Before you start your investment journey, you need to understand how the investment world actually works.

What is the landscape? Who are the players? What do they do? How do they make money? And most importantly—whose interests do they really serve?

I've worked with private clients for years. I've watched smart, successful people make expensive mistakes because they didn't understand the basics. They sat in meetings nodding along, too embarrassed to ask questions. Later, it turned out they had no clue what was happening.

Don't be that person.

Think of this as your orientation to the investment world. Understanding this landscape helps you avoid traps, spot opportunities, and build wealth that actually lasts.

If you're going to swim in the ocean, you should know who's a dolphin and who's a shark.

Where All the Money Comes From

Let's start at the source.

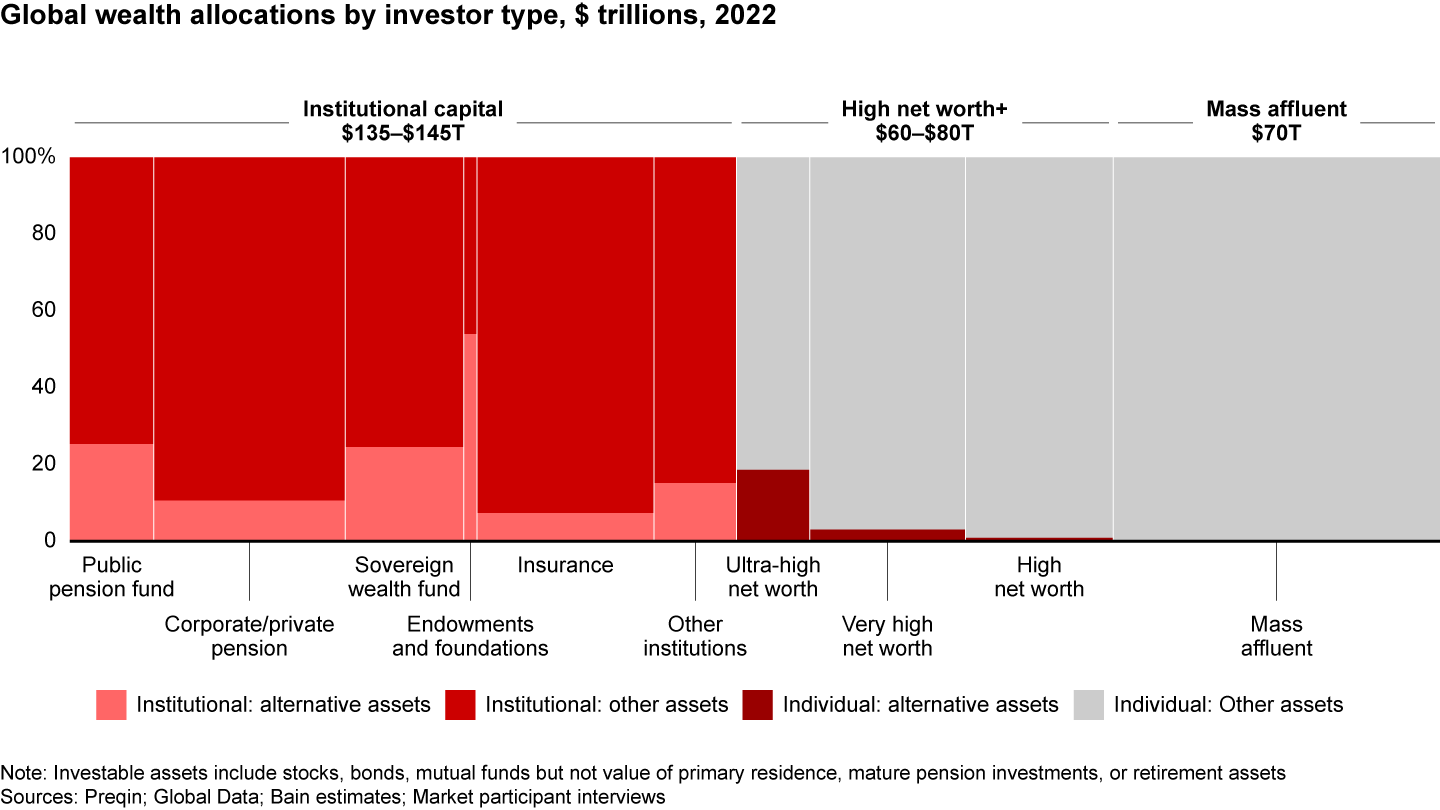

According to Bain & Company, there's about $300 trillion in global wealth. Roughly half is managed by institutions, half by individuals.

Broadly speaking, wealth originates from these two groups:

Institutional money comes from pension funds, insurance companies, endowments, sovereign wealth funds, and corporations. They collect contributions from people or businesses and invest to meet long-term obligations—retirement payouts, insurance claims, and national reserves.

Private wealth is money owned by individuals.

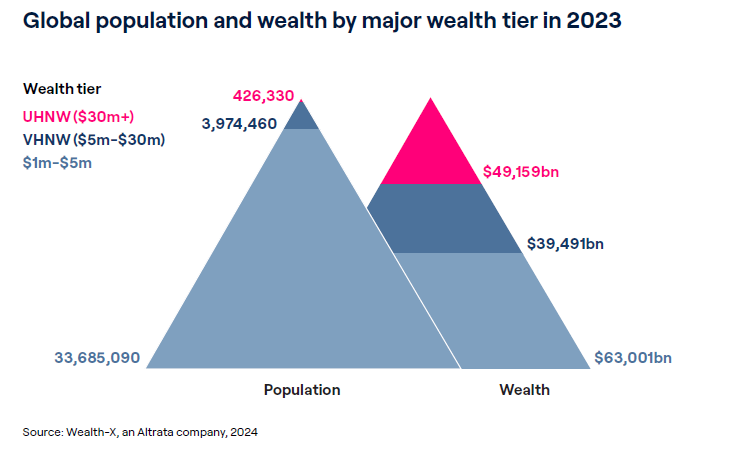

The numbers are staggering. According to Altrata, there were 38.1 million high-net-worth individuals globally in 2023, people with at least $1 million in assets. Of those, 4.5 million had over $5 million, collectively controlling around $90 trillion.

Despite economic chaos, wealthy people keep multiplying. Family offices are exploding, too. Deloitte counted roughly 8,030 family offices globally in 2019. They expect that number to hit 10,720 by 2030.

And that's just the wealthy. Millions more have under $1 million sitting mostly in bank deposits, not actively invested. There's even more capital on the sidelines than these numbers suggest.

From here on, we're focusing on private wealth and the ecosystem around it.

Your First Decision: DIY or Get Help?

As a private investor, you have two paths:

Do it yourself – Research investments, follow markets, make your own calls. Some people love this. They read annual reports at night and wake up checking futures.

Work with an adviser – Get professional help to help you manage your wealth without making costly mistakes.

Here's how I think about it. You've been given a car but don't know how to drive. Sure, you could figure it out by trial and error. Or you could learn from an instructor. Or hire a driver.

What do you prefer?

Retail vs. Accredited: Choose Your Player Mode

No matter which path you choose, you'll be classified as one of two investor types.

Retail Investor – This is where everyone starts by default, even if you have $100 million. You get strong regulatory protections but limited access to sophisticated products like hedge funds and private equity.

Accredited (or Sophisticated) Investor – You get access to more investment options with potentially higher returns and higher risks. But you lose some consumer protections.

In the US, you're accredited if you meet two of these three criteria:

- Income of $200,000+ annually ($300,000 with spouse) for two consecutive years

- Net worth of $1 million+ (excluding primary residence)

- Professional credentials like Series 7, 65, or 82, or you're a "knowledgeable employee" working in financial services/investment industry

The UK and EU have similar rules.

Pro tip: You can stay retail for your core portfolio (keeping protections) and opt into accredited status selectively for specific opportunities if you qualify.

What Wealth Advisers Actually Do

All advisers share one goal: helping you achieve your financial objectives through tailored strategies.

Different types of advisers typically work with different wealth levels:

- Under $3M – Independent Financial Advisers (IFAs) in the UK or Registered Investment Advisers (RIAs) in the US

- $3M to $30M – Wealth management firms or private banks with more comprehensive services

- $30M to $100M – Multi-family offices with sophisticated, personalised approaches

- Over $100M – Single-family offices for complete in-house control

These aren't strict rules but general guidelines.

A good adviser will develop your investment strategy and asset allocation, help with tax planning and structuring, provide access to alternative investments, and assist with asset protection and financing.

Think of your portfolio like Lego blocks. The adviser helps you build the right structure, balance it, and swap pieces when conditions change.

How Advisers Get Paid (And Why You Should Care)

Most advisers charge 0.5% to 1% annually based on your Assets Under Management. Some charge flat fees instead.

Here's where it gets interesting.

Product commissions – Some advisers receive commissions from product providers like insurance companies or fund managers. This isn't always bad, but you need to be aware of it.

Independent vs. tied – Independent advisers have fewer conflicts because they're not bound to one company's products.

In developed markets, most advisers are paid by clients to avoid conflicts of interest. In emerging markets, commissions are still common and can be massive. Structured products might pay 2% placement fees in the UK, but 5% to 7% in some countries.

Choosing an independent adviser paid exclusively by you helps avoid this problem.

Questions you should ask:

- Do you receive commissions or referral fees from products you recommend?

- What percentage do you charge on assets? Is it tiered?

- Are there hidden costs like transaction fees or platform fees?

Investment Managers: Who Actually Run Your Money

Once your adviser sets your strategy, an investment manager handles day-to-day portfolio management.

Model portfolios are used primarily for retail investors. They come in different risk profiles—cautious, balanced, adventurous. There are usually five levels, sometimes up to eight. Management fees are low.

Bespoke portfolios are for high-net-worth clients, typically with $5 million or more. They may include alternatives like hedge funds, private equity, venture capital, and structured products. Management fees are higher.

Investment strategies also differ.

Long-term portfolios use a buy-and-hold approach with stocks, bonds, ETFs, and mutual funds. They're benchmarked against indices like the S&P 500. The goal is to ride out market cycles and leverage compounding.

Absolute return strategies aim to achieve positive returns, regardless of market conditions. This approach is often utilised by hedge funds employing strategies like short-selling, derivatives, or arbitrage. Performance is not measured against a benchmark, but rather by the consistency of positive returns.

How they get paid:

- Model portfolios: 0.1% to 0.5% annually

- Custom portfolios: Up to 1% annually

- Alternative investments: Up to 2% management fee plus 20% of performance (with high watermarks and hurdle rates)

Key point: understand whether you're aiming for steady growth or dynamic returns. Both can exist in one portfolio.

Fund Managers vs. Portfolio Managers

This gets confusing because both are sometimes called "asset managers."

Fund managers run individual funds—hedge funds, private equity, venture capital. These are building blocks within your portfolio.

Portfolio managers construct and monitor your overall asset allocation using third-party or in-house funds.

Some large firms like Goldman Sachs or JPMorgan do both. One division runs funds. Another advises clients and manages portfolios. They might also have private banks, investment banks, and brokerages under the same umbrella.

Investment products come in many forms:

- Individual securities—stocks, bonds, derivatives like options and futures.

- Pooled vehicles—mutual funds, ETFs, investment trusts.

- Alternatives—hedge funds, private equity, venture capital, real estate, commodities, crypto.

- Non-traditional products—actively managed certificates, structured products, exchange-traded notes.

These are your portfolio's Lego blocks.

Custody: Where Your Assets Actually Live

The last piece is custodians.

Custodians are specialised institutions that safeguard your assets. They manage several key functions for your investments, including:

- Safekeeping: Your stocks and bonds are kept separate (segregated) from the custodian’s own money.

- Trade Processing: This involves settling and reconciling transactions.

- Asset Servicing: Custodians are responsible for collecting dividends and managing corporate actions, such as stock splits.

- Regulatory Compliance: They must adhere to strict regulations to ensure the protection of client assets.

In the US, retail investors typically have custody at Charles Schwab, Fidelity, Pershing, LPL Financial, or Altruist. In the UK, they're called investment platforms—Aviva, Standard Life, Quilter, AJ Bell, JustFA.

Accredited investors usually have accounts at private banks, wealth management firms, or multi-family offices with broader product access.

Important: Holding client money is the most regulated, capital-intensive business. If a large financial institution is a city, the custody business is the fortress where treasures are kept. It's the most protected part.

Smaller private banks or wealth managers that hold client assets are typically sub-custodians with accounts at global institutions.

The largest custodians are BNY Mellon ($46.6 trillion), State Street ($38.2 trillion), JP Morgan ($28.6 trillion), and Citi ($26.8 trillion).

Custodians charge fees—typically 0.10% to 0.3% of assets held, plus costs for reporting, corporate actions, and transactions.

Pro tip: Your statements should break down all fees. Read them carefully. Fees add up fast and impact returns.

What's a Managed Account?

Managed accounts let you keep assets with trusted custodians like UBS, Goldman Sachs, or Interactive Brokers while allowing external advisers to manage investments directly in your account—but not withdraw or transfer funds.

This setup has become popular because everyone wins. Clients keep assets secure with large institutions. Banks keep custody and earn fees. Advisers focus on strategy instead of building custody infrastructure.

This is especially popular in Switzerland, where it's called External Asset Management. Clients use private banks to hold assets and for services like lending, but specialist advisers manage the investments.

The Infrastructure Behind Everything

Last, there's the infrastructure making all this work.

Think of these as invisible engines powering the market. You don't interact with them directly, but they're crucial.

Investment banks handle underwriting, M&A advisory, and research. Brokers and prime brokers facilitate trades and provide leverage. Exchanges, market makers, and liquidity providers are where buyers meet sellers. Regulators and clearinghouses like the SEC and FCA ensure compliance and orderly settlement. Market data and technology platforms like Bloomberg and FactSet provide the tools.

Putting It Together

Here's your cast of players:

Wealth owners – Institutions and individuals with money to invest

Wealth advisers – Help you create and execute a strategy

Investment managers and fund managers – Manage portfolios and run funds

Custodians – Safeguard your assets

Infrastructure and service providers – The behind-the-scenes engine

Your next steps are deciding if you'll invest solo or work with an adviser, choosing your investor status, building the right team, and understanding fees and conflicts of interest.

You're not just building a portfolio. You're building a system that works for you long-term.

Welcome to the game. Now play it smart.