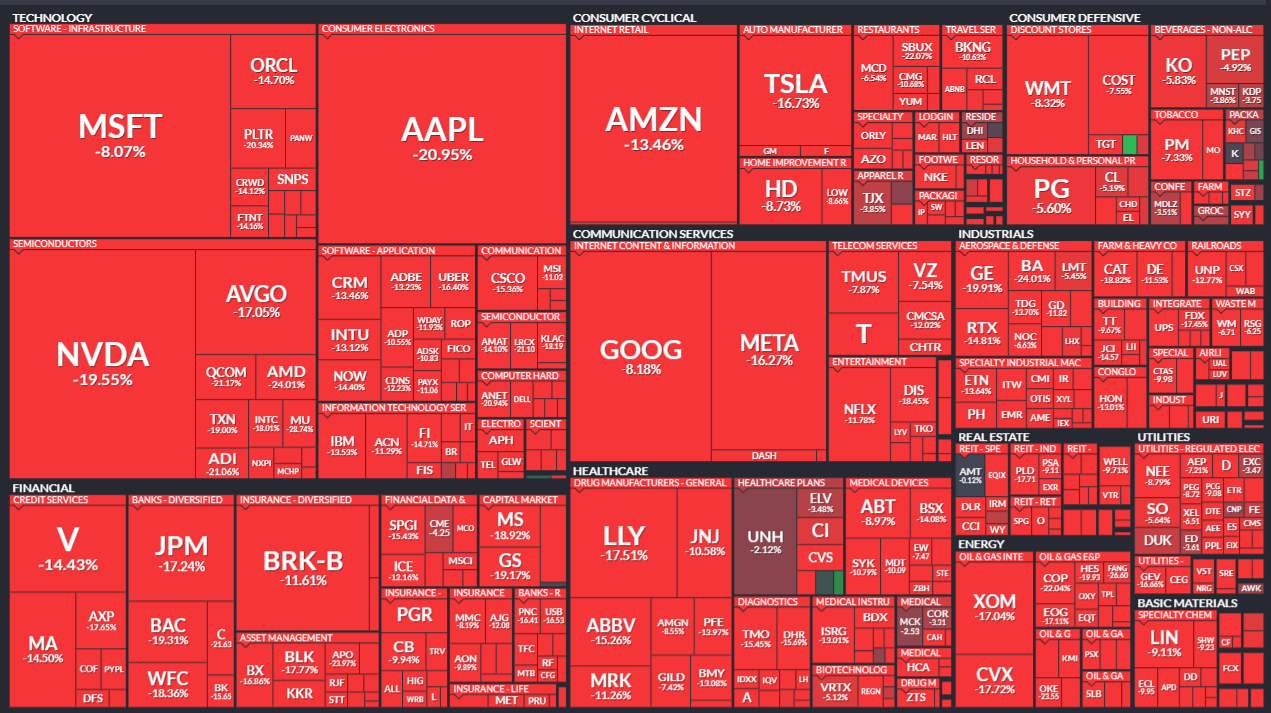

When I started writing this post, the markets went haywire. The tariff announcements in early 2025 wiped out trillions in value within days. My social media feed was filled with people claiming they saw it coming.

They didn’t. Nobody did. Not really.

And that’s exactly why investment philosophy matters more than market prediction. A philosophy isn’t about calling tops and bottoms. It’s a framework that guides decisions when things stop making sense.

Without one, every sell-off feels existential. With one, you’re making adjustments while staying on course. The difference shows up in real numbers: according to Dalbar’s 2024 Quantitative Analysis of Investor Behaviour, the average equity investor underperformed the S&P 500 by 848 basis points (8.48%) last year alone. That’s the fourth-largest gap since 1985. And 2024 was a good year for markets.

The gap wasn’t caused by bad stock picks. It was caused by bad behaviour. Panic selling. Tactical moves that missed rallies. In Dalbar’s words: “More effort, less return.”

This post won’t tell you what to buy. I won’t predict the Fed’s next move or analyse the latest policy announcements. Instead, I want to talk about something more foundational. How to think about investing when it feels like everything is falling apart.

Your strategy is only as good as the principles behind it.

Key Takeaways

- Philosophy beats prediction: Average investors underperformed the S&P 500 by 848 basis points in 2024—not from bad picks, but bad behavior

- Downside protection pays: A 3.3% allocation to tail-risk protection returned 11.5% annually since 2008 vs 7.9% for index-only

- Stage determines strategy: Focused bets build wealth. Spreading risk preserves it. Most founders keep playing offense when they should switch to defense

- Cash is strategic: HNW investors hold 15-25% in cash and equivalents—not from fear, but for opportunity capital and clear thinking during chaos

- Fees compound quietly: 1% AUM over 20 years on $3M consumes ~$1.3M. Flat fee structures can cut this by 60-80%

- Psychology destroys more wealth than markets: 68% of crypto decisions driven by FOMO. 15 consecutive years of retail underperformance. The enemy is in the mirror

- Geographic concentration is real risk: Country-specific events can wipe out assets overnight. Spreading across jurisdictions isn't paranoia—it's insurance

- Know your breaking point: If a 50% decline would be catastrophic and your allocation could produce it, you're taking too much risk. Period

Start With Why

Too many people invest without ever asking themselves what they’re actually trying to accomplish.

There are different levels to this game. What you need when building wealth isn’t what you need when preserving it.

Level 1: Replace your active income with passive returns. Generate enough that working becomes optional.

Level 2: Fund bigger dreams. The holiday home. The experiences. The education for your kids. Whatever matters to you.

Level 3: Preserve what you build so it outlasts you.

Level 4: Deploy capital for impact, curiosity, or because the problem interests you.

Different levels require different strategies. I’ve watched founders who made fortunes in business decide to become traders. They brought high risk tolerance and overconfidence from past success. They focused on concentrated bets they didn’t fully understand. It rarely ended well.

Public markets work differently from building a company. The skills that got you here won’t automatically work there.

Here’s what took me years to understand about money: its value isn’t what you can buy. It’s the freedom it gives you over your time. It’s optionality. Figure out your number. Then build everything around that.

Understanding Risk (Actually Understanding It)

Everyone talks about risk. Few can explain what it actually means beyond “you might lose money.”

Financial markets are mechanisms for transferring risk between participants. Entrepreneurs take concentrated bets to build companies. They risk almost everything, especially at the early stage. Then, investors buy pieces of that risk for potential returns. They get more for their buck at an earlier stage, when the venture is still risky, and less as the business matures. Different asset classes are different flavours of the same underlying thing - risk.

The more risk you take, the more return you should expect. But “should expect” and “will get” are different concepts. Sometimes enormous risks hide in places that look perfectly safe. Remember what happened to Credit Suisse?

Risk isn’t just volatility. It’s:

- Permanent loss of capital

- Not having cash when you desperately need it

- Being forced to sell at the worst possible time

- Correlation surprise (when assets that “should” move differently all drop together)

Tail Risk: The Events That “Can’t Happen”

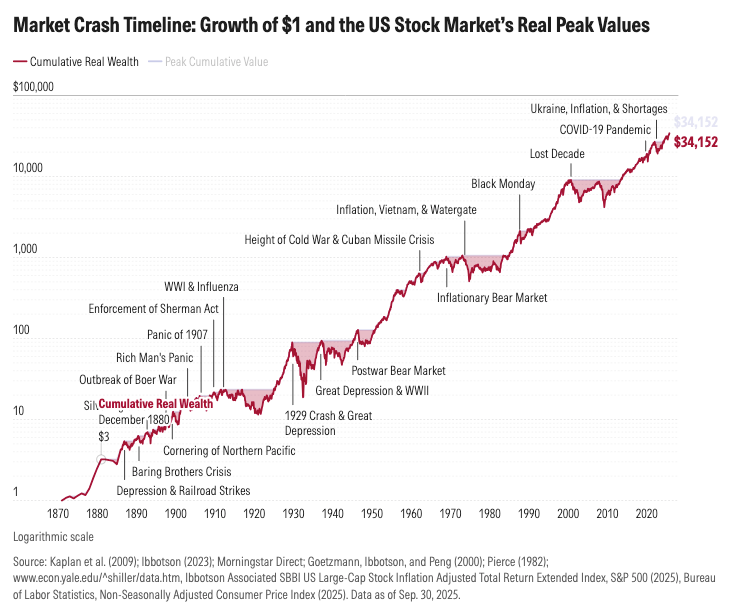

A Black Swan isn’t just a bad market day. It’s not even a 20% correction. It’s an event beyond normal expectations that reshapes everything.

The 2008 financial crisis saw major investment banks collapse overnight. AAA-rated securities became worthless. The COVID crash in March 2020 sent oil futures negative. The Russia-Ukraine conflict transformed lives in hours.

History is full of events that “couldn’t happen” until they did.

Here’s the thing: if every expert is predicting something, it’s probably not a Black Swan. Real tail events catch almost everyone off guard. The 2020 pandemic crash is instructive. Markets fell 34% in about a month. Then recovered in six months. The fastest recovery of any crash in the past 150 years, according to Morningstar’s analysis of 150 years of market history.

Nobody predicted either the speed of the crash or the recovery.

Protect the Downside

Regardless of your net worth, things can change faster than you think possible.

“Just because you’re paranoid doesn’t mean they aren’t after you.” — Joseph Heller

Wall Street celebrates risk-takers. The financial media loves the aggressive bet that paid off. But the most resilient long-term portfolios are built by people obsessed with what could go wrong.

Capital preservation isn’t a boring conservative strategy. It’s the foundation everything else rests on.

Some examples from those who got this right:

Mark Spitznagel’s Universa Investments delivered a 4,144% return in Q1 2020 using tail-risk protection while the broader market collapsed. According to The Wall Street Journal, a portfolio consisting of just 3.3% in Universa’s fund with the rest passively invested in the S&P 500 would have returned 11.5% annually since 2008, compared to 7.9% for the index alone.

The insight: Spitznagel’s fund accepts small losses in normal times to generate explosive returns when markets crash. The protection isn’t free. But when the insurance pays out, everything changes.

Bill Ackman turned a $27 million investment in credit default swaps into roughly $2.6 billion in less than a month during March 2020. He saw the pandemic developing, recognised that credit spreads were at near-historic tights (meaning insurance was cheap), and bought protection before the market priced in the risk.

The trade wasn’t magic. It was a preparation meeting opportunity. CDS contracts on investment-grade bonds were trading near their lowest levels in a decade. Ackman bought insurance when it was cheap, held through the early chaos, and exited on March 23, 2020, the same day the Fed announced unlimited QE. He sold at peak fear, then used the proceeds to buy quality stocks at massive discounts.

These aren’t strategies you can easily replicate at home. The point is the principle: successful investors survived major crashes because they had built-in protection before they needed it.

Questions to ask yourself:

- Could your portfolio take a 40% hit and you’d still be okay?

- Do you have actual downside protection, or are you just hoping?

- What’s your “sleep-at-night” allocation that keeps you calm when everything is red?

Hope for the best. Plan for the worst. That’s how you stay in the game long enough for compounding to work.

Focused Bets vs. Spreading Risk

Two schools of thought exist on this:

“Don’t put all your eggs in one basket.” — Conventional wisdom

and also

“Put all your eggs in one basket and watch that basket like a hawk.” — Andrew Carnegie

Both are right. The answer depends entirely on where you are.

Building Wealth

Fortunes are built through highly concentrated bets. Elon Musk’s 2008 story is the extreme example of this. After selling PayPal, Musk could have spread his capital into a comfortable portfolio and lived well forever. Instead, he put everything into SpaceX and Tesla.

By December 2008, both companies were days from bankruptcy. SpaceX had three failed rocket launches. Tesla was bleeding cash. Musk was borrowing rent money from friends. Then on December 23, NASA awarded SpaceX a $1.6 billion contract. And on Christmas Eve 2008, Tesla’s funding round closed hours before payroll would have bounced.

“If that round hadn’t closed on Christmas Eve, Tesla would have died,” Musk later said.

Today, his net worth exceeds $350 billion.

Most people can’t stomach that kind of risk. Most people shouldn’t try. But the principle remains: wealth creation often requires focused bets on things you understand deeply.

Preserving Wealth

Spreading risk protects what you’ve built. Once you’ve won the game, the objective changes. Since 1950, there have been 13 bear markets with an average decline of 33%. The average recovery takes about two years. But averages lie. Some recoveries take months. Others take a decade.

A well-structured portfolio survives downturns without forced selling. You don’t need to predict which crisis comes next. You need a structure that can weather any of them.

QUICK ASK — Everything here is free. If you're finding this useful, subscribing helps me understand what's working — and keeps you updated when new pieces come out.

Liquidity Management

Cash might be the most underrated asset in wealth management.

High-net-worth individuals keep more cash than most people realise. According to the U.S. Trust Survey of Affluent Americans, investors with over $3 million in assets hold an average of 15% in cash and cash equivalents. For ultra-high-net-worth investors with $30 million or more, that figure often climbs to 20-30%.

This isn’t laziness or fear. It’s strategic.

Cash at Different Wealth Levels

The right amount of liquidity depends on where you sit (not financial advice, as an example only).

$5-10 million liquid assets: Consider holding 6-12 months of expenses in immediately accessible accounts, plus another 10-15% of investable assets in cash equivalents. This gives you runway during market disruptions without having to sell at the worst times.

$10-25 million: At this level, liquidity serves two purposes. First, it provides the traditional safety buffer. Second, it creates “opportunity capital” for deals that require quick deployment. I’ve seen founders miss excellent private investment opportunities because their capital was locked in positions that would have cost them dearly to exit. Keep 12-18 months of expenses liquid, plus 10-20% in short-term instruments.

$25-50 million and above: Here, the math changes. You can afford more sophisticated cash management strategies. Short-term Treasuries, Treasury ladders, money market funds with different redemption profiles. The goal is to maximise yield on cash while maintaining immediate access to a meaningful portion. Conservative investors at this level often hold 15-25% in cash and near-cash instruments. More aggressive investors might keep 8-12%.

The Psychology of Cash

Cash does something no other asset can: it lets you think clearly during chaos.

In March 2020, the S&P 500 fell 34% in about a month. Investors with adequate cash reserves could buy quality assets at significant discounts. Investors without cash were forced to either sell at terrible prices or watch opportunities pass.

Warren Buffett famously keeps enormous cash reserves at Berkshire Hathaway. He’s often criticised for this during bull markets. Then a crisis hits, and he has capital to deploy while everyone else is scrambling.

The real cost of cash isn’t just the opportunity cost during good times. It’s the peace of mind that lets you make rational decisions when everyone else is panicking.

Asset Allocation

Everyone wants the “right” allocation. The reality is more complex. There’s no universally correct answer. But there are principles that separate thoughtful allocations from random ones.

The Building Blocks

Public equities remain the engine of long-term growth. Over the past century, global equities have delivered roughly 7-10% real returns annually. But they come with gut-wrenching volatility. You need to be able to stomach 30-50% drawdowns without panic selling.

Fixed income provides stability and income. In a world where bond yields finally offer meaningful returns again, quality fixed income deserves a place in most portfolios. For preservation-focused investors, consider 20-40% in high-quality bonds and bond funds.

Real assets, including real estate, infrastructure, and commodities, provide inflation protection and different return drivers. Real estate in particular has been a cornerstone of wealth building for generations. The Long Angle 2025 Asset Allocation Report found that 81% of high-net-worth investors own their primary residence, and 30% own rental properties.

Alternatives cover everything from private equity to private credit to venture capital. More on this below.

Sample Allocations by Objective

Growth-focused

(longer time horizon, higher risk tolerance):

- 60-70% public equities (global, spread across sectors and geographies)

- 10-15% alternatives (private equity, venture)

- 10-15% real assets

- 5-10% fixed income

- 5-10% cash and cash equivalents

Balanced

(moderate risk, 10+ year horizon):

- 45-55% public equities

- 15-20% fixed income

- 10-15% real assets

- 10-15% alternatives

- 10-15% cash and equivalents

Preservation-focused

(capital protection priority):

- 30-40% public equities

- 25-35% fixed income

- 10-15% real assets

- 5-10% alternatives

- 15-25% cash and equivalents

These allocations are examples and for illustration only. They’re starting points for conversations about what actually makes sense for your specific situation.

Manager & Adviser Selection

The traditional wealth management industry has a fee problem. The standard 1% of assets under management fee might look small on paper. Over 20 years on a $3 million portfolio earning 7% annually, that 1% fee consumes roughly $1.3 million. That’s not a rounding error.

Understanding Fee Structures

Percentage of AUM (Assets Under Management): The most common model. Typical rates range from 0.5% to 1.5% depending on portfolio size and services included. Fees generally decrease as assets increase. A $10 million portfolio might negotiate 0.75%. A $50 million portfolio might get 0.5% or lower.

Flat fees: Increasingly popular, especially among fee-only advisors. Annual retainers typically range from $5,000 to $50,000, depending on complexity. For larger portfolios, this often works out cheaper than percentage-based fees. A $10 million portfolio at a flat $40,000 annual fee costs 0.4%. That same fee on a 1% AUM model would cost $100,000.

Hourly rates: Best for specific projects or occasional advice. Rates typically range from $200 to $500 per hour. Useful if you need guidance but don’t want ongoing management.

What Good Advice Actually Looks Like

The value of an advisor isn’t just investment selection. Studies suggest advisors can add roughly 3% to annual returns through a combination of behavioural coaching, tax optimisation, proper asset location, and helping clients avoid costly emotional decisions.

That last part matters most. Dalbar’s research consistently shows the average investor underperforms indexes by enormous margins. Much of that gap comes from panic selling and performance chasing. A good advisor can pay for themselves simply by talking you off the ledge during market crashes.

Red Flags in Manager Selection

Watch for these warning signs:

- Unwillingness to discuss all fees transparently. If you can’t get a clear, complete picture of what you’re paying, walk away.

- Proprietary products that generate hidden revenue. Some advisors earn commissions on products they recommend. Ask directly if they receive any compensation beyond what you pay them.

- Excessive trading. Unless there’s a clear strategic reason, frequent trading often signals either incompetence or a desire to generate commissions.

- No discussion of risk. If an advisor only talks about returns and never discusses what could go wrong, they’re selling a fantasy.

- Lack of fiduciary commitment. Fiduciary advisors are legally required to act in your best interest. Suitability-standard advisors only need to recommend “suitable” products. The difference matters.

Geographic Allocations

I learned this lesson personally. In 2014, the annexation of Crimea turned things upside down for many. People who had invested in the region watched their assets become worthless in days when they couldn't touch them. The legal systems they relied on simply ceased to function for their purposes.

Country risk isn’t theoretical. It’s real, and especially now, it can affect even the most stable-seeming jurisdictions.

Why Geography Matters

Political risk: Governments change. Policies change with them. Tax regimes that seem permanent get rewritten. What’s legal today might be restricted tomorrow.

Currency risk: Holding all your assets in a single currency exposes you to that currency’s fluctuations. The purchasing power of any currency can decline substantially over time.

Legal risk: Different jurisdictions offer different protections. Asset protection trusts, inheritance laws, privacy regulations, and creditor protections vary enormously across borders.

Systemic risk: Banking crises, sovereign debt defaults, and economic collapses are not evenly distributed globally. Geographic spreading means a catastrophe in one country doesn’t wipe out everything.

Practical Approaches

For most emerging wealthy investors, geographic considerations are as follows:

Currency exposure through investments: Owning international equities naturally provides some FX exposure. A global equity portfolio includes exposure to euros, yen, pounds, and emerging market currencies alongside US dollars.

International real estate: Owning property in another country provides both an asset outside your home jurisdiction and potential future optionality. Portugal, Spain, and several Caribbean nations offer residency programs tied to real estate investment.

Multi-jurisdictional banking: Having accounts in more than one country provides redundancy. If something goes wrong with your domestic banking system, you have options.

Trust structures: For larger estates, trusts in jurisdictions such as the Channel Islands, Singapore, or certain US states can provide asset protection and estate-planning benefits.

This isn’t about tax avoidance. It’s about not putting all your eggs in one national basket. Proper geographic should be done in full tax compliance in your home jurisdiction and regulations.

Portfolio Stress Testing

Most investors have never actually examined what happens to their portfolio in a crisis. They have a vague sense that things might decline, but they haven’t run the numbers.

The Federal Reserve runs stress tests on major banks every year. They model what happens to bank capital under severe scenarios: 40% equity declines, massive credit losses, sharp interest rate movements. Banks that fail these tests face restrictions on dividends and capital distribution.

Your personal portfolio deserves similar scrutiny.

Running Your Own Stress Test

Start with historical scenarios. What would your current portfolio have looked like during these events?

2008 Financial Crisis: The S&P 500 fell approximately 57% from peak to trough. High-yield bonds dropped 26%. Even investment-grade corporate bonds declined. Real estate values collapsed. What would your current allocation have lost?

March 2020 COVID Crash: The S&P 500 fell 34% in 23 trading days. Then recovered within six months. How would your portfolio have handled the whipsaw?

2022 Interest Rate Shock: Both stocks and bonds declined together. The traditional 60/40 portfolio had its worst year in decades. Correlations that investors relied on for protection broke down.

Key Questions to Answer

For each scenario, calculate:

- Maximum drawdown: What’s the worst-case percentage decline?

- Dollar impact: What does that percentage mean in actual money? A 40% decline on $10 million is $4 million. Does that number make you feel something?

- Recovery time: Based on historical precedent, how long might recovery take?

- Liquidity during the crisis: Would you have cash available to meet obligations without selling at depressed prices?

- Income disruption: If your portfolio generates income you depend on, how would dividends and distributions behave?

Reverse Stress Testing

Start with the outcome you can’t survive and work backwards.

What level of portfolio decline would force you to change your lifestyle? Sell your home? Delay retirement indefinitely? Now figure out what scenarios could produce that outcome, and what you can do to prevent them.

If your current allocation could lose 50% and that loss would be catastrophic, you’re taking too much risk. Period.

Alternative Investments

For investors with sufficient scale, alternatives offer something traditional portfolios can’t: return streams that behave differently.

Private Credit

Private credit has exploded in recent years. The market reached roughly $3 trillion at the start of 2025 and is projected to hit $5 trillion by 2029, according to Morgan Stanley research. Direct lending delivered 10.5% annualised returns in Q4 2024, outperforming both high-yield bonds and leveraged loans.

The appeal is clear: higher yields than public fixed income, floating rates that protect against interest rate increases, and returns that don’t correlate perfectly with public markets.

The catch: liquidity is limited. You’re locking up capital for years. Due diligence on managers matters enormously. And if credit conditions deteriorate, losses can be significant.

J.P. Morgan Private Bank recommends allocating 5-20% of portfolios to private credit for qualified investors, spread across direct lending, asset-backed credit, and opportunistic strategies.

Real Estate

Real estate remains the most accessible alternative for most investors. You don’t need to be an accredited investor to buy rental properties or invest in public REITs.

The appeal: tangible assets with inflation protection, income generation, and tax advantages through depreciation and 1031 exchanges.

The reality: real estate requires work or expensive management. It’s illiquid. And it concentrates risk geographically and sectorally. Office real estate faces structural challenges from remote work. Retail faces pressure from e-commerce. Residential has been more resilient but varies enormously by market.

Private Equity & Venture Capital

Private equity and venture capital offer access to companies before they go public. Historical returns have been strong, but those returns come with significant caveats.

The best private equity and venture funds have dramatically outperformed public markets. The median ones have roughly matched or slightly underperformed. The bottom quartile has destroyed capital. Manager selection isn’t just important. It’s everything.

Minimum investments typically range from $250,000 to $1 million or more. Lock-up periods run 7-12 years. You’re betting on a manager’s ability to find, improve, and exit companies profitably. That bet has historically paid off but past performance tells you little about which manager will outperform in the future.

How Much in Alternatives?

Institutional investors now routinely allocate 20-30% to alternatives, up from single digits in the early 2000s. But institutions have time horizons and liquidity profiles that individual investors don’t.

For most emerging wealthy investors, 10-20% in alternatives makes sense if you can:

- Lock up capital for extended periods without stress

- Access quality managers (ideally through relationships or platforms)

- Spread across strategies rather than concentrating in one bet

- Stomach the illiquidity during market dislocations

If any of those criteria don’t apply, stick with public markets. There’s no shame in simplicity.

Ignore the Noise

Markets generate more noise than signal.

Every day brings headlines designed to make you feel like you need to act right now. Some new crisis. Some new opportunity. Some experts’ predictions about what happens next.

Research from NYU Stern and NBER found that retail investors spend an average of six minutes researching a stock before buying. Six minutes. The average retail investor returned 16.5% in 2024 while the S&P 500 returned 25%. That’s what impulse trading produces.

The Media’s Incentives Aren’t Your Incentives

Financial media exists to capture attention. Extreme predictions drive clicks. “Markets Will Crash 50%” gets more views than “Markets Will Probably Do Something Between -10% and +15%.”

Brokers make money on commission, so they just want you to trade regardless of whether you are losing or making money on the trade.

The talking heads aren’t accountable for their predictions. They don’t lose money when they’re wrong. They just make new predictions.

Algorithmic Trading Has Changed the Game

More than half of all trading volume is now driven by algo traders. These systems react to news, patterns, and each other in milliseconds. They create volatility that has nothing to do with fundamental value.

Unless you’re sitting at an institutional desk with sophisticated infrastructure and proper research teams, stop trying to react to every headline.

Investing is a long-term game. Think in years and decades, not days and weeks.

Investor Psychology

Unless you’re a professional investor, the biggest risk to your portfolio isn’t inflation, interest rates, or geopolitical uncertainty. It’s you. Your fear. Your greed. Your FOMO when you hear about your neighbour’s crypto gains.

A 2024 Journal of Behavioural Finance study found that 68% of crypto investment decisions were driven by FOMO and internet sentiment rather than technical analysis. Dalbar’s research shows the average investor (actively trading stocks) has now underperformed the S&P 500 for 15 consecutive years. The last time average investors beat the index was 2009.

The pattern is consistent: investors buy after rallies (when prices are high) and sell after crashes (when prices are low). The opposite of what works.

Building Systems to Protect You From Yourself

Create rules before you need them. When thinking clearly, decide in advance what would trigger a buy or sell. Write it down. Don’t deviate when emotions are running high.

Keep an investment journal. Document what you’re buying or selling, why you’re doing it, and how you feel. Review it quarterly. The patterns that emerge will be uncomfortable and useful.

Build in cooling-off periods. For any significant decision, wait 48 hours. The best decisions rarely happen at moments of peak emotion.

Find someone who will tell you the truth. Whether a trusted friend or professional advisor, you need someone who can say “you’re not thinking clearly right now” and have you actually listen.

Morgan Housel’s The Psychology of Money and Daniel Kahneman’s Thinking, Fast and Slow are worth reading for anyone serious about understanding their own blind spots.

Investor Types

Like a role-playing game, knowing your archetype helps you navigate what comes next. After years of working with clients, I’ve seen distinct patterns emerge.

The Operator-Turned-Investor

You built and sold a business. You want to stay active, so now you’re investing that capital. You bring real operational expertise, but might struggle with the passivity that spreading risk across a portfolio requires. Risk tolerance is high. The temptation to go all-in on deals you “understand” is strong.

The danger: public markets work differently from running a business. The skills that made you successful as a founder can actively hurt you as an investor. Overconfidence is real.

What tends to work: Hire a financial advisor for the core portfolio. Put aside a defined allocation to play with. Invest in startups or private companies where your operational experience adds value. Mentor founders. Stay connected to building without betting your entire financial future on it.

The Capital Preserver

Focused primarily on not losing what’s been built. Often a second or third generation wealth that has seen what can go wrong. Or the first generation who understands that the game they are playing has changed.

What tends to work: Work with an advisor to build a long-term portfolio with risk well spread. Accept that returns won’t be exciting. Focus energy on things you enjoy beyond the portfolio.

The Allocator

Institutionalised private wealth. That is family office territory, typically requiring $100M+ in assets to justify the infrastructure. At this scale, you need a professional investment team. Run it like a business where costs must be justified and meaningful returns generated.

The Moonshot Maximalist

Comfortable putting significant capital into high-risk, high-reward opportunities. Accepts that most bets will fail. Hunting for asymmetric outcomes that change everything.

This is rare. Most people who think they’re this type actually can’t stomach the losses when they arrive. Elon Musk’s 2008 experience is the extreme version. He nearly lost everything and kept going. How many can honestly say they’d do the same?

Strategy Before Tactics

Most people don’t have an investment philosophy. They have a collection of reactions to market events. They chase returns. They follow whatever seems to be working. They buy high and sell low, then wonder why their results don’t match the index.

If you’ve built a business, you understand the importance of strategy. An investment approach deserves the same rigour.

A coherent philosophy helps you:

- Stay calm when markets go crazy (and they will)

- Make decisions aligned with your actual goals

- Avoid the mistakes that permanently destroy capital

- Play your own game instead of reacting to everyone else’s

This is my framework for thinking about wealth. Take what works. Ignore what doesn’t. But develop something that can guide you when the next crisis arrives.

Your investment philosophy isn’t just about making money. It’s about aligning capital with your values, goals, and the life you want. It’s a framework that lets you act decisively when everyone else is frozen with fear or drunk on greed.

Know your why. Protect your downside. Play your own game.

You don’t need to be the smartest person in the market. You need to stay in the game long enough for compounding to work its magic.

Survive first. Thrive later.

I write when there’s something worth sharing — playbooks, signals, and patterns I’m seeing among founders building, exiting, and managing real capital.

If that’s useful, you can subscribe here.