insights report, 86% of family offices have AI exposure primarily through public equities, suggesting many sophisticated investors prefer this lower-friction approach.

Private credit:

If you're seeking yield rather than growth, private credit offers returns of 8-12% with lower volatility and more predictable cash flows. According to Goldman Sachs, 26% of family offices intend to increase private credit allocations, reflecting appetite for yield and bespoke financing solutions without the execution risk of equity strategies.

The question isn't just whether AI roll-ups are attractive in isolation. It's whether they're the best risk-adjusted use of your capital given alternatives. If traditional PE offers returns similar to those of AI with less execution risk, or if public AI exposure offers liquidity with comparable technology upside, the case for AI roll-ups specifically becomes harder to make.

Value Creation Mechanics

To evaluate AI roll-up investments intelligently, you need to understand how value is supposedly created. There are four primary drivers:

Multiple arbitrage:

This is the mathematical core of roll-up economics. Smaller professional services firms typically trade at 4-6x EBITDA. Larger, more diversified platforms trade at 8-12x or higher. By acquiring firms at lower multiples and consolidating them into a larger entity, sponsors create value through the gap.

A roll-up that acquires platform companies at 5x EBITDA and bolt-on acquisitions at 3-4x EBITDA, then exits at 10x EBITDA, can generate 2x returns purely through multiple arbitrage—before any operational improvements.

This math works regardless of AI. The technology thesis claims it will enhance the multiple expansion by making the consolidated platform more valuable—higher-margin, faster-growing, and more defensible—than traditional roll-ups. But multiple arbitrage is the foundation that makes roll-ups viable even if technology disappoints.

Operational improvement:

The second value driver is improving the operations of acquired companies. Standard PE playbooks include professionalising management, implementing better financial controls, cross-selling services, and reducing redundant costs.

AI roll-ups claim to accelerate these improvements through technology. If AI tools genuinely reduce labour costs by 20-30%, improve client outcomes, and enable faster integration, the operational improvement driver becomes more powerful.

This is where the investment thesis stands or falls. Multiple arbitrage is mechanical—it happens if you execute acquisitions at the right prices. Operational improvement through AI requires the technology to actually work as claimed. According to EY's analysis, about two-thirds of PE clients had implemented at least one AI initiative in their portfolio by 2024—but implementation doesn't equal transformation. Many initiatives deliver modest efficiency gains, not the dramatic improvements sponsors project.

Leverage:

Private equity uses debt to amplify equity returns. A $100M platform acquired with $40M equity and $60M debt, sold later for $150M, returns $90M to equity holders (after debt pay-down)—a 2.25x return versus the 1.5x return an all-equity acquisition would generate.

AI roll-ups use leverage similarly. Predictable cash flows from acquired professional services firms make debt financing available on reasonable terms. The risk, as always, is that leverage amplifies both losses and gains. A 20% decline in platform value can wipe out equity entirely in a leveraged structure.

Revenue synergies:

The fourth driver is growing acquired companies faster through platform resources—shared business development, cross-selling across the client base, and geographic expansion enabled by combined scale.

AI roll-ups claim that technology accelerates these synergies by enabling better client matching, faster service delivery, and expanded service offerings that individual firms couldn't provide on their own. But according to small-cap roll-up analysis, synergies "have a bad habit of falling short." Great roll-up CEOs pay fair prices for businesses today and treat synergies as gravy rather than the primary return thesis.

Fee Reality: What You're Actually Paying

Private equity fees are complex and significantly impact net returns. Understanding the full cost structure is essential before committing capital.

The standard "2 and 20" model:

Most PE funds charge a 2% annual management fee on committed capital during the investment period, plus 20% carried interest on profits above a hurdle rate (typically 8%). According to Callan's 2024 Private Equity Fees and Terms Study, median management fees run 1.75-2.00% during the investment period, then step down by 20-25 basis points afterwards.

What this actually costs:

On a $5 million commitment to a fund with standard terms:

- Management fees during a 5-year investment period: ~$500,000 (2% × $5M × 5 years)

- Management fees during a 5-year harvest period at a reduced rate: ~$375,000 (1.5% × $5M × 5 years)

- Total management fees over fund life: ~$875,000

That's 17.5% of your committed capital consumed by management fees alone, before any carried interest. If the fund generates 2x MOIC (returning $10M on your $5M), carried interest on the $5M profit above the hurdle is an additional $1M (20% of profit).

Your net return after fees: $10M - $875K - $1M = $8.125M, or 1.625x MOIC versus 2.0x gross.

Co-investment fee savings:

Co-investments typically eliminate or significantly reduce fees. According to Morgan Lewis attorneys, sponsors increasingly offer co-investment rights with zero management fee and reduced carry (often 10% or eliminated entirely) to induce larger fund commitments.

On the same $5M investment as a co-investment with no management fee and 10% carry:

- Management fees: $0

- Carried interest (10% on $5M profit): $500,000

- Net return: $10M - $500K = $9.5M, or 1.9x MOIC versus 2.0x gross

The difference—$1.375M more in your pocket—explains why sophisticated family offices actively pursue co-investment.

Hidden fees to watch:

Beyond headline fees, some sponsors charge:

- Transaction fees on acquisitions (1-2% of deal value)

- Monitoring fees to portfolio companies

- Fund expenses (legal, audit, administration)

According to Carta's fee analysis, a single fee calculation error "can have a cascading effect, leading to incorrect financial statements, inaccurate tax reporting, and eroded trust with LPs." Request the Limited Partnership Agreement and have counsel review the fee provisions before committing.

Due Diligence for Allocators

If you're evaluating an AI roll-up investment, your diligence process differs from that of a seller. You're not evaluating whether to join a specific platform; you're evaluating whether to bet capital on a team's ability to execute the strategy repeatedly over a fund's life.

GP Selection: The Single Most Important Decision

The general partner—the management team executing the strategy—matters more than any individual deal. According to Bennett Jones' analysis, two-thirds of family offices with over $1 billion in assets plan to increase PE allocations, but the same research emphasises that manager selection drives returns more than sector or strategy selection.

Track record attribution:

Did the returns come from the current team or predecessors who have departed? PE firms sometimes market historical returns generated by people no longer at the firm. Request attribution data showing which team members led which investments.

Team stability:

High turnover among senior investment professionals is a red flag. If the partner who led acquisitions left two years ago and the replacement is learning the playbook, you're not investing in the track record being marketed. Ask about team tenure and departures over the past three years.

Fund size progression:

Has the sponsor grown fund sizes dramatically? A team that successfully managed $150M may struggle with $500M. Larger funds require more deals, often pushing sponsors into competitive auctions that erode entry multiples. According to Crowe's analysis, accelerated roll-ups acquiring 30-50 companies per year face "an array of added challenges due to their large transaction volumes and rapid pace."

GP commitment:

How much of the GP's own capital is invested alongside LPs? Industry standard is 1-2% of fund size, but a higher commitment signals stronger alignment. A GP with 5% of their net worth in the fund makes decisions differently than one with a token commitment.

Reference patterns:

What do other LPs—particularly those who've been through full fund cycles—say about the sponsor? Ask about communication transparency, behaviour during difficult periods, and whether reported performance matched expectations.

Technology Assessment

This is where AI roll-up diligence diverges from traditional PE evaluation. You're betting on technology claims that may be difficult to verify.

Working systems versus roadmaps:

Request demonstrations of working systems, not roadmap slides. Ask which portfolio companies are using which capabilities, and what measured results they've achieved. If the technology is "being deployed" or "in pilot," the thesis is still theoretical.

Technology team credentials:

Engineers building AI systems for professional services should have relevant experience—either in AI/ML development or in the specific services being automated. A recently hired technology team from unrelated industries is a yellow flag. According to McKinsey's analysis, 60% of PE firms have portfolio companies experimenting with generative AI, but only a small percentage have scaled these efforts.

Deployment timeline versus fund life:

If the fund has a seven-year life and the technology roadmap shows meaningful capabilities arriving in years four through six, much of the fund's capital will be deployed before the AI thesis can be tested. You're essentially betting on traditional roll-up returns with technology option value attached.

Integration Playbook Assessment

Roll-up returns depend on the successful integration of acquired companies. A sponsor with a repeatable, documented integration process will outperform one that approaches each acquisition ad hoc.

Documentation:

Request the integration playbook, including timelines, milestones, responsibility matrices, and technology deployment schedules. The absence of documentation suggests the process isn't yet mature.

Historical success rates:

How many acquired firms have successfully integrated, versus those that have struggled? What happened to the struggles—were they worked through, or did key people leave and client relationships deteriorate?

Earn-out achievement rates:

If acquired founders consistently miss earn-outs, integration is probably more disruptive than presented. As discussed in Chapter 5 of this playbook, earn-out structures reveal how sponsors think about alignment. Consistent misses signal integration problems regardless of how they're explained.

Portfolio Company References

Talk to founders who have sold to the platform. Not just the references the sponsor provides—those are carefully selected. Find founders independently, ideally including some who have completed their earn-out periods and departed.

Questions to ask:

- How did actual integration compare to what was presented during negotiation?

- When did technology capabilities arrive, and how did they compare to promises?

- Would you sell to this platform again, knowing what you know now?

- For those who have left: why did you leave, and what would you tell someone considering investing?

The pattern of responses tells you more about execution capability than any slide deck. As discussed in Chapter 8's red flags, founder experiences reveal operational realities that marketing materials obscure.

Investor Due Diligence Checklist

Before committing to any AI roll-up investment, verify the following:

Sponsor Verification:

- Reviewed audited track record (not marketing materials)

- Confirmed track record attribution to current team members

- Assessed team stability over the past 3 years

- Understood fund size progression and capacity constraints

- Verified GP commitment level

Technology Verification:

- Observed working technology demonstration (not roadmap)

- Identified specific portfolio companies using AI capabilities

- Reviewed and measured results from technology deployment

- Assessed technology team credentials and tenure

- Compared the technology timeline to the fund deployment schedule

Execution Verification:

- Reviewed the documented integration playbook

- Obtained historical integration success rates

- Analysed earn-out achievement patterns

- Spoke with 3+ founders who sold to the platform (including departed ones)

- Identified consistent patterns across reference conversations

Economics Verification:

- Understood full fee structure (management fee, carry, expenses)

- Calculated net impact of fees on projected returns

- Reviewed LPA with counsel for hidden costs

- Compared terms to market benchmarks

Portfolio Fit Verification:

- Confirmed position size appropriate for total portfolio (2-4% typical)

- Assessed correlation with existing holdings

- Stress-tested liquidity needs over the full hold period

- Modelled returns under conservative assumptions

Portfolio Construction Considerations

Even if an AI roll-up opportunity passes diligence, position sizing matters. The question isn't just whether to invest, but how much.

Concentration risk:

A single roll-up investment is a concentrated bet on one sponsor, one strategy, and one set of technology assumptions. According to the J.P. Morgan 2024 Global Family Office Report, the average family office portfolio targets roughly 11% returns and maintains 45% allocation to alternatives, including PE, real estate, venture capital, and hedge funds.

Within that alternatives allocation, PE specifically runs 20-25% for family offices in the Americas, according to Goldman Sachs data. A single roll-up fund should represent 10-20% of your PE allocation at most—implying 2-4% of the total portfolio.

These numbers feel small relative to the attention these opportunities receive. That's appropriate. You're allocating to one strategy, in one sector, executed by one team. The potential returns justify some allocation; they don't justify portfolio-level concentration.

Liquidity considerations:

PE investments are illiquid. According to PwC's Family Office Deals Study, family office fund investments peaked at 2,871 transactions in H2 2021 but dropped to just 186 in H1 2025—partly reflecting liquidity concerns from the 2022-2024 exit drought. Startup exit activity among family offices dropped 78% post-2021.

Before committing to an AI roll-up, stress-test your liquidity needs:

- What if you need capital in year three and the fund has made no distributions?

- What if the exit environment deteriorates and the hold period extends from seven to ten years?

- Can your broader portfolio accommodate that illiquidity without forced sales?

Correlation with existing holdings:

If you built wealth in professional services, investing in a roll-up that acquires professional services firms creates a correlation between your investment portfolio and your source of wealth. Domain expertise is valuable, but it concentrates sector exposure.

Consider whether AI roll-up investments complement or duplicate existing exposures. If your portfolio already has significant professional services exposure through retained equity, real estate leased to such firms, or other investments, adding more through a roll-up increases rather than decreases concentration.

The Bear Case: What Could Go Wrong

Intellectual honesty requires acknowledging the risks that could cause AI roll-up investments to underperform.

Multiple compression:

Roll-up returns depend on exit multiples exceeding entry multiples. If the exit environment deteriorates through rising rates, reduced buyer appetite, or sector concerns, the multiple arbitrage that drives returns could reverse.

AI roll-ups face an additional dimension. If markets become broadly sceptical of AI valuations, platforms that acquired firms based on technology-enabled multiple expansion could face severe compression. The 2022-2023 correction in public technology companies illustrates how quickly sentiment can shift.

Technology disappointment:

The AI thesis assumes technology capabilities will improve operations meaningfully. If they don't—if the technology remains more demo than deployment, if efficiency gains are modest rather than transformational, if integration of AI tools proves more difficult than projected—returns will disappoint.

According to BDO's 2025 Private Equity Survey, 84% of fund managers report longer holding periods, suggesting exits are already harder to achieve. Adding technology execution risk to exit uncertainty compounds the challenge.

Integration failures:

As one PE analyst observes, "PE firms often underestimate just how hard it is to integrate multiple companies. They assume that systems can be merged overnight, that customers won't mind a few hiccups, and that employees will simply fall in line. Spoiler alert: they don't."

AI roll-ups may face elevated integration risk because they're asking acquired firms to adopt new technology simultaneously with new ownership. The due diligence chapter of this playbook examines how founders can evaluate integration capability—but that same scrutiny applies from the investor side.

Competitive dynamics:

If AI roll-up strategies prove successful, competition for acquisitions will intensify. More sponsors chasing the same fragmented industries will bid up entry multiples, compressing the arbitrage that drives returns.

According to M&A Science's analysis, "Private equity funds will almost always outbid family offices, at least in the middle market." If platforms are competing aggressively for quality targets, entry economics may already be eroding.

Regulatory scrutiny:

The FTC has increased its focus on roll-up strategies. According to Skadden's analysis, the agencies believe roll-up strategies "are particularly pernicious, because individual transactions may fall below the Hart-Scott-Rodino reporting thresholds and thus escape agency scrutiny." While enforcement to date has focused on healthcare, expanded scrutiny could affect professional services roll-ups.

What We Can't Know

Even thorough diligence can't eliminate uncertainty. Here's what remains genuinely unknowable:

Future market conditions:

Exit markets five to seven years from now are impossible to forecast. The interest rate environment, buyer appetite, and sector valuations will determine exit outcomes, but nobody knows what those conditions will be.

Technology trajectories:

Even AI experts disagree on development timelines and capability curves. The technology that seems transformational in 2025 may be commoditised by 2030—or may still be "emerging." Your investment thesis shouldn't require predicting AI development timelines accurately.

Sponsor behaviour under pressure:

Track records show how sponsors perform in favourable conditions. They don't necessarily predict behaviour when exit windows close, LP pressure intensifies, or portfolio companies underperform. A sponsor who seems collaborative during fundraising may become adversarial when returns are threatened.

Your own circumstances:

Your liquidity needs, risk tolerance, and investment timeline may change over a seven-year hold period. Health issues, family circumstances, or other investment opportunities could arise that make illiquidity more costly than anticipated.

The appropriate response to uncertainty isn't avoiding investment entirely. It's sizing positions conservatively and maintaining enough flexibility to absorb outcomes that differ from projections.

Contrarian Insights: What Most Investors Miss

Having evaluated AI roll-ups from both seller and investor perspectives, several counterintuitive observations emerge:

The best investments might succeed even if AI disappoints:

Look for platforms where traditional roll-up economics provide a return floor—attractive entry multiples, fragmented industries with consolidation logic, competent integration execution. If returns require AI to transform operations, you're making a technology bet masquerading as PE. If AI adds option value on top of a solid traditional thesis, you have genuine upside with downside protection.

Sponsors who acknowledge limitations may be better bets:

Sponsors who admit what they don't know—that technology deployment is harder than projected, that integration timelines slip, that some acquisitions will struggle—are often more competent than those promising seamless execution. Humility about complexity correlates with realistic planning.

Your domain expertise might hurt you:

Former professional services owners often believe their operating experience translates to investment acumen. But familiarity can create blind spots. You may over-index on patterns from your specific firm while missing dynamics that differ across the industry. Consider whether your expertise provides a genuine edge or a comfortable bias.

Deals you're offered may be the deals sponsors are least confident in:

Co-investment opportunities arise when sponsors have excess deal flow or want to share risk. Ask why this particular deal is being offered. If it's a genuine capacity constraint, that's neutral. If it's a deal the sponsor is less confident in and wants to distribute risk, that's adverse selection.

Smaller, less prominent sponsors may offer better risk-adjusted returns:

Brand-name PE firms compete for the same high-profile deals, bidding up entry multiples. Smaller sponsors operating in overlooked markets may achieve better entry economics. The trade-off is a less established track record and potentially weaker exit relationships—but the math can favour less competitive deal sourcing.

What the Seller Perspective Teaches Investors

Having explored AI roll-ups from the seller's perspective throughout this playbook, you understand dynamics that pure allocators miss.

Integration difficulty signals execution risk:

If founders consistently describe integration as more difficult than expected—if earn-outs are frequently missed, if cultural friction is common, if technology deployment timelines slip—that's information about platform execution capability. The integration chapter details what good integration looks like. Founder experiences reveal whether platforms achieve it.

Earn-out economics reveal alignment:

How sponsors structure earn-outs tells you how they think about alignment with acquired founders. Structures that set founders up to fail—metrics outside their control, targets requiring perfect execution with no margin for disruption—predict retention problems and cultural conflict. As an investor, you want sponsors whose earn-out structures suggest genuine partnership. Predatory structures might boost near-term returns but damage long-term platform value.

Technology claims require verification:

Founders selling into AI roll-ups often discover that technology capabilities are less developed than initially presented. If this is a consistent pattern—if multiple founders describe the same gap between promise and delivery—that's diligence data. As the due diligence chapter emphasises, working systems matter more than roadmaps.

Red flags compound:

The red flags discussed for sellers apply equally to investors. A platform with rapid acquisition pace, high turnover, vague technology timelines, and defensive reference responses is the same platform regardless of whether you're selling to it or investing in it. The seller's concerns are the investor's concerns.

Decision Framework for Investors

Bringing this together, here's a framework for evaluating whether to commit capital to an AI roll-up opportunity:

Step 1: Confirm the opportunity fits your portfolio.

Is this an appropriate allocation size relative to your total portfolio? Does it complement or duplicate existing exposures? Can you tolerate the illiquidity over the expected hold period? If any answer is no, stop here.

Step 2: Compare to alternatives.

Are risk-adjusted returns genuinely superior to traditional PE, public market AI exposure, or private credit? If similar returns are available with less execution risk or more liquidity, the case for AI roll-ups specifically weakens.

Step 3: Evaluate the sponsor.

Does the team have a relevant track record, in roll-ups specifically, in professional services specifically? Have previous funds performed at or above benchmarks? Is the team stable? If the sponsor doesn't pass muster, the specific opportunity doesn't matter.

Step 4: Assess the technology thesis.

Is technology real and deployed, or theoretical and roadmapped? Can you independently evaluate whether AI claims are credible? If you can't assess technology, are you comfortable betting on traditional roll-up returns without the AI upside?

Step 5: Verify execution capability through references.

Talk to founders who have sold to this platform. Ask about integration experience, technology deployment, and earn-out achievement. Look for patterns, not outliers. If reference patterns suggest execution problems, weight that heavily regardless of sponsor presentation quality.

Step 6: Model returns under conservative assumptions.

What returns does the investment generate if multiple expansion is modest (1-2 turns rather than 3-4)? What if technology delivers 10% efficiency gains rather than 30%? What if the hold period is extended by 2 years? If returns under conservative assumptions don't meet your threshold, the opportunity requires betting on favourable outcomes that may not materialise.

Step 7: Size appropriately.

Even if the opportunity passes all screens, size it as a single concentrated bet within your alternatives allocation—not as a core portfolio holding. The potential returns justify some allocation; they don't justify portfolio-level concentration.

Final Thoughts

AI-enabled roll-ups represent a genuine opportunity for sophisticated capital. The underlying thesis—that fragmented professional services industries can be consolidated, that technology can improve operations, that scale creates value—is sound.

But the opportunity is also crowded, execution-dependent, and technology-contingent. Returns require sponsors who can identify attractive acquisition targets in increasingly competitive markets, integrate them successfully while deploying new technology, and exit at favourable multiples in uncertain future environments.

Some sponsors will execute well and deliver attractive returns. Others will disappoint—acquiring at multiples that prove too high, struggling with integration, failing to deliver technology as promised, or facing unfavourable exit conditions.

As an investor, your job is to identify the former and avoid the latter. That requires diligence that goes beyond marketing materials, return expectations grounded in realistic assumptions, and position sizing that acknowledges the concentrated nature of any single investment.

The seller's perspective—which you now understand from the preceding chapters—is one of your best tools. Founders who have actually experienced these transactions know things that slide decks don't reveal. Their experiences, aggregated across multiple conversations, tell you whether a platform can actually execute its thesis or merely present it compellingly.

Use that knowledge. It's the advantage you have over investors who approach these opportunities without understanding what happens on the other side of the transaction.

← Back to Chapter 5: Deal Structures

Continue to Chapter 7: The Integration Playbook →

Or return to: The Founder's Guide to AI-Enabled Roll-Ups (Hub)

Capital Founders OS is an educational platform for founders with $5M–$100M in assets. We focus on frameworks for thinking about wealth—so you can make better decisions.

If it's your first time here, don't forget to Subscribe.